Everything to Know About Form 15G for Provident Funds (PF)

Employee Provident Funds (EPF) are funds set up for employees' welfare in which 12% of each employee's monthly base pay and dearness allowance are deposited into the fund account. The employer contributes correspondingly. This fund balance has an annual interest rate of 8.10%.

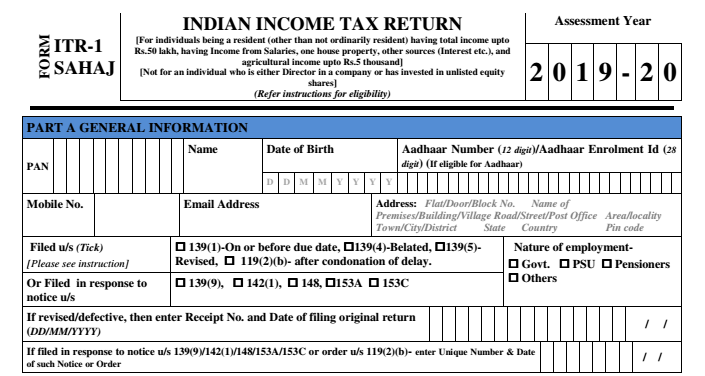

According to the PF withdrawal regulations, you can withdraw this PF sum. However, if the withdrawal amount exceeds Rs. 50,000 each fiscal year, Tax Deducted at Source (TDS) will be withheld following section 192A of the income tax Act. As a result, you will only get the remaining sum. If your income falls below the taxable limit, however, you can ensure no TDS deductions on your withdrawal amount by completing PF form 15G. Let’s find out more information about this form in this post.

What is Form 15G?

15G Form or EPF helps to prevent TDS from being deducted from the interest you earn from your EPF, Recurring deposit (RD), or Fixed Deposit (FD) in a given year. Everybody under 60 years of age and Hindu Undivided Families (HUFs) are required to make this statement.

Characteristics of EPF Form 15G

The Form 15G's primary characteristics are as follows:

- Form 15G is a self-declaration form used to request no TDS deduction on a specific income where the tax assessee's yearly income is below the exemption threshold

- The requirements of Section 197A of the Income Tax Act, 1961 state the rules for this particular self-declaration form

- To reduce the compliance burden and expense for tax deductor and tax deductee, Form 15G's format underwent a significant revision in 2015

- Form 15G can be submitted by those less than 60 years of age in its current version. Form 15H, the senior citizens (those who are above the age of 60) variant of Form 15G, was developed by the Central Board of Direct Taxes

- Even though Form 15H and Form 15G are very similar, only senior citizens can use Form 15H

- For existing investments, this statement must be submitted in the first quarter of the year to get the benefit. Form 15G can be submitted for new investments before the initial interest credit

Talk to our investment specialist

Form 15G Download

You can download the form from here - 15G Form

Instructions to Fill 15G Form EPFO

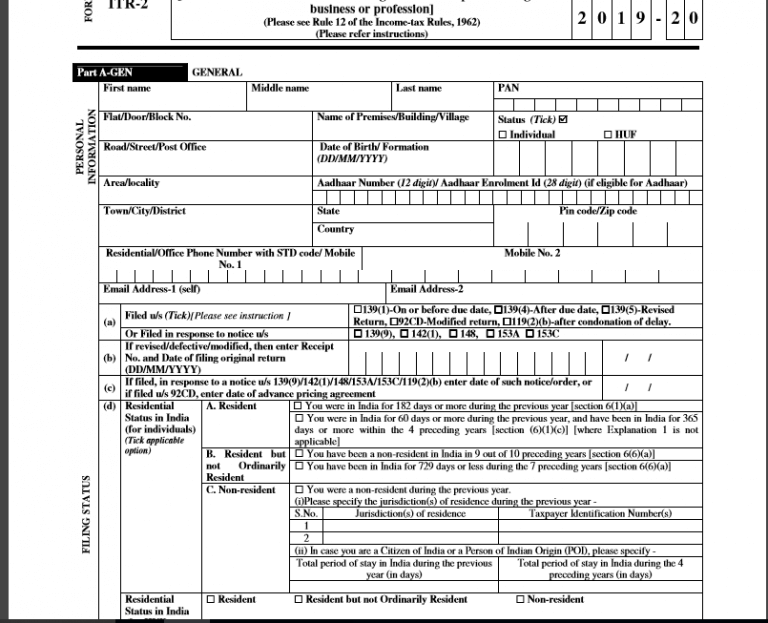

There are two sections on Form 15G. The person who wants to claim no deduction of TDS on a particular income should fill out the first component. The important information you must enter in the first section of Form 15G is as follows:

- Name as it appears on your PAN Card

- A valid PAN card is required to submit Form 15G. Your declaration will be void if you do not include proper PAN information

- An individual can provide a declaration in Form 15G; however, an organization or company cannot

- The financial year for which you claim no TDS deduction must be the previous year

- Mention that you are a resident individual because NRIs cannot submit Form 15G

- Include your PIN code and communication address exactly

- Give a working email address and a phone number for future conversations

- If you were subject to tax under the terms of the Income Tax Act of 1961 for any prior assessment year, check the box next to "Yes"

- Mention the most recent evaluation year that your returns were evaluated for

- Include the estimated income that you are declaring and the estimated annual revenue in its entirety (which includes all the income)

- If you already submitted Form 15G at any point during the fiscal year, including the specifics of that submission along with the total amount of income on your current declaration

- The final paragraph of section 1 discusses the specific investments for which you are filing a declaration. The investment account number (term deposit number, Life Insurance policy number, employee code, etc.) must be provided

- Recheck all the information after completing the field to ensure there are no mistakes

- The deductor, or the person who will deposit the tax withheld at source to the government on behalf of the tax assessee, must complete the second portion of Form 15G

Is it Mandatory to Fill out Form 15G for Withdrawing PF?

Yes, if you do not want TDS to be subtracted from the withdrawal amount, Form 15G is required. As per Section 192A of the Finance Act 2015, if your work term is shorter than five years and you take more than Rs. 50,000 from your PF, TDS will be applied.

Following the guidelines mentioned above, the below-mentioned PF withdrawal rules will be applicable:

- 10% TDS if you submit Form 15G but have no PAN card

- 42.744% tax deducted at source if you have not submitted both Form 15G and PAN card

- No TDS if Form 15G is submitted

Form 15G and 15H

Here are the differences between Form 15H and Form 15G:

| Form 15G | Form 15H |

|---|---|

| Applicable to anyone under 60 years of age | Applicable to people who are 60 years or older |

| HUF, as well as people, can submit | Can only be submitted by people |

| Only individuals or HUF with annual incomes below the basic exemption limit are eligible | No matter their annual income, older citizens can submit the form |

How to Complete the 15G Form Online for Withdrawal of PF?

Let's go on and learn how to fill out Form 15G for an online EPF withdrawal now that you are aware of the TDS regulations that apply to EPF and what Form 15G or 15H is:

- For members, use the EPFO UAN Unified Portal

- Log into your account using UAN and password

- Select "ONLINE SERVICES" and then "Claim" (Form 31, 19, 10C)

- Verify your Bank account's last four numbers

- Click Upload form 15G, located beneath the choice "I wish to apply for"

Alternatives to Filling 15G Form for PF Withdrawal

Here is what you can do if Form 15G was due but wasn't submitted timely and TDS has already been taken out:

- Option 1: File an Income Tax Return to Receive your TDS Refund

Once a bank or other deductor deducts TDS, they are obligated to deposit the money with the Income Tax Department and cannot reimburse you. The only way out is to file an ITR and receive a refund of your income taxes. The Income Tax Department will process your refund claim request and credit the extra tax withheld for the fiscal year after verification

- Option 2: Submit Form 15G Right Away to Stop Additional Deductions for the Current Fiscal Year

After each quarter, when the relevant interest is computed on the fixed deposit, banks typically deduct the TDS. To avoid further deductions for the current fiscal year, filing Form 15G as soon as possible is preferable

Punishments for Submitting a False Declaration on Form 15G

The Income Tax Act of 1961's Section 277 imposes severe fines and prison sentences for making a false statement on Form 15G to avoid TDS. The specifics of the penalties are as follows:

- If a fraudulent declaration is made to dodge paying more than INR 1 lakh in taxes, the offender faces a sentence of six months to seven years in prison

- In some situations, the sentence ranges from three months to three years in prison

Final Words

When it comes to reducing the TDS load, Form 15G is often very helpful. However, under Section 277 of the Income Tax Act of 1961, making a false declaration in Form 15G to avoid TDS can result in a fine or perhaps jail time. The person who will deposit the tax withheld at source to the government on behalf of the tax assessee or the deductor must fill out a second section of the form.

Frequently Asked Questions (FAQs)

1. Do I need to complete Form 15G Part 2?

A: No, the financier or bank must complete the second section of Form 15G.

2. Can NRIs use Form 15G to seek a TDS deduction as well?

A: No, only Indian citizens are qualified to submit Form 15G.

3. By submitting Form 15G, would my interest income be exempt from taxation?

A: No, Form 15G is merely a self-declaration form that enables no TDS to be taken on interest income because there is no tax on your complete or total income.

4. What does "estimated income" imply on Form 15G?

A: The estimated income listed in Form 15G is the income you have brought in throughout the specific fiscal year.

5. How long is Form 15G valid?

A: Form 15G is only valid for one fiscal year, and a person must provide a new form for each further year.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.