A Guide to Investing in Gold ETFs

Investing in Gold ETFs is not only growing in popularity but is also considered to be one of the best ways to invest in gold. Gold ETFs have gained a lot of significance over the last decade. Gold Exchange Traded Funds first came into being in Australia in 2003 with the "Gold Bullion Security" being launched. Since then many countries (including India) have launched Gold ETFs. The first gold ETF in India was the Gold BeES, this was launched in February 2007.

Talk to our investment specialist

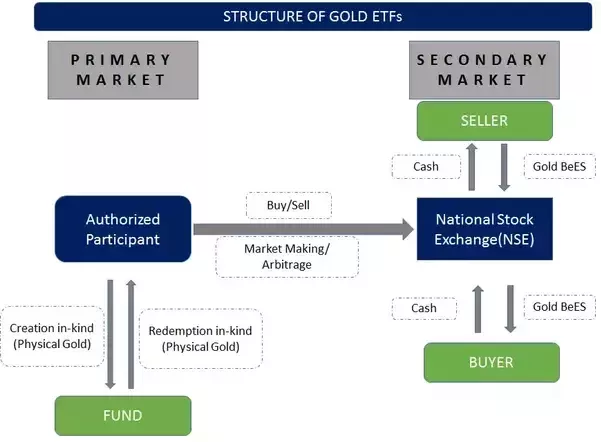

How Do Gold ETFs Work? Structure of Gold ETFs

Before Investing in Gold ETFs, it is important to know the structure under which they operate. Gold ETFs are backed by physical gold at the back-end. So when an investor purchases a Gold ETF on the exchange, the entity involved at the back-end buys physical gold. The Gold ETF units are listed on an exchange, for e.g Gold BeES are listed on the National Stock Exchange (NSE) and they closely track the actual prices of gold (called spot prices). There is continuous buying and selling by "Authorised Participants" to ensure that the price of Gold ETF and gold price are the same. An Authorised Participant is an entity deputed by the stock exchange (in this case NSE) to manage the buying and selling of the underlying asset (in this case physical gold) to create the Exchange Traded Fund. These are usually very large organisations.

While the diagram below may look complex:

- Buyer and sellers (investors) of Gold ETF use the exchange platform (NSE), so trading is easy. They can place buy & sell orders, and the broker would execute the same.

- Any additional buying or selling net of this(after the buyer and seller transactions) is settled with Authorised Participants who buy and sell physical gold. So if there are no buyers and someone wants to sell, the Authorised Participant would create liquidity, buy buying the units of Gold ETF from the seller.

Advantages of Investing in Gold ETFs

Some of the benefits of investing in Gold ETFs are:

1. Small Denomination

Going to a retailer will require a decent sum of money to buy a very small quantity of physical gold, also gold shops will not allow one to buy very small quantities of pure gold. Gold ETFs can be bought and sold in very small quantities and traded in them.

2. Cost Efficiency

Another advantage of investing in Gold ETFs is that it is cost efficient. There is no premium like making charges attached to gold ETFs, one can buy at the international rate without any markup.

3. Convenience for Long-term Holding

There is no wealth tax on Gold ETFs (in India), unlike physical gold. Also, there is no issue of storage where one is worried about security etc. The units are held in the name of the individual in a Demat account. Typically, this is a problem if one stores physical gold in good quantities at home or a Bank locker.

4. Uniform Availability

There is no issue with respect to the availability of Gold Bees(or ay other Gold ETF) on the exchange, since the exchange is responsible for trading, for buying and selling.

5. Liquidity

Liquidity is available since this is traded on the exchange and there are market makers(Authorised Participants) for creating liquidity. So one does not have to worry about finding a shop to sell or even worry about mark-downs or even testing purity when faced with selling.

6. No Risk of Theft

Since the units of Gold ETFs are in the demat (dematerialized) account of the holder, there is no risk of theft.

7. Purity

One of the biggest benefits of investing in Gold ETFs the purity is constant. There is no risk to purity since each unit is backed by the price of pure gold.

Fund Selection Methodology used to find 5 funds

Best Gold ETFs 2026

Some of the best underlying Gold ETFs to Invest in India are:

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Aditya Birla Sun Life Gold Fund Growth ₹44.5952

↑ 0.31 ₹1,781 25.9 55.1 75.2 37.5 25.5 72 Invesco India Gold Fund Growth ₹42.9219

↑ 0.15 ₹476 25.6 53.6 72.9 37 25.2 69.6 SBI Gold Fund Growth ₹44.9826

↑ 1.10 ₹15,024 25.6 55.4 75.6 38 25.5 71.5 Nippon India Gold Savings Fund Growth ₹58.736

↑ 0.21 ₹7,160 25.4 55 75.2 37.6 25.6 71.2 ICICI Prudential Regular Gold Savings Fund Growth ₹47.5707

↑ 1.14 ₹6,338 25.6 55.3 75.7 37.8 25.4 72 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 20 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Aditya Birla Sun Life Gold Fund Invesco India Gold Fund SBI Gold Fund Nippon India Gold Savings Fund ICICI Prudential Regular Gold Savings Fund Point 1 Bottom quartile AUM (₹1,781 Cr). Bottom quartile AUM (₹476 Cr). Highest AUM (₹15,024 Cr). Upper mid AUM (₹7,160 Cr). Lower mid AUM (₹6,338 Cr). Point 2 Established history (13+ yrs). Oldest track record among peers (14 yrs). Established history (14+ yrs). Established history (14+ yrs). Established history (14+ yrs). Point 3 Top rated. Rating: 3★ (upper mid). Rating: 2★ (lower mid). Rating: 2★ (bottom quartile). Rating: 1★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 25.54% (upper mid). 5Y return: 25.16% (bottom quartile). 5Y return: 25.54% (lower mid). 5Y return: 25.56% (top quartile). 5Y return: 25.44% (bottom quartile). Point 6 3Y return: 37.52% (bottom quartile). 3Y return: 37.03% (bottom quartile). 3Y return: 38.00% (top quartile). 3Y return: 37.64% (lower mid). 3Y return: 37.81% (upper mid). Point 7 1Y return: 75.24% (bottom quartile). 1Y return: 72.91% (bottom quartile). 1Y return: 75.65% (upper mid). 1Y return: 75.24% (lower mid). 1Y return: 75.70% (top quartile). Point 8 1M return: 2.06% (bottom quartile). 1M return: 4.19% (upper mid). 1M return: 1.67% (bottom quartile). 1M return: 4.79% (top quartile). 1M return: 2.86% (lower mid). Point 9 Alpha: 0.00 (top quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Alpha: 0.00 (bottom quartile). Point 10 Sharpe: 3.08 (bottom quartile). Sharpe: 3.23 (upper mid). Sharpe: 3.25 (top quartile). Sharpe: 3.01 (bottom quartile). Sharpe: 3.10 (lower mid). Aditya Birla Sun Life Gold Fund

Invesco India Gold Fund

SBI Gold Fund

Nippon India Gold Savings Fund

ICICI Prudential Regular Gold Savings Fund

Gold ETFs & Measuring Performance

The performance of Exchange Traded Funds (including Gold ETFs) and Index Funds is measured by an indicator called “tracking error”. Tracking error is nothing but a measure that sees the divergence between the ETF (or index Fund) performance and the performance of the benchmark it seeks to copy. So lower the tracking error, better the ETF.

Indians are very culturally inclined towards buying gold, whether for ornamental purposes or even for wealth creation. While earlier physical gold used to be the choice, Gold ETFs are clearly better in every aspect (except for ornamental purpose where once needs to buy physical gold), with benefits such as storage, security, wealth tax, liquidity, no mark-ups etc. One can use various choices such as Gold BeES etc where one can Buy Gold on the exchange!

How to Invest in Gold Mutual Funds Online?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Informative page