Rajiv Gandhi Equity Savings Scheme (RGESS)

Rajiv Gandhi Equity Savings Scheme (RGESS) is a Tax Saving Scheme announced by the government in 2012. This further expanded in the Union Budget of 2013-14. This scheme was initiated purely for first-time investors in the securities market.

About Rajiv Gandhi Equity Savings Scheme

The scheme was brought into existence to encourage a constant flow of savings among individuals in the country. Another objective of the Rajiv Gandhi Equity Savings Scheme was to improve the domestic Capital Markets in the country. Its major aim was to widen the retail investor base in the Indian market. This would, in turn, further the goal of financial stability and inclusion.

Eligibility Criteria for RGESS

The Rajiv Gandhi Equity Saving Scheme was open to all new retail investors with gross total income less than or equal to Rs. 12 lakh.

These retail investors are those who are:

- A resident individual and not a corporate entity, trusts, etc.

- Anyone who hasn't opened a Demat account and has not undertaken any trade until he brings the RGESS eligible investment into account

- Anyone who has no history of trading in the equity market

- Investments can be made only in companies that belong to BSE-100 or CNX-100 by retail investors, who are the residents of India

The investor can make an end number of investments in the first year. After that, any investments made are not qualified for tax exemptions.

If someone wished to open a joint account under this scheme only the first account holder would be considered as a new retail investor.

Talk to our investment specialist

Benefits of RGESS

Taxable income

The retail investors can get a 50% deduction of the investment amount of the taxable income for the year under section 80CCG in the income tax act.

No minimum investment

One of the major benefits of the scheme is that there is no minimum investment rule here. This could be a huge benefit to the first time investors.

Tax benefits

The investors can enjoy tax benefits for three consecutive years from the date of investment. However, the investor should be able to comply with the rules laid down for investment.

Safeguarded Investors’ interests

The Ministry of Finance safeguarded the interests of first-time investors by restricting the investments to large-cap stocks, lock-in period, etc.

Pledging stocks

Investors can avail the facility of pledging stocks after a fixed locked-in period.

A better option for retail investors

Investing through RGESS was the best option for first-time investors because of the benefits and the other schemes that came with it.

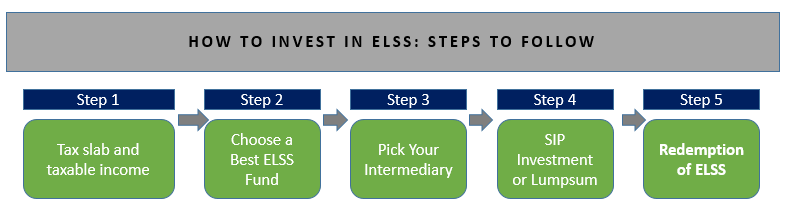

Difference between ELSS and RGESS

Both Equity Linked Saving Scheme (ELSS) and Rajiv Gandhi Equity Saving Scheme (RGESS) are different schemes in their stride. They function differently operationally. ELSS is for indirect participation in the stock market and RGESS aims at encouraging direct participation in the stock market.

So here is a breakdown of the operational differences between ELSS and RGESS.

| Differences | ELSS | RGESS |

|---|---|---|

| Investment | Investments are purely Mutual Funds | Investments made directly in listed Equity Funds or into units of mutual funds and ETFs |

| Deduction | Allows 100% deduction of the investment | Allows 50% deduction of the investment |

| Benefits | The investor can avail benefits every year | The investor can avail benefit only for three consecutive years |

| Lock-in period | Lock-period of three years | Lock-in period of three years but the investor can start trading after one-year subject to conditions |

| Risk | Less risky since it deals with mutual funds | Riskier since it deals directly with equity market |

Latest Status of RGESS

The Union Budget in 2017 proposed the phasing out of the scheme completely by 2018 due to less number of assessees. Those who invested and claimed the given benefits before the phasing out can be a part of the scheme. However, new retail investors cannot enrol under the Rajiv Gandhi Equity Savings Scheme anymore.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.