Equity Linked Savings Schemes (ELSS)

Equity Linked Savings Scheme, also called as ELSS, is a type of mutual fund that is equity diversified with a major portion of the fund corpus being invested either in Equity Funds or equity-related products. Primarily, 80% of these tax saver Mutual Funds are exposed to equity and the remaining 20% in debt, money market instruments, cash or in even more equity instruments.

ELSS funds (also known as the tax saving mutual funds) are open-ended, meaning that investors can subscribe to these funds whenever they wish.

Fund Selection Methodology used to find 5 funds

Top 5 ELSS Mutual Funds Schemes

In the Capital Markets, mutual funds aid in tax saving under its Equity Linked Saving Schemes. By Investing in ELSS, one can attain deductions upto INR 1,50,000 from their taxable income as per the Section 80C of income tax Act. Moreover, the units of each scheme are offered at its Net Asset Value (NAV). The NAV of these tax saver mutual funds is announced on each Business Day and it keeps on changing in accordance to the prices of stocks held in the Portfolio of the scheme. Some of the Best elss Mutual Funds are mentioned below. Take a look!

Talk to our investment specialistFund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) SBI Magnum Tax Gain Fund Growth ₹444.821

↓ -5.27 ₹31,862 -1.5 3.2 12.9 24 19.7 6.6 Motilal Oswal Long Term Equity Fund Growth ₹48.3635

↓ -0.20 ₹4,188 -7.1 -3.5 14.3 22 17.2 -9.1 HDFC Tax Saver Fund Growth ₹1,424.9

↓ -17.49 ₹16,749 -2.8 1 14.1 21.4 19.6 10.3 DSP Tax Saver Fund Growth ₹142.856

↓ -1.53 ₹17,223 -1.3 4.9 15.6 20.9 17.2 7.5 IDBI Equity Advantage Fund Growth ₹43.39

↑ 0.04 ₹485 9.7 15.1 16.9 20.8 10 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 27 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary SBI Magnum Tax Gain Fund Motilal Oswal Long Term Equity Fund HDFC Tax Saver Fund DSP Tax Saver Fund IDBI Equity Advantage Fund Point 1 Highest AUM (₹31,862 Cr). Bottom quartile AUM (₹4,188 Cr). Lower mid AUM (₹16,749 Cr). Upper mid AUM (₹17,223 Cr). Bottom quartile AUM (₹485 Cr). Point 2 Established history (18+ yrs). Established history (11+ yrs). Oldest track record among peers (29 yrs). Established history (19+ yrs). Established history (12+ yrs). Point 3 Rating: 2★ (lower mid). Not Rated. Rating: 2★ (bottom quartile). Top rated. Rating: 3★ (upper mid). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 19.72% (top quartile). 5Y return: 17.20% (lower mid). 5Y return: 19.60% (upper mid). 5Y return: 17.18% (bottom quartile). 5Y return: 9.97% (bottom quartile). Point 6 3Y return: 24.01% (top quartile). 3Y return: 21.97% (upper mid). 3Y return: 21.40% (lower mid). 3Y return: 20.86% (bottom quartile). 3Y return: 20.84% (bottom quartile). Point 7 1Y return: 12.88% (bottom quartile). 1Y return: 14.33% (lower mid). 1Y return: 14.09% (bottom quartile). 1Y return: 15.58% (upper mid). 1Y return: 16.92% (top quartile). Point 8 Alpha: -0.63 (bottom quartile). Alpha: -5.20 (bottom quartile). Alpha: 2.37 (top quartile). Alpha: 1.75 (lower mid). Alpha: 1.78 (upper mid). Point 9 Sharpe: 0.13 (bottom quartile). Sharpe: -0.04 (bottom quartile). Sharpe: 0.41 (upper mid). Sharpe: 0.33 (lower mid). Sharpe: 1.21 (top quartile). Point 10 Information ratio: 1.85 (top quartile). Information ratio: 0.49 (bottom quartile). Information ratio: 1.20 (upper mid). Information ratio: 0.93 (lower mid). Information ratio: -1.13 (bottom quartile). SBI Magnum Tax Gain Fund

Motilal Oswal Long Term Equity Fund

HDFC Tax Saver Fund

DSP Tax Saver Fund

IDBI Equity Advantage Fund

Comparison of Equity Linked Savings Scheme & Other Tax Saving Investment Options

| Parameter | PPF | NSC | FD | ELSS |

|---|---|---|---|---|

| Tenure | 15 years | 6 years | 5 Years | 3 years |

| Returns | 7.60% (Compounded Annually) | 7.60%(Compounded Annually) | 7.00 - 8.00 % (Compounded Annually) | No Assured Dividend / Return as it market linked |

| Min. Investment | Rs. 500 | Rs. 100 | Rs. 1000 | Rs. 500 |

| Max. Investment | Rs. 1.5 Lakhs | No Upper Limit | No Upper Limit | No Upper Limit |

| Amount Eligible for Deduction under 80c | Rs. 1.5 Lakhs | Rs. 1.5 Lakhs | Rs. 1.5 Lakhs | Rs. 1.5 Lakhs |

| Taxation for Interest/return | Tax Free | Interest Taxable | Interest Taxable | Gains up to INR 1 lakh are free of tax. Tax at 10% applies to gains above INR 1 lakh |

| Safety/Ratings | Safe | Safe | Safe | Risk |

ELSS Tax Benefits

Investors looking for Tax Saving Investment, here are some of the major benefits of investing ELSS:

1. ELSS Mutual Funds Ensure Money Growth

Being a combination of equity and tax saving, Equity Linked Savings Scheme is an optimal gateway to equity. Since these mutual funds invest in equity-related instruments, the money you invest grows as the stock market grows. So, the gains are high in ELSS mutual funds.

2. Act as Tax Saver Mutual Fund

Not only the money you invest grows but also you can save tax by investing in ELSS mutual funds. Under section 80C of Income Tax, you can avail tax exemption of 1,50,000 from your annual income. So Equity Linked Savings Scheme provides double benefits through a single scheme.

3. ELSS Funds Have a Short Lock-in Period

The lock-in period of Equity Linked Savings Scheme is 3 years, which is much less than others like NSC (National Savings Certificate) that has a lock-in period of 6 years and PPF (Public Provident Fund) has that of 15 years.

SIP Vs Lumpsum Investment

SIP or Lump sum? This is the most common query people have while investing in ELSS mutual funds. Though most of the people would suggest ELSS through SIP, the final decision should always depend on your motive. The SIP route is undoubtedly a convenient option as the investment can be divided into small amounts over a period of time. The investment can also be as low as INR 500 per month. Further, if you choose a wrong scheme through SIP, a huge amount will not be locked with Equity Linked Savings Scheme.

Smart Tip to Invest in ELSS

Everyone who wishes to invest in tax saving mutual funds can go for Equity Linked Savings Scheme. Just that, these funds have a higher risk factor since most of the investments are in stock markets. As the market goes up, your money grows and vice versa. Even senior citizens who have a taxable income and are ready to take some short-term risks can invest in these mutual funds and avail long-term benefits.

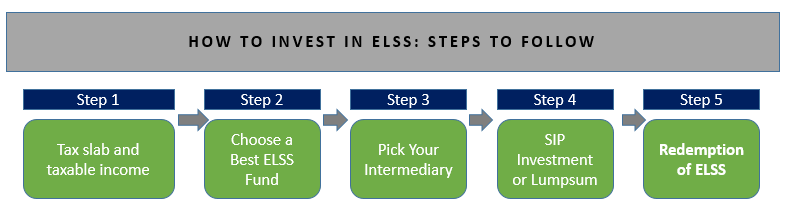

How to Invest in ELSS Online?

Open Free Investment Account for Lifetime at Fincash.com

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

Conclusion

Planning taxes is a fundamental part of financial planning. ELSS Funds not only help in tax saving but offer money growth as well. So, make an ELSS investment today to enjoy unbelievable tax benefits and money gains.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.