Income Tax Department Portal – Login & Registration Guide

The way digitization is impacting lives today, even the most complex tasks have become easier and simpler. And, the government association bodies are not leaving any stone unturned when it comes to making people aware of the power of the internet. Similar to other departments, the income tax Department Portal has made it mandatory and easier for taxpayers to register online. So, in case you have not done that yet, this post will guide you throughout the process. Have a read.

Requirements to Register on Income Tax Portal

When you are ready for the process of income tax department efiling portal, there are certain prerequisites that you would have to take care of. Prior to sitting for the registration, make sure that you have the below-mentioned documents with you:

- Valid email address

- Valid PAN number

- Valid current address

- Valid mobile number

Keep in mind that minors and others who have been barred by the Indian Contract Act, 1872 cannot register on this income tax portal.

Talk to our investment specialist

Step-by-Step Guide to Register on Income Tax Department Login Portal

The following steps will help the newbies register on the tax department’s website seamlessly.

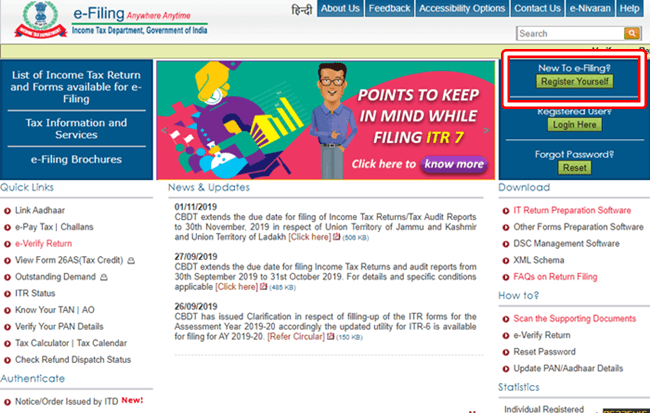

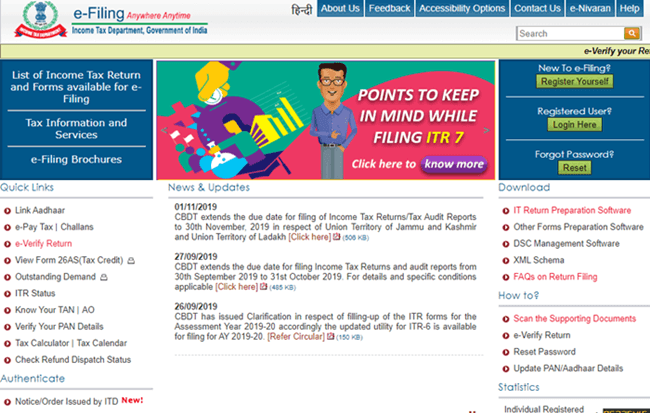

Income Tax Portal

To begin with, visit the http://www.incometaxindiaefiling.gov.in/home/. On the homepage, you will see several options. Look for New to e-filing? on the right-hand side. Below that, you will find, Register Yourself; click on it.

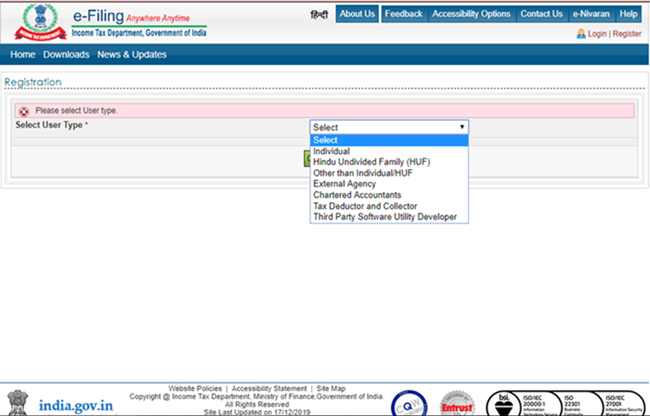

Choosing the Type

The next page will ask you the User Type. From the options available, such as Individual, hindu undivided family (HUF), External Agency, Tax Deductor and Collector, Chartered Accountants and Third-Party Software Utility Developer; choose the one that matches your requirements and hit Continue.

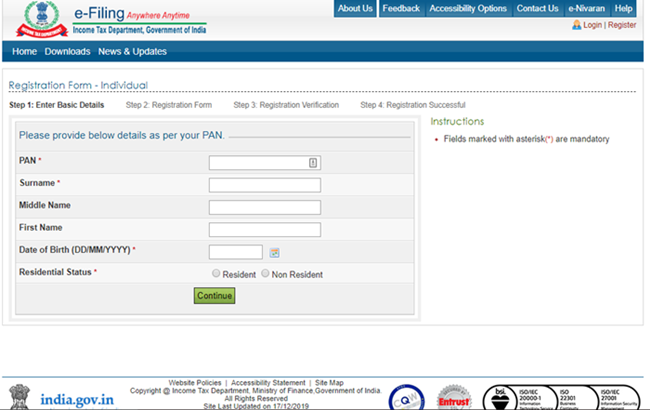

Entering Details

The next step, you would have to enter your necessary details like your PAN, surname, middle name, first name, date of birth, and residential status. After filling up, click on Continue.

The next step is filling up the Registration Form. This mandatory form will ask you details like password, contact number, and current address. After filling, click Submit to move onto the next step.

Upon submitting the form, the next step is to verify the registration. For this, you will receive a six-digit One Time Password (OTP) to the registered mobile number as well as the email ID. Once you have entered the OTP, you will be verified successfully.

Login On the Income Tax Web Portal

In case you are an already existing user of the portal, you will have to log into your account instead of registering there. Below-mentioned steps will help you with incometax efiling India login:

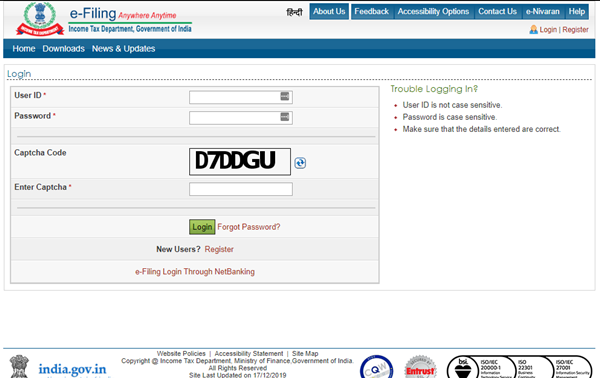

Visiting the Income Tax Homepage

As mentioned above, you would have to visit the official government website of the income tax department. Here, on the right-hand side, you will find Login Here option under the Registered User? tab. Simply click there to move forward.

Submitting Details

To log into your dashboard, you would have to enter your User ID, Password, Captcha Code, and hit the Login button.

Keep in mind that if you are logging to check your ITR status, you would have to use your PAN Card number as your user ID.

Final Words

Whether it is about registering or logging into the income tax department portal, the process is quite simpler and easier. So, if you are not a user of this portal yet, despite coming under the benchmark of a tax-paying citizen, register yourself today.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.