Mutual Fund Return Calculator

Mutual Fund return calculator refers to a smart tool that helps us to check how the investment grows over a period of time. People can invest in Mutual Funds either through lumpsum or SIP mode. In the lumpsum mode, people invest a considerable amount at one stretch and hold it for a certain period. Contrarily, in SIP mode people invest in small amounts at regular intervals. Therefore, the calculator plays a key role in any investment mode. So, let us understand how the importance of Mutual Fund return calculator both lumpsum and SIP ones, how to use them and the best mutual funds for investment.

Mutual Fund SIP Calculator

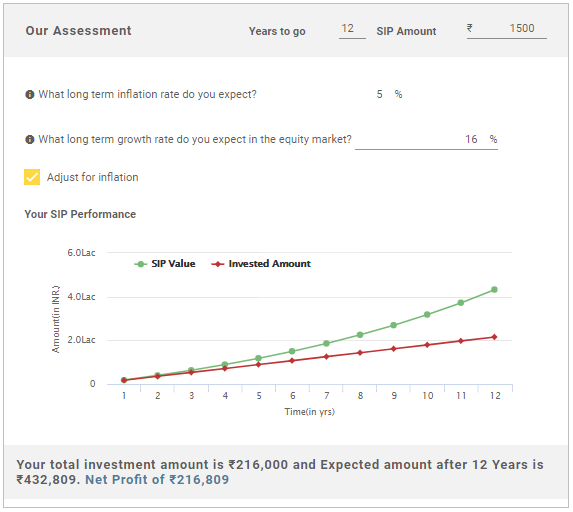

sip calculator is a smart tool that helps to determine the amount to be invested along with the tenure to attain their objectives. It also shows how the SIP investment grows over a period of time. As SIP is known as a goal-based investment; through SIP people plan to attain various objectives such as purchasing a house, purchasing a vehicle, Retirement planning, and much more. The illustration given below shows how the SIP investment grows over a given period.

Know Your SIP Returns

Illustration

- Monthly Investment: INR 1,500

- Investment Tenure: 12 Years

- Total Amount Invested: INR 2,16,000

- Expected Long-term Growth on Investment: 16% (approx.)

- Expected Long-term Inflation: 5% (approx.)

The graph given below shows how the SIP investment grows given the above-mentioned parameters grows over the tenure 12 years.

From the above image, we can say that at the end of 12th year, the total value of the investment would be INR 4,32,809 and the net profit on the investment would be INR 2,16,809.

Talk to our investment specialist

How does a Mutual Fund SIP Calculator Work?

In order to check how the SIP calculator works, there are certain details or questions whose related data need to be entered. So, let us look at the questions that need to be answered to find how the SIP calculator works:

- What would be the tenure of the investment or for how long are you planning to invest.

- How much amount are you planning to invest.

- Your expected growth rate in the equity market for long-run.

- Your expected inflation rate in the long-term.

You need to be ready with the data related to the questions before doing the calculation. People also click on Next button after entering the details wherever required. Thus, we can say that by using Mutual Fund return calculator related to SIP, people can assess what will be their SIP value at the end of their expected tenure.

Now, let us shift our focus towards Lumpsum calculator.

Mutual Fund Lumpsum Return Calculator

Lumpsum investment in Mutual Fund refers to the Investing a considerable amount in Mutual Funds as a onetime activity. People having a considerable amount lying in their Bank account can choose to invest lump sum amount. There is a difference between a lumpsum calculator and SIP calculator. The lumpsum calculator helps people to assess how their onetime investment grows over a period of time. So, let us understand how the lumpsum returns grow over a given timeframe.

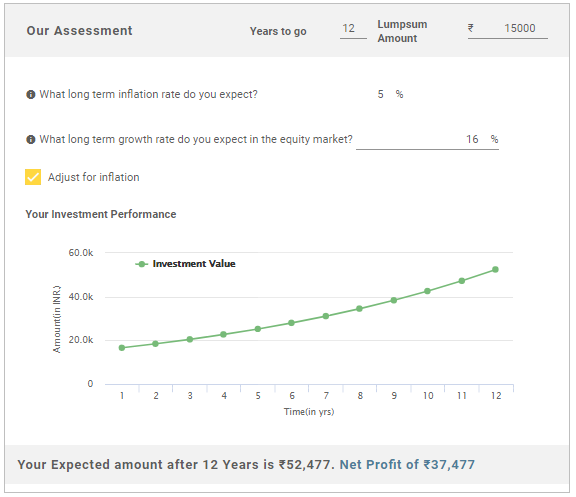

Illustration

- Onetime Investment Amount: INR 15,000

- Investment Tenure: 12 Years

- Total Amount Invested: INR 15,000

- Expected Long-term Growth on Investment: 16% (approx.)

- Expected Long-term Inflation: 5% (approx.)

The graph given below shows how the lumpsum investment grows given the above-mentioned parameters grows over the tenure 12 years.

From the above image, we can say that at the end of 12th year, the total value of the investment would be INR 52,477 and the net profit on the investment would be INR 37,477.

How does a Mutual Fund Lumpsum Return Calculator Work?

The functioning process of a Mutual Fund lumpsum return calculator and SIP calculator is the same. However, people in this situation need to enter the lumpsum investment amount instead of SIP amount. However, the rest of the data related to investment tenure, expected long-term growth rate, and expected long-term inflation remains the same. Here too, you need to be ready with the data related to the questions before doing the calculation and click on Next button after entering the details wherever required.

Thus, we can say it is easy to use both the Mutual Fund calculators for lumpsum as well as SIP investment. Nevertheless, though people can use both of them but before making any investment; it is important to understand the modalities of the scheme completely. In addition, people can consult a financial advisor if required, to ensure that their investment gives them the required returns.

Fund Selection Methodology used to find 2 funds

Top Funds for 2026

*Best funds based on 3 year performance.

"The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in units of MLIIF - WGF. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or units of money market/liquid schemes of DSP Merrill Lynch Mutual Fund, in order to meet liquidity requirements from time to time. However, there is no assurance that the investment objective of the Scheme will be realized." Below is the key information for DSP World Gold Fund Returns up to 1 year are on To generate capital appreciation by investing in Equity and Equity Related Instruments of companies where the Central / State Government(s) has majority shareholding or management control or has powers to appoint majority of directors. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The Scheme does not assure or guarantee any returns. Research Highlights for Invesco India PSU Equity Fund Below is the key information for Invesco India PSU Equity Fund Returns up to 1 year are on 1. DSP World Gold Fund

DSP World Gold Fund

Growth Launch Date 14 Sep 07 NAV (09 Mar 26) ₹62.799 ↑ 0.52 (0.84 %) Net Assets (Cr) ₹1,975 on 31 Jan 26 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.41 Sharpe Ratio 3.41 Information Ratio -0.47 Alpha Ratio 2.12 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹10,843 28 Feb 23 ₹9,241 29 Feb 24 ₹8,778 28 Feb 25 ₹13,911 28 Feb 26 ₹41,909 Returns for DSP World Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 9 Mar 26 Duration Returns 1 Month 2.6% 3 Month 28.2% 6 Month 58.2% 1 Year 154.1% 3 Year 60.6% 5 Year 29.4% 10 Year 15 Year Since launch 10.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 167.1% 2023 15.9% 2022 7% 2021 -7.7% 2020 -9% 2019 31.4% 2018 35.1% 2017 -10.7% 2016 -4% 2015 52.7% Fund Manager information for DSP World Gold Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.93 Yr. Data below for DSP World Gold Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Basic Materials 95.89% Asset Allocation

Asset Class Value Cash 1.55% Equity 95.89% Debt 0.01% Other 2.56% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Gold I2

Investment Fund | -74% ₹1,458 Cr 1,177,658

↓ -41,596 VanEck Gold Miners ETF

- | GDX25% ₹497 Cr 573,719 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -2% ₹35 Cr Net Receivables/Payables

Net Current Assets | -1% -₹15 Cr 2. Invesco India PSU Equity Fund

Invesco India PSU Equity Fund

Growth Launch Date 18 Nov 09 NAV (10 Mar 26) ₹66.35 ↑ 0.92 (1.41 %) Net Assets (Cr) ₹1,492 on 31 Jan 26 Category Equity - Sectoral AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆ Risk High Expense Ratio 2.14 Sharpe Ratio 0.53 Information Ratio -0.5 Alpha Ratio -2.7 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,709 28 Feb 23 ₹13,515 29 Feb 24 ₹25,468 28 Feb 25 ₹22,731 28 Feb 26 ₹31,469 Returns for Invesco India PSU Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 9 Mar 26 Duration Returns 1 Month -2.6% 3 Month 4.2% 6 Month 7.6% 1 Year 26.4% 3 Year 29.8% 5 Year 24.4% 10 Year 15 Year Since launch 12.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 10.3% 2023 25.6% 2022 54.5% 2021 20.5% 2020 31.1% 2019 6.1% 2018 10.1% 2017 -16.9% 2016 24.3% 2015 17.9% Fund Manager information for Invesco India PSU Equity Fund

Name Since Tenure Hiten Jain 1 Jul 25 0.59 Yr. Sagar Gandhi 1 Jul 25 0.59 Yr. Data below for Invesco India PSU Equity Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 31.92% Financial Services 29.89% Utility 18.15% Energy 12.64% Basic Materials 4.19% Consumer Cyclical 1.08% Asset Allocation

Asset Class Value Cash 2.14% Equity 97.86% Top Securities Holdings / Portfolio

Name Holding Value Quantity State Bank of India (Financial Services)

Equity, Since 28 Feb 21 | SBIN9% ₹139 Cr 1,294,989

↓ -92,628 Bharat Electronics Ltd (Industrials)

Equity, Since 31 Mar 17 | BEL9% ₹135 Cr 2,997,692 Indian Bank (Financial Services)

Equity, Since 30 Jun 21 | INDIANB7% ₹106 Cr 1,157,444 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 30 Sep 18 | BPCL7% ₹99 Cr 2,717,009 Hindustan Aeronautics Ltd Ordinary Shares (Industrials)

Equity, Since 31 May 22 | HAL6% ₹87 Cr 187,643

↓ -8,515 NTPC Green Energy Ltd (Utilities)

Equity, Since 30 Nov 24 | NTPCGREEN5% ₹79 Cr 9,129,820 Dredging Corp of India Ltd (Industrials)

Equity, Since 31 Jul 25 | DREDGECORP5% ₹73 Cr 646,300 Bharat Dynamics Ltd Ordinary Shares (Industrials)

Equity, Since 31 May 22 | BDL5% ₹69 Cr 445,685 Bank of Baroda (Financial Services)

Equity, Since 30 Jun 21 | BANKBARODA5% ₹67 Cr 2,244,222 NTPC Ltd (Utilities)

Equity, Since 31 May 19 | NTPC4% ₹64 Cr 1,801,543

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Research Highlights for DSP World Gold Fund