Top 3 Reasons of Investing in Gold

Gold plays an important role in the Indian culture. Also, Investing in gold is known to be a safe haven for investors. Whenever something huge and unexpected happens globally like Brexit, Trump presidency or the recent demonetization in India, while other stocks see red, gold prices surge at such times. For reasons cultural or monetary, investors flock towards gold, making it one of the most sought after asset in the country (and globally).

Why Should you be Investing in Gold?

1. Inflation Hedge

Gold is known to be an excellent inflation hedge. It means that you can Buy Gold in today’s currency and can sell it at the value of the currency tomorrow. Thus, hedging the losses occurring due to currency devaluation.

2. High Demand

There is always a demand for gold. No matter what the circumstances of the market, gold is a prized commodity internationally. So, if you want to sell off your gold today, you will always find takers for it.

3. Risk Averse

As said earlier, during an international crisis, people start investing in gold. This happens mainly due to the fear of the unknown. Speculation causes gold prices to rise drastically thus having an inverse relation with the market. Hence the reason gold is known as a "Safe Haven" asset.

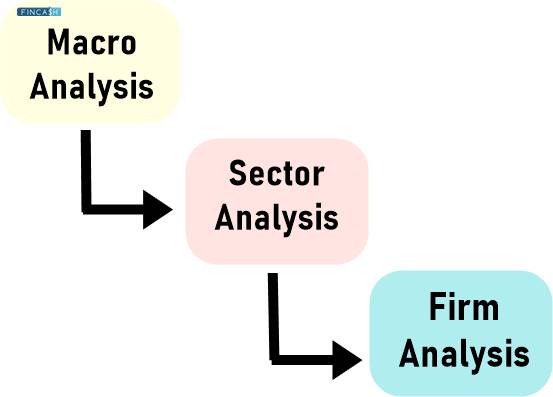

How to Start Gold Investment?

You can invest in gold either by buying physical gold or buying gold indirectly in the form of gold Mutual Funds or gold ETFs. Each form has its own set of advantages and disadvantages.

Physical Gold

Gold can be bought in physical forms like coins, jewellery, bullion, etc. The investor has the possession of the gold. This gives a sense of assurance to the investor since he can see his gold.

Talk to our investment specialist

Indirect Gold: Gold ETFs or Gold Mutual Funds

Gold funds are topping the returns chart for over three years now, making them an attractive option for investors. A gold ETF (Exchange Traded Fund) is an instrument that is based on gold price. It holds physical gold as the underlying asset.

Gold Mutual Funds are mutual funds that are issued with gold ETFs held as underlying assets. Here’s the difference between the two:

| Gold ETFs | Gold Mutual Funds |

|---|---|

| Purchase price based on the market value of gold | Purchase price based on NAV (Net Asset Value) of the fund |

| Hold physical gold as the underlying asset | Hold gold ETFs as the underlying asset |

| Requires a Demat account | Does not require demat account |

| Investors as to pay a brokerage chargers | Investors has to pay management fees as well as the underlying costs incurred for holding the ETFs |

How to Buy Gold: Physical Gold Vs Indirect Gold

Investing in gold is a great idea. But, buying physical gold has its own hassles. This is where gold funds or gold ETFs are a saviour.

Purity

One of the biggest concerns while buying gold is the purity factor. Gold bought through jewellery shops may or may not be 100% pure. Gold ETFs are backed by 24-carat gold so the investors are assured of the quality of the gold.

Liquidity

Liquidity is another problem while buying physical gold. You have to take the gold to the jewellery shop and take whatever price he is willing to give you. There is no fixed price here. Whereas, gold funds can be liquidated by calling your broker or just a few clicks. The price of the ETF is linked to the international price of gold, so you know the exact value you would get.

Making Charges

Buying gold in the form of jewellery involves making charges which are included in the cost price. Whereas, gold funds don’t have such making charges, thus reducing the cost price.

Easy to Buy

Physical gold has to be brought from a trusted source, be checked for its purity and ensure you get a good price. Gold funds can be bought in minutes. The quality is assured and the prices are transparent, making them a better option.

Taxation

On the taxation aspect, gold attracts VAT( Value Added Tax) and wealth tax. Neither of these applies to gold funds.

According to experts, a Portfolio should have at least 5-10% invested in gold. It balances the portfolio since it has an inverse relation with the market. So, start investing in gold today and add some shine to your investments.

Fund Selection Methodology used to find 8 funds

Best Gold Mutual Funds in India 2026

Below is the list of top Gold Funds having AUM/Net Assets > 25 Crore

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Aditya Birla Sun Life Gold Fund Growth ₹48.3821

↑ 2.36 ₹1,781 26.1 56.6 82.8 40 26.4 72 Invesco India Gold Fund Growth ₹46.3298

↑ 2.24 ₹476 25.7 54.2 79.7 39 25.8 69.6 SBI Gold Fund Growth ₹48.8255

↑ 2.38 ₹15,024 30.9 59.7 94 42.3 28.2 71.5 Nippon India Gold Savings Fund Growth ₹63.6919

↑ 3.09 ₹7,160 26.2 56.6 82.3 40 26.3 71.2 Axis Gold Fund Growth ₹48.8914

↑ 2.74 ₹2,835 26.1 54.1 84.4 40 26.4 69.8 ICICI Prudential Regular Gold Savings Fund Growth ₹51.6533

↑ 2.61 ₹6,338 26.4 56.7 83.4 40.1 26.4 72 HDFC Gold Fund Growth ₹49.6937

↑ 2.32 ₹11,458 26.3 56.9 82.8 39.9 26.3 71.3 Kotak Gold Fund Growth ₹63.9239

↑ 3.07 ₹6,556 26.2 56.7 82.6 39.8 26.1 70.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 2 Mar 26 Research Highlights & Commentary of 8 Funds showcased

Commentary Aditya Birla Sun Life Gold Fund Invesco India Gold Fund SBI Gold Fund Nippon India Gold Savings Fund Axis Gold Fund ICICI Prudential Regular Gold Savings Fund HDFC Gold Fund Kotak Gold Fund Point 1 Bottom quartile AUM (₹1,781 Cr). Bottom quartile AUM (₹476 Cr). Highest AUM (₹15,024 Cr). Upper mid AUM (₹7,160 Cr). Lower mid AUM (₹2,835 Cr). Lower mid AUM (₹6,338 Cr). Top quartile AUM (₹11,458 Cr). Upper mid AUM (₹6,556 Cr). Point 2 Established history (13+ yrs). Established history (14+ yrs). Established history (14+ yrs). Oldest track record among peers (15 yrs). Established history (14+ yrs). Established history (14+ yrs). Established history (14+ yrs). Established history (14+ yrs). Point 3 Top rated. Rating: 3★ (top quartile). Rating: 2★ (upper mid). Rating: 2★ (upper mid). Rating: 1★ (lower mid). Rating: 1★ (lower mid). Rating: 1★ (bottom quartile). Rating: 1★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 26.39% (top quartile). 5Y return: 25.85% (bottom quartile). 5Y return: 28.22% (top quartile). 5Y return: 26.26% (lower mid). 5Y return: 26.39% (upper mid). 5Y return: 26.39% (upper mid). 5Y return: 26.32% (lower mid). 5Y return: 26.12% (bottom quartile). Point 6 3Y return: 39.97% (lower mid). 3Y return: 39.03% (bottom quartile). 3Y return: 42.32% (top quartile). 3Y return: 40.00% (upper mid). 3Y return: 40.00% (upper mid). 3Y return: 40.12% (top quartile). 3Y return: 39.94% (lower mid). 3Y return: 39.82% (bottom quartile). Point 7 1Y return: 82.81% (upper mid). 1Y return: 79.67% (bottom quartile). 1Y return: 94.00% (top quartile). 1Y return: 82.35% (bottom quartile). 1Y return: 84.36% (top quartile). 1Y return: 83.39% (upper mid). 1Y return: 82.80% (lower mid). 1Y return: 82.55% (lower mid). Point 8 1M return: 0.26% (upper mid). 1M return: -0.40% (bottom quartile). 1M return: 14.47% (top quartile). 1M return: 0.12% (lower mid). 1M return: 2.08% (top quartile). 1M return: 0.06% (bottom quartile). 1M return: 0.20% (lower mid). 1M return: 0.23% (upper mid). Point 9 Alpha: 0.00 (top quartile). Alpha: 0.00 (top quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Alpha: 0.00 (bottom quartile). Point 10 Sharpe: 3.08 (bottom quartile). Sharpe: 3.23 (lower mid). Sharpe: 3.25 (upper mid). Sharpe: 3.01 (bottom quartile). Sharpe: 3.44 (top quartile). Sharpe: 3.10 (lower mid). Sharpe: 3.29 (upper mid). Sharpe: 3.55 (top quartile). Aditya Birla Sun Life Gold Fund

Invesco India Gold Fund

SBI Gold Fund

Nippon India Gold Savings Fund

Axis Gold Fund

ICICI Prudential Regular Gold Savings Fund

HDFC Gold Fund

Kotak Gold Fund

How to Invest in Gold MF Online?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

FAQs

1. Why is investing in gold ETFs considered secure?

A: Investing in gold is always considered to be secure as it offers security against market Volatility. When you invest in gold ETFs, it is similar to investing in physical gold, except that you will not be the owner of a piece of gold. Instead, it will represent the gold in the form of an Exchange Traded Fund. However, the gold ETF offers similar facilities as physical gold, and you can be assured that your investment is safe.

2. Do gold ETFs help in diversifying an investment portfolio?

A: Yes, if you are planning to diversify your investment portfolio, you must invest in multiple products and not just stocks and shares of different companies. In such a scenario investing in gold, ETFs can prove a suitable method for diversifying your investment portfolio.

3. How can gold ETFs broaden your investment portfolio?

A: When you invest in gold ETFs, you are not investing in the gold capital market. Instead, you diversify your investments and gain exposure to other related industries like gold mining, transportation, and other related industries. Thus, when you invest in gold ETFs, your investment automatically gets diversified.

4. What is the most significant problem with physical gold?

A: The most significant advantage is liquidity. You can exit from the investment anytime, and you can get cash in return. However, liquidating physical gold can become an issue as you will have to approach a jeweler store and sell the gold. Moreover, liquidating physical gold is often considered a loss, but liquidating gold ETF is like liquidating any other investment.

5. What are the tax benefits of gold ETF?

A: Compared to physical gold, you do not have to pay VAT for gold ETF. Similarly, you will not have to pay wealth tax. It falls under long-term Capital Gains, and hence the gold ETFs are not taxable.

6. How can I purchase gold ETFs?

A: You need to open DEMAT account with a reputed Bank. Your stockbroker or fund manager can help you with the process. After that, you can log in to the financial institution's website and select the gold ETF offered by a particular company. You can then purchase ETFs of the specified number of units. You will get confirmation over email once the purchase has been completed.

7. Which is better direct or indirect gold?

A: In the case of direct gold, you will have to pay the jeweler to purchase the ornament, and you will be paying additional charges such as making charge, VAT, and service charge. However, when you purchase gold ETFs, you bypass all of these issues, but you become the owner of the equivalent value of gold. Moreover, you can earn more by trading in gold ETFs, whereas the physical gold will not be productive. Thus, gold ETFs are a better investment compared to physical gold.

8. Is there any chance of loss while investing in gold ETFs?

A: The price of gold ETFs is dependent on market volatility. However, the price of gold never plummets so low that your investment will be a complete loss. Therefore, the chances that your investment will be a complete loss are rare.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Very informative guide, I like how you broke down the pros and cons of physical gold versus indirect options like ETFs and mutual funds.