Liquid Fund Vs Debt Fund

Many people always get confused whether Debt fund and Liquid Funds are different. However, it is not the case. Debt funds refer to the Mutual Fund category that invests its collective pool of money in fixed Income securities. The liquid fund is a subset of debt fund scheme that invests its fund in fixed securities having a very short maturity tenure. Though debt fund is the parent category and the liquid fund is a subset of it nevertheless; there exists a lot of difference between liquid funds and other categories of Fixed Income Mutual Fund schemes. So, let us understand the differences between liquid funds and debt funds with respect to various parameters such as returns, risk, Underlying asset Portfolio, and much more, through this article.

Talk to our investment specialist

What are Debt Funds?

Debt funds invests its corpus in various fixed income instruments. Some of these instruments in which debt funds invest its corpus include treasury bills, government Bonds, corporate bonds, government securities, commercial papers, certificate of deposits, and much more. Debt funds are classified into various categories depending on the maturity profile of the underlying securities forming part of its portfolio. These categories are liquid funds, short-term funds, ultra short-term funds, Gilt Funds, Dynamic Bond Funds and so on. People having a low-risk appetite can choose to invest in debt funds. It is also suitable for investors whose investment tenure is the short and medium term.

What are Liquid Funds?

Liquid Fund is a subset of debt funds. The liquid fund invests a major corpus of its portfolio in fixed income securities whose maturity tenure is very less. The maturity of these securities is less than or equal to 91 days. Liquid funds are considered to be one of the safe Mutual Fund avenues. People having idle funds lying in their Bank accounts can choose to invest in liquid funds to earn more income. In addition, these schemes earn more revenue as compared to a Savings Account.

Liquid Funds Vs Debt Funds: Know the Differences

Though the liquid fund is a part of debt funds yet, it has its own features as compared to other debt fund categories. So, let us understand these differences on the Basis of various parameters.

Maturity Profile of Underlying Assets

One of the primary Factor that differentiates a liquid fund and a debt fund is its underlying portfolio. The fixed income securities forming part of a liquid fund’s portfolio have a maximum maturity profile of less than or equal to 91 days. In addition, these securities are generally held till maturity. However, this restriction does not apply to other debt funds. The maturity profile of underlying assets forming part of debt funds can be a combination of short and long-term instruments based on the fund’s underlying objective.

Returns

The returns in case of liquid funds are considered to be stable as they generate stable returns. However, in other debt funds, the returns are considered to fluctuate depending on the interest rate movements in the country.

Liquidity

Liquid funds are considered to have high liquidity as compared to other Mutual Fund schemes. Many AMCs even offer the option of instant Redemption in case of liquid funds. Through instant redemption Facility, people can get their money into bank accounts within 30 minutes since the time they place the order. On the contrary, in case of other debt funds, the liquidity is not as high as liquid funds. People will get their maturity proceeds the next working day after placing the order.

Risk

The risk component is low in case of liquid funds. This is because maturity tenure of the underlying securities is very less due to which they carry low-interest rate and credit risk. In addition, these securities are generally held till maturity instead of trading. On the other hand, other debt instruments are exposed to both credit and interest rate risk. As a consequence, the other debt fund schemes carry more risk as compared to liquid funds.

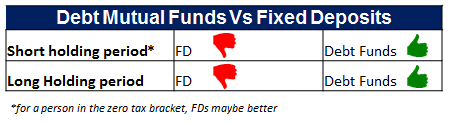

Taxation

Since, the liquid fund is a part of the debt fund, the taxation implications of debt funds is applicable even to liquid funds. In case of debt funds, the short-term Capital Gain is applicable if the investment is redeemed within three years from the date of purchase and long-term Capital gain is applicable if the investment is redeemed after three years from the date of purchase. The short-term capital gain is taxable as per the individual’s regular tax slab while; the long-term capital gain is taxable at 20% with indexation benefits.

The table given below summarizes the comparison between debt funds and liquid funds.

| Parameters | Liquid Funds | Debt Funds |

|---|---|---|

| Maturity Profile of Underlying Assets | The maturity profile of the assets is less than or equal to 91 days | There is no such criteria on the maturity profile of underlying assets |

| Returns | Generally Stable Returns | Keep on fluctuating depending on the interest rate scenario |

| Liquidity | High liquidity | Low as compared to Liquid Funds |

| Risk | Low as compared to other debt funds | High as compared to liquid funds |

| Taxation | Same as Debt Funds | Short-term: Taxed as per individual’s slab rates Long-term: Taxed at 20% and had taxation benefits |

Best Funds to Invest in 2025

After looking at the differentiating factors between debt funds and liquid funds, you can have a look some of the best funds that can be considered for investment under both liquid fund category and debt fund category as per your requirements.

Best Debt Funds

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Axis Credit Risk Fund Growth ₹22.5071

↓ -0.01 ₹363 1.3 3.7 8.7 8 8.7 8.64% 2Y 3M 14D 2Y 8M 1D PGIM India Credit Risk Fund Growth ₹15.5876

↑ 0.00 ₹39 0.6 4.4 8.4 3 5.01% 6M 14D 7M 2D UTI Banking & PSU Debt Fund Growth ₹22.7962

↑ 0.01 ₹1,078 1 2.7 7.4 7.4 7.8 7.04% 1Y 1M 10D 1Y 2M 19D Aditya Birla Sun Life Savings Fund Growth ₹571.703

↑ 0.19 ₹22,857 1.3 3 7.2 7.4 7.4 6.81% 5M 19D 6M 11D HDFC Banking and PSU Debt Fund Growth ₹23.8083

↑ 0.00 ₹5,620 0.6 2.6 7 7.3 7.5 7.26% 3Y 1M 17D 4Y 5M 1D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 6 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Axis Credit Risk Fund PGIM India Credit Risk Fund UTI Banking & PSU Debt Fund Aditya Birla Sun Life Savings Fund HDFC Banking and PSU Debt Fund Point 1 Bottom quartile AUM (₹363 Cr). Bottom quartile AUM (₹39 Cr). Lower mid AUM (₹1,078 Cr). Highest AUM (₹22,857 Cr). Upper mid AUM (₹5,620 Cr). Point 2 Established history (11+ yrs). Established history (11+ yrs). Established history (12+ yrs). Oldest track record among peers (22 yrs). Established history (11+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 5★ (bottom quartile). Rating: 5★ (bottom quartile). Point 4 Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderately Low. Risk profile: Moderately Low. Point 5 1Y return: 8.69% (top quartile). 1Y return: 8.43% (upper mid). 1Y return: 7.44% (lower mid). 1Y return: 7.16% (bottom quartile). 1Y return: 7.05% (bottom quartile). Point 6 1M return: 0.70% (top quartile). 1M return: 0.27% (bottom quartile). 1M return: 0.51% (bottom quartile). 1M return: 0.52% (lower mid). 1M return: 0.55% (upper mid). Point 7 Sharpe: 2.08 (upper mid). Sharpe: 1.73 (lower mid). Sharpe: 1.05 (bottom quartile). Sharpe: 2.17 (top quartile). Sharpe: 0.36 (bottom quartile). Point 8 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 8.64% (top quartile). Yield to maturity (debt): 5.01% (bottom quartile). Yield to maturity (debt): 7.04% (lower mid). Yield to maturity (debt): 6.81% (bottom quartile). Yield to maturity (debt): 7.26% (upper mid). Point 10 Modified duration: 2.29 yrs (bottom quartile). Modified duration: 0.54 yrs (upper mid). Modified duration: 1.11 yrs (lower mid). Modified duration: 0.47 yrs (top quartile). Modified duration: 3.13 yrs (bottom quartile). Axis Credit Risk Fund

PGIM India Credit Risk Fund

UTI Banking & PSU Debt Fund

Aditya Birla Sun Life Savings Fund

HDFC Banking and PSU Debt Fund

Best Liquid Funds

Fund NAV Net Assets (Cr) 1 MO (%) 3 MO (%) 6 MO (%) 1 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Indiabulls Liquid Fund Growth ₹2,626.59

↑ 0.40 ₹169 0.5 1.4 2.9 6.3 6.6 6.62% 1M 1M PGIM India Insta Cash Fund Growth ₹353.514

↑ 0.06 ₹546 0.4 1.4 2.9 6.3 6.5 6.43% 26D 29D JM Liquid Fund Growth ₹74.0587

↑ 0.01 ₹2,703 0.4 1.4 2.9 6.2 6.4 6.44% 1M 2D 1M 4D Axis Liquid Fund Growth ₹3,024.7

↑ 0.52 ₹39,028 0.5 1.5 2.9 6.3 6.6 6.5% 27D 30D Aditya Birla Sun Life Liquid Fund Growth ₹437.647

↑ 0.08 ₹54,615 0.5 1.4 2.9 6.3 6.5 6.19% 2M 1D 2M 1D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 8 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Indiabulls Liquid Fund PGIM India Insta Cash Fund JM Liquid Fund Axis Liquid Fund Aditya Birla Sun Life Liquid Fund Point 1 Bottom quartile AUM (₹169 Cr). Bottom quartile AUM (₹546 Cr). Lower mid AUM (₹2,703 Cr). Upper mid AUM (₹39,028 Cr). Highest AUM (₹54,615 Cr). Point 2 Established history (14+ yrs). Established history (18+ yrs). Oldest track record among peers (28 yrs). Established history (16+ yrs). Established history (21+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 4★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Low. Risk profile: Low. Risk profile: Low. Risk profile: Low. Risk profile: Low. Point 5 1Y return: 6.35% (top quartile). 1Y return: 6.31% (bottom quartile). 1Y return: 6.21% (bottom quartile). 1Y return: 6.33% (upper mid). 1Y return: 6.31% (lower mid). Point 6 1M return: 0.46% (top quartile). 1M return: 0.44% (bottom quartile). 1M return: 0.44% (bottom quartile). 1M return: 0.45% (upper mid). 1M return: 0.45% (lower mid). Point 7 Sharpe: 2.72 (bottom quartile). Sharpe: 2.89 (lower mid). Sharpe: 2.30 (bottom quartile). Sharpe: 3.16 (top quartile). Sharpe: 3.01 (upper mid). Point 8 Information ratio: -0.70 (bottom quartile). Information ratio: -0.09 (lower mid). Information ratio: -1.73 (bottom quartile). Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Point 9 Yield to maturity (debt): 6.62% (top quartile). Yield to maturity (debt): 6.43% (bottom quartile). Yield to maturity (debt): 6.44% (lower mid). Yield to maturity (debt): 6.50% (upper mid). Yield to maturity (debt): 6.19% (bottom quartile). Point 10 Modified duration: 0.08 yrs (lower mid). Modified duration: 0.07 yrs (top quartile). Modified duration: 0.09 yrs (bottom quartile). Modified duration: 0.07 yrs (upper mid). Modified duration: 0.17 yrs (bottom quartile). Indiabulls Liquid Fund

PGIM India Insta Cash Fund

JM Liquid Fund

Axis Liquid Fund

Aditya Birla Sun Life Liquid Fund

How to Invest in Debt Funds Online?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

Conclusion

Thus, it can be said that it is both the funds have their own merits and demerits. However, it finally lies on the individuals on which scheme to choose. People before choosing any schemes need to assess whether the fund’s objective is in-line with their objective or not. Also, people should understand the modalities of the scheme completely before Investing in it. They can even consult a financial advisor to ensure that their investment gives them maximum returns.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

You Might Also Like

SBI Equity Hybrid Fund Vs ICICI Prudential Equity And Debt Fund

HDFC Balanced Advantage Fund Vs ICICI Prudential Equity And Debt Fund

ICICI Prudential Equity And Debt Fund Vs HDFC Balanced Advantage Fund

ICICI Prudential Equity And Debt Fund Vs ICICI Prudential Balanced Advantage Fund

Liquid Funds Vs Savings Account: Where To Park Your Idle Cash?