Gold Investment Options in India

Today, gold as an investment is just not limited to buying ornaments or jewellery, it has expanded into many different options. One can invest in gold through various other means like Gold ETFs, Gold Mutual Funds, E-Gold, etc., with each holding unique benefits. Investors wanting to invest in gold, here’s a guide on different Gold Investment options in India.

Top Gold Investment Options in India

Here are some of the best investment options under Gold:

- Gold ETF

- E-Gold

- Gold Schemes - Gold Monetisation Scheme, Gold Sovereign Bond Scheme & Indian Gold Coin Scheme

- Gold Mutual Fund

- Gold Coins and Bullion

1. Invest in Gold Via Gold ETFs

Gold (ETFs) Exchange Traded Funds are units representing physical gold, which may be in dematerialised form or paper form. These are open-ended funds that trade on major stock exchanges. Investors can Buy Gold ETFs online and keep it in their Demat account. Here one gold ETF unit is equal to one gram of gold.

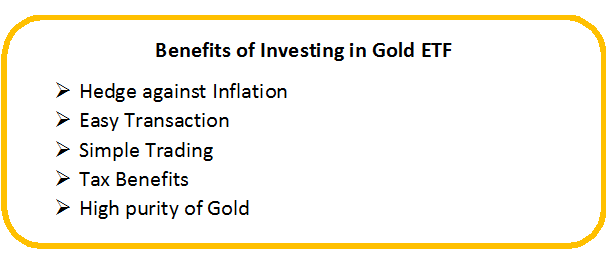

Benefits

One of the major advantages of Investing in Gold ETFs is that it is cost efficient. There is no premium like making charges attached to it. One can buy at the international rate without any markup. Furthermore, unlike physical gold, there is no wealth tax on Gold ETFs in India.

Fund Selection Methodology used to find 5 funds

Best Gold ETFs to Invest 2026

Some of the best underlying gold ETFs to invest are:

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Aditya Birla Sun Life Gold Fund Growth ₹45.8244

↑ 0.03 ₹1,781 22.6 47.3 81.3 39.3 27 72 Invesco India Gold Fund Growth ₹44.1603

↑ 0.26 ₹476 21.5 45.8 78.3 38.5 26.6 69.6 SBI Gold Fund Growth ₹46.3452

↑ 0.22 ₹15,024 22.4 47.5 81.5 39.7 27.3 71.5 Nippon India Gold Savings Fund Growth ₹60.482

↑ 0.24 ₹7,160 22.2 47.2 81.2 39.3 27.1 71.2 ICICI Prudential Regular Gold Savings Fund Growth ₹48.9785

↑ 0.30 ₹6,338 22.1 47 81.2 39.5 27.1 72 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 9 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Aditya Birla Sun Life Gold Fund Invesco India Gold Fund SBI Gold Fund Nippon India Gold Savings Fund ICICI Prudential Regular Gold Savings Fund Point 1 Bottom quartile AUM (₹1,781 Cr). Bottom quartile AUM (₹476 Cr). Highest AUM (₹15,024 Cr). Upper mid AUM (₹7,160 Cr). Lower mid AUM (₹6,338 Cr). Point 2 Established history (13+ yrs). Established history (14+ yrs). Established history (14+ yrs). Oldest track record among peers (15 yrs). Established history (14+ yrs). Point 3 Top rated. Rating: 3★ (upper mid). Rating: 2★ (lower mid). Rating: 2★ (bottom quartile). Rating: 1★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 26.98% (bottom quartile). 5Y return: 26.58% (bottom quartile). 5Y return: 27.34% (top quartile). 5Y return: 27.12% (lower mid). 5Y return: 27.14% (upper mid). Point 6 3Y return: 39.27% (bottom quartile). 3Y return: 38.53% (bottom quartile). 3Y return: 39.67% (top quartile). 3Y return: 39.34% (lower mid). 3Y return: 39.53% (upper mid). Point 7 1Y return: 81.30% (upper mid). 1Y return: 78.28% (bottom quartile). 1Y return: 81.52% (top quartile). 1Y return: 81.25% (lower mid). 1Y return: 81.17% (bottom quartile). Point 8 1M return: 4.23% (bottom quartile). 1M return: 4.57% (upper mid). 1M return: 4.44% (lower mid). 1M return: 4.60% (top quartile). 1M return: 4.02% (bottom quartile). Point 9 Alpha: 0.00 (top quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Alpha: 0.00 (bottom quartile). Point 10 Sharpe: 3.08 (bottom quartile). Sharpe: 3.23 (upper mid). Sharpe: 3.25 (top quartile). Sharpe: 3.01 (bottom quartile). Sharpe: 3.10 (lower mid). Aditya Birla Sun Life Gold Fund

Invesco India Gold Fund

SBI Gold Fund

Nippon India Gold Savings Fund

ICICI Prudential Regular Gold Savings Fund

2. E-Gold- Buy Gold in Electronic Form

One of the other gold investment options in India is e-gold. To invest here, one should have a Trading Account with specified National Spot Exchange (NSE) dealers. E-gold units can be bought and sold through the exchange (NSE) just like shares. Here one unit of e-gold is equal to one gram of gold.

Benefits

Investors wanting to make a long-term investment can buy e-gold in small quantities and keep it in their Demat account. Later, after achieving the target, they can take the physical delivery of gold or can encash the electronic units. Also, the transparency in pricing and seamless trading is one of the major benefits of this product.

Talk to our investment specialist

3. Invest in Three New Gold Schemes

The Government of India has recently launched three gold-related schemes, namely- the Gold Monetisation Scheme, Gold Sovereign Bond Scheme and the Indian Gold Coin Scheme.

Gold Monetisation Scheme

The Gold Monetisation Scheme (GMS) works like a gold Savings Account, which will earn interest on the gold that you deposit, based on the weight along with the appreciation in the value of gold. Investors can deposit gold in any physical form- bar, coins or jewellery.

Investors would earn regular interest on their idle gold, which not only encourages gold investment but also adds value to savings too. The deposit term of this scheme i.e.,- Short-term, mid and long term- allows investors to achieve their Financial goals.

Sovereign Gold Bond

The Sovereign Gold Bond scheme is an alternative to purchasing physical gold. When people invest in gold Bonds, they get a paper against their investment. Upon maturity, investors can redeem these bonds to cash or can sell it on Bombay Stock Exchange (BSE) at the prevailing market price.

Sovereign Gold Bonds are available in the digital & Demat form and can also be used as Collateral for loans. Minimum investment under this scheme is 1 gram.

Indian Gold Coin

The Indian Gold Coin Scheme is one of the three gold investment options launched by the Government of India. The coin is currently available in denominations of 5gm, 10gm & 20gm, which allows even those with a small appetite to buy gold. The Indian Gold Coin is the first national gold coin which will have the face of Mahatma Gandhi on one side and the image of Ashok Chakra minted on the other side.

One of the most advantageous features of this scheme is the ‘Buy Back’ option that it provides. Metals and Minerals Trading Corporation of India (MMTC) offers the transparent ‘buy back’ option for these gold coins through its own showrooms across India.

| Options | Gold ETFs | E-Gold | Gold Mutual Funds | Gold Sovereign Bond | Gold Monetisation Scheme |

|---|---|---|---|---|---|

| Minimum Investment Limit | 1 unit, no upper limit | 1 gram of gold | INR 1000 | Denominations of 5gm | 30 grams of gold |

| Liquidity | Can be sold on exchange | Can be sold any point | Can be redeemed at any point | Can be sold on exchange | Can be sold before maturity at penalty interest |

| Interest Earned | None | None | None | 2.75% p.a. interest on initial value of purchase, payable semi annually | 2.25% on mid-tenure & 2.5% on long-term deposit |

| Medium Holding Period | None | None | None | 8th year with exit option from 5th year | Short Term- 3 Yr, Mid Term- 7 Yr, Long Term- 12 Yr |

4. Gold Mutual Funds as a Gold Investment Option

Gold Mutual Funds are schemes that mainly invest in gold ETFs and other related assets. Gold Mutual Funds do not directly invest in physical gold, but take the same position indirectly by Investing in Gold ETFs.

Benefits

To invest in Gold MF, investors don’t need a Demat account. Also, here you are not constrained to buy complete units, unlike in an Exchange Traded Fund. So if you have INR 2000 to invest in gold you can buy units in a Gold Mutual Funds but it would be insufficient for a unit of gold in an ETF. You have the option of systematic investment too, so you can buy for as little as INR 500 p.m. SIPs are a good way to accumulate gold as an investment.

5. Gold Coins and Bullion

Buying gold in the form of bullion, bars or coins is generally considered to be one of the popular gold investment options, especially for those who want to buy physical gold. Since gold bars and bullion are made with a purest physical form of gold, investors are more inclined towards Investing in gold in this form.

Benefits

The benefit of gold bullion is that it is easily recognisable and easy to find buyers.

How to Invest in Gold Mutual Funds Online?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Good..............

This blog was amazing. I have learnded a lot from this blog. I have discovered some ways that will make us great gold investor check this . Read more at makingemperorsme.blogspot.com