Best Gold ETFs to Invest in 2026

In recent years, the popularity of Gold ETFs (Exchange Traded Fund) amongst investors has surged high. Investors are more inclined towards Investing in Gold ETFs as they

track gold prices and eliminate the need of storage. But, when it comes to Investing, often investors are confused over choosing the best Gold ETFs.

The ideal way to go for Gold ETFs is to focus on the fund with the lowest tracking error. It is advisable to go for a Gold ETF that has the largest margin and highest volume. To make it convenient for investors, we have listed down the best Gold ETFs to invest in India.

How to Invest in Gold ETFs?

To invest in gold ETF, you need to have a Demat account and an online Trading Account. To open an account, you would require a PAN Card, an address proof and an identity proof. After the account is ready, you can choose a Gold ETF and place an order. Once the trade is executed a confirmation is sent to you in your account. A small fee from the fund house and the broker is charged when one buys or sells these Gold ETFs.

How to Invest in Gold Mutual Funds Online?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

Talk to our investment specialist

Fund Selection Methodology used to find 5 funds

Best Gold ETFs to Invest 2026

Some of the best performing underlying gold ETFs having AUM/Net Assets > 25 Crore are:

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Aditya Birla Sun Life Gold Fund Growth ₹46.022

↑ 0.38 ₹1,781 26.1 56.6 82.8 40 26.4 72 Invesco India Gold Fund Growth ₹44.0896

↑ 0.24 ₹476 25.7 54.2 79.7 39 25.8 69.6 SBI Gold Fund Growth ₹46.4429

↑ 0.39 ₹15,024 26.6 57.2 83.1 40.4 26.6 71.5 Nippon India Gold Savings Fund Growth ₹60.6

↑ 0.52 ₹7,160 26.2 56.6 82.3 40 26.3 71.2 ICICI Prudential Regular Gold Savings Fund Growth ₹49.0474

↑ 0.46 ₹6,338 26.4 56.7 83.4 40.1 26.4 72 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 27 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Aditya Birla Sun Life Gold Fund Invesco India Gold Fund SBI Gold Fund Nippon India Gold Savings Fund ICICI Prudential Regular Gold Savings Fund Point 1 Bottom quartile AUM (₹1,781 Cr). Bottom quartile AUM (₹476 Cr). Highest AUM (₹15,024 Cr). Upper mid AUM (₹7,160 Cr). Lower mid AUM (₹6,338 Cr). Point 2 Established history (13+ yrs). Oldest track record among peers (14 yrs). Established history (14+ yrs). Established history (14+ yrs). Established history (14+ yrs). Point 3 Top rated. Rating: 3★ (upper mid). Rating: 2★ (lower mid). Rating: 2★ (bottom quartile). Rating: 1★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 26.39% (upper mid). 5Y return: 25.85% (bottom quartile). 5Y return: 26.55% (top quartile). 5Y return: 26.26% (bottom quartile). 5Y return: 26.39% (lower mid). Point 6 3Y return: 39.97% (bottom quartile). 3Y return: 39.03% (bottom quartile). 3Y return: 40.39% (top quartile). 3Y return: 40.00% (lower mid). 3Y return: 40.12% (upper mid). Point 7 1Y return: 82.81% (lower mid). 1Y return: 79.67% (bottom quartile). 1Y return: 83.09% (upper mid). 1Y return: 82.35% (bottom quartile). 1Y return: 83.39% (top quartile). Point 8 1M return: 0.26% (upper mid). 1M return: -0.40% (bottom quartile). 1M return: 0.35% (top quartile). 1M return: 0.12% (lower mid). 1M return: 0.06% (bottom quartile). Point 9 Alpha: 0.00 (top quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Alpha: 0.00 (bottom quartile). Point 10 Sharpe: 3.08 (bottom quartile). Sharpe: 3.23 (upper mid). Sharpe: 3.25 (top quartile). Sharpe: 3.01 (bottom quartile). Sharpe: 3.10 (lower mid). Aditya Birla Sun Life Gold Fund

Invesco India Gold Fund

SBI Gold Fund

Nippon India Gold Savings Fund

ICICI Prudential Regular Gold Savings Fund

An Open ended Fund of Funds Scheme with the investment objective to provide returns that tracks returns provided by Birla Sun Life Gold ETF (BSL Gold ETF). Below is the key information for Aditya Birla Sun Life Gold Fund Returns up to 1 year are on To provide returns that closely corresponds to returns provided by Invesco India Gold Exchange Traded Fund. Research Highlights for Invesco India Gold Fund Below is the key information for Invesco India Gold Fund Returns up to 1 year are on The scheme seeks to provide returns that closely correspond to returns provided by SBI - ETF Gold (Previously known as SBI GETS). Research Highlights for SBI Gold Fund Below is the key information for SBI Gold Fund Returns up to 1 year are on The investment objective of the Scheme is to seek to provide returns that closely correspond to returns provided by Reliance ETF Gold BeES. Research Highlights for Nippon India Gold Savings Fund Below is the key information for Nippon India Gold Savings Fund Returns up to 1 year are on ICICI Prudential Regular Gold Savings Fund (the Scheme) is a fund of funds scheme with the primary objective to generate returns by investing in units of ICICI Prudential Gold Exchange Traded Fund (IPru Gold ETF).

However, there can be no assurance that the investment objectives of the Scheme will be realized. Research Highlights for ICICI Prudential Regular Gold Savings Fund Below is the key information for ICICI Prudential Regular Gold Savings Fund Returns up to 1 year are on 1. Aditya Birla Sun Life Gold Fund

Aditya Birla Sun Life Gold Fund

Growth Launch Date 20 Mar 12 NAV (27 Feb 26) ₹46.022 ↑ 0.38 (0.84 %) Net Assets (Cr) ₹1,781 on 31 Jan 26 Category Gold - Gold AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 0.51 Sharpe Ratio 3.08 Information Ratio 0 Alpha Ratio 0 Min Investment 100 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹9,602 31 Jan 23 ₹11,314 31 Jan 24 ₹12,322 31 Jan 25 ₹15,883 31 Jan 26 ₹31,280 Returns for Aditya Birla Sun Life Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 27 Feb 26 Duration Returns 1 Month 0.3% 3 Month 26.1% 6 Month 56.6% 1 Year 82.8% 3 Year 40% 5 Year 26.4% 10 Year 15 Year Since launch 11.6% Historical performance (Yearly) on absolute basis

Year Returns 2024 72% 2023 18.7% 2022 14.5% 2021 12.3% 2020 -5% 2019 26% 2018 21.3% 2017 6.8% 2016 1.6% 2015 11.5% Fund Manager information for Aditya Birla Sun Life Gold Fund

Name Since Tenure Priya Sridhar 31 Dec 24 1.09 Yr. Data below for Aditya Birla Sun Life Gold Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 2.07% Other 97.93% Top Securities Holdings / Portfolio

Name Holding Value Quantity Aditya BSL Gold ETF

- | -99% ₹1,770 Cr 122,558,766

↑ 14,664,583 Clearing Corporation Of India Limited

CBLO/Reverse Repo | -3% ₹45 Cr Net Receivables / (Payables)

Net Current Assets | -2% -₹34 Cr 2. Invesco India Gold Fund

Invesco India Gold Fund

Growth Launch Date 5 Dec 11 NAV (27 Feb 26) ₹44.0896 ↑ 0.24 (0.54 %) Net Assets (Cr) ₹476 on 31 Jan 26 Category Gold - Gold AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 0.37 Sharpe Ratio 3.23 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-6 Months (2%),6-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹9,425 31 Jan 23 ₹11,241 31 Jan 24 ₹12,180 31 Jan 25 ₹15,728 31 Jan 26 ₹29,851 Returns for Invesco India Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 27 Feb 26 Duration Returns 1 Month -0.4% 3 Month 25.7% 6 Month 54.2% 1 Year 79.7% 3 Year 39% 5 Year 25.8% 10 Year 15 Year Since launch 11% Historical performance (Yearly) on absolute basis

Year Returns 2024 69.6% 2023 18.8% 2022 14.5% 2021 12.8% 2020 -5.5% 2019 27.2% 2018 21.4% 2017 6.6% 2016 1.3% 2015 21.6% Fund Manager information for Invesco India Gold Fund

Name Since Tenure Abhisek Bahinipati 1 Nov 25 0.25 Yr. Data below for Invesco India Gold Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 4.59% Other 95.41% Top Securities Holdings / Portfolio

Name Holding Value Quantity Invesco India Gold ETF

- | -97% ₹461 Cr 329,298

↑ 47,500 Triparty Repo

CBLO/Reverse Repo | -5% ₹23 Cr Net Receivables / (Payables)

CBLO | -2% -₹8 Cr 3. SBI Gold Fund

SBI Gold Fund

Growth Launch Date 12 Sep 11 NAV (27 Feb 26) ₹46.4429 ↑ 0.39 (0.84 %) Net Assets (Cr) ₹15,024 on 31 Jan 26 Category Gold - Gold AMC SBI Funds Management Private Limited Rating ☆☆ Risk Moderately High Expense Ratio 0.3 Sharpe Ratio 3.25 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹9,629 31 Jan 23 ₹11,359 31 Jan 24 ₹12,462 31 Jan 25 ₹16,115 31 Jan 26 ₹30,818 Returns for SBI Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 27 Feb 26 Duration Returns 1 Month 0.4% 3 Month 26.6% 6 Month 57.2% 1 Year 83.1% 3 Year 40.4% 5 Year 26.6% 10 Year 15 Year Since launch 11.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 71.5% 2023 19.6% 2022 14.1% 2021 12.6% 2020 -5.7% 2019 27.4% 2018 22.8% 2017 6.4% 2016 3.5% 2015 10% Fund Manager information for SBI Gold Fund

Name Since Tenure Raviprakash Sharma 12 Sep 11 14.4 Yr. Data below for SBI Gold Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 1.93% Other 98.07% Top Securities Holdings / Portfolio

Name Holding Value Quantity SBI Gold ETF

- | -100% ₹14,966 Cr 1,097,211,666

↑ 145,868,881 Treps

CBLO/Reverse Repo | -2% ₹306 Cr Net Receivable / Payable

CBLO | -2% -₹248 Cr 4. Nippon India Gold Savings Fund

Nippon India Gold Savings Fund

Growth Launch Date 7 Mar 11 NAV (27 Feb 26) ₹60.6 ↑ 0.52 (0.86 %) Net Assets (Cr) ₹7,160 on 31 Jan 26 Category Gold - Gold AMC Nippon Life Asset Management Ltd. Rating ☆☆ Risk Moderately High Expense Ratio 0.35 Sharpe Ratio 3.01 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (2%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹9,635 31 Jan 23 ₹11,321 31 Jan 24 ₹12,369 31 Jan 25 ₹15,957 31 Jan 26 ₹31,222 Returns for Nippon India Gold Savings Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 27 Feb 26 Duration Returns 1 Month 0.1% 3 Month 26.2% 6 Month 56.6% 1 Year 82.3% 3 Year 40% 5 Year 26.3% 10 Year 15 Year Since launch 12.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 71.2% 2023 19% 2022 14.3% 2021 12.3% 2020 -5.5% 2019 26.6% 2018 22.5% 2017 6% 2016 1.7% 2015 11.6% Fund Manager information for Nippon India Gold Savings Fund

Name Since Tenure Himanshu Mange 23 Dec 23 2.11 Yr. Data below for Nippon India Gold Savings Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 1.5% Other 98.5% Top Securities Holdings / Portfolio

Name Holding Value Quantity Nippon India ETF Gold BeES

- | -100% ₹7,154 Cr 527,059,679

↑ 44,753,946 Triparty Repo

CBLO/Reverse Repo | -1% ₹36 Cr Net Current Assets

Net Current Assets | -0% -₹29 Cr Cash Margin - Ccil

CBLO/Reverse Repo | -0% ₹0 Cr Cash

Net Current Assets | -0% ₹0 Cr 00 5. ICICI Prudential Regular Gold Savings Fund

ICICI Prudential Regular Gold Savings Fund

Growth Launch Date 11 Oct 11 NAV (27 Feb 26) ₹49.0474 ↑ 0.46 (0.94 %) Net Assets (Cr) ₹6,338 on 31 Jan 26 Category Gold - Gold AMC ICICI Prudential Asset Management Company Limited Rating ☆ Risk Moderately High Expense Ratio 0.38 Sharpe Ratio 3.1 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-15 Months (2%),15 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹9,678 31 Jan 23 ₹11,361 31 Jan 24 ₹12,399 31 Jan 25 ₹16,060 31 Jan 26 ₹31,216 Returns for ICICI Prudential Regular Gold Savings Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 27 Feb 26 Duration Returns 1 Month 0.1% 3 Month 26.4% 6 Month 56.7% 1 Year 83.4% 3 Year 40.1% 5 Year 26.4% 10 Year 15 Year Since launch 11.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 72% 2023 19.5% 2022 13.5% 2021 12.7% 2020 -5.4% 2019 26.6% 2018 22.7% 2017 7.4% 2016 0.8% 2015 8.9% Fund Manager information for ICICI Prudential Regular Gold Savings Fund

Name Since Tenure Manish Banthia 27 Sep 12 13.36 Yr. Nishit Patel 29 Dec 20 5.1 Yr. Ashwini Bharucha 1 Nov 25 0.25 Yr. Venus Ahuja 1 Nov 25 0.25 Yr. Data below for ICICI Prudential Regular Gold Savings Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 2.73% Other 97.27% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Pru Gold ETF

- | -99% ₹6,265 Cr 448,751,665

↑ 56,893,421 Treps

CBLO/Reverse Repo | -3% ₹174 Cr Net Current Assets

Net Current Assets | -2% -₹101 Cr

How To Choose Best Gold ETFs?

The parameters to choose the best Gold ETFs in India are as follows-

Fund Track Record

It is important to know the past performance of the fund house in Exchange Traded Funds. Investors looking for the best Gold ETFs, it is advisable to choose a fund which has a track record of at least three years.

Liquidity

Exchange Traded Funds need to be checked based on the trading activity. Most of the ETFs trade heavily based on the changes in the benchmark, but some ETFs trade barely. The trading activity actually confirms the liquidity of an ETF. The higher the trading activity, the higher is the liquidity.

Tracking Error

The ETFs are expected to track the underlying index closely, but some ETF do not track it closely. An investor should prefer an ETF with minimum tracking error.

FAQs

1. How is the value of gold ETFs evaluated?

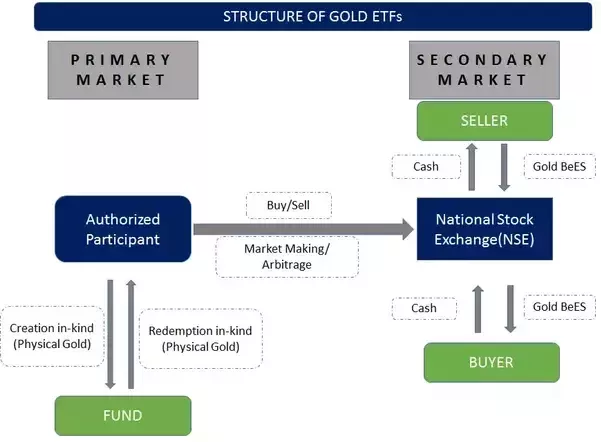

A: The value of gold ETFs is tracked based on the market value of physical gold. It represent the price of gold bars that have a purity of 99.5%. You can track the price of gold by logging into the NSE website or the BSE, and it will be reflected in the ongoing price of gold ETFs.

2. Who sells gold ETFs?

A: Mutual Fund companies and financial institutes sell gold ETFs. Some of the well-performing gold ETFs are mentioned above.

3. Can I purchase physical gold with the gold ETFs?

A: No, once the investment period is completed, you can close the account and withdraw the money. You cannot en-cash the gold ETFs for physical gold.

4. What do the gold ETFs invest in?

A: Gold ETFs have diversified investments in gold mining, manufacturing, transportation, and other similar sectors. Usually, the assets are made in industries known to produce good returns, ensuring that the investments are safe and secure.

5. Why should I invest in gold ETFs?

A: Gold ETFs are suitable investments, especially if you are looking to diversify your investment Portfolio. Gold, as experts mention, is one of the safest investments as its value does not go down extensively. The same is applicable for gold ETFs.

6. Is there any exit load in this investment?

A: Given the nature of the investment, most companies do not levy an exit load in gold ETFs. Hence, if you want to withdraw from the investment before its maturity, you do not have to pay any exit load. However, most financial institutes levy a brokerage charge you will have to discuss with your fund manager.

7. Are there any tax benefits on the investments?

A: You would not have to pay any VAT in the case of gold ETFs, which would be the case if you had purchased physical gold of similar value. Moreover, depending on the income tax slab that you fall under, you can enjoy tax benefits from the investment you make. With gold ETFs, you will not have to pay any wealth tax, long-term Capital Gains tax, or Sales Tax.

8. Can I use gold ETFs as collateral for loans?

A: Yes, gold ETFs are similar to gold, and hence, you can use them as Collateral for loans. You can it to secure the loan that you require from a Bank or a financial institute.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Research Highlights for Aditya Birla Sun Life Gold Fund