Gold Mutual Funds Vs Gold ETFs

One can invest in gold or other precious metal as an asset by either buying physical gold or by Investing in them electronically (e.g. Gold Funds or Gold ETFs). Amongst all the Gold Investment options available in India, Gold Mutual Funds and Gold ETFs are considered to a better option as it simplifies the gold buying process, provided by better liquidity and a safer accumulation of gold. But, often investors get confused between these two investments. Hence, in this article, we will study- Gold Mutual Funds Vs Gold ETFs - for making a better investment decision.

Gold ETFs

gold ETF (Exchange Traded Fund) is an open-ended fund that trades on stock exchanges. It is an instrument that is based on a gold price on invests in gold bullion. Gold ETFs invests in gold of 99.5 per cent purity (by RBI approved banks). They are managed by fund managers who track gold prices daily and trade physical gold to optimise returns. Gold ETFs offers high liquidity for both buyers and sellers.

Gold Mutual Funds

Gold Mutual Funds is a variant of Gold ETFs. These are schemes that mainly invest in gold ETFs and other related assets. Gold Mutual Funds do not directly invest in physical gold but take the same position indirectly by Investing in Gold ETFs.

Gold Mutual Funds Vs Gold ETFs

Gold ETFs and Gold Mutual Funds- both are pooled investments managed by Mutual Fund Houses and are designed to help investors invest in gold electronically. However, knowing them in detail brings out certain differences, which allows investors to make a better decision.

In Gold Mutual Funds you don't need a Demat account to invest. These funds invest in a Gold ETF floated by the same AMC (Asset Management Company). Investors can invest in Gold Mutual Funds through the SIP route, which is not possible when investing in the ETF. The flipside of the convenience is the exit load that one has to pay, which is slightly higher than Gold ETFs.

In contrast, in Gold ETFs, you need a Demat account and a broker through whom you can buy and sell them. Gold ETFs hold physical gold of equivalent value as the underlying asset. But in contrast, units of Gold Mutual Funds are issued with Gold ETFs as the underlying asset. The units of Gold ETFs are traded on exchanges and hence offers better liquidity and the right price for both buyers and sellers. But, this liquidity varies across fund houses, which makes liquidity an important factor when investing in a Gold ETF.

Talk to our investment specialist

Other Key Differences-

Investment Amount

Minimum investment amount in Gold Mutual Funds is of INR 1,000 (as monthly SIP), whereas Gold ETFs typically require 1gram gold as a minimum investment, which is close to INR 2,785 at current prices.

Liquidity

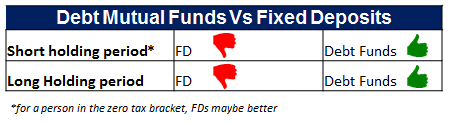

Being listed on stock exchange Gold ETFs are traded in the market, and with no exit loads or SIP constraints, thus investors can buy/sell at any time during market hours. But, since Gold Mutual Funds are not traded in the market, they can be bought/sold based on NAV for the day.

Transaction Cost

Gold Mutual Funds may have exit loads which are generally up to 1 year. Whereas, Gold ETFs don’t have any exit loads.

Expenses

Gold ETFs have lower management expenses than Gold Mutual Funds. Since Gold MFs invest in Gold ETFs their expenses include Gold ETF expense too.

Mode of Investment

Gold Mutual Funds can be purchased from Mutual Funds without a Demat account, but Gold ETFs are traded on the exchanges, they require a Demat account.

An overview-

| Parameters | Gold Mutual Funds | Gold ETFs |

|---|---|---|

| Investment Amount | Minimum investment INR 1,000 | Minimum investment- 1 gram of gold |

| Transaction Convenience | Demat account not required | Demat account required |

| Transaction Cost | Exit load uo tp 1 year | No exit load |

| Expenses | Higher management fees | Lower management fees |

Fund Selection Methodology used to find 8 funds

Best Gold ETFs to Invest in 2026

Some of the best underlying gold ETFs to invest are:

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) SBI Gold Fund Growth ₹48.8255

↑ 2.38 ₹15,024 30.9 59.7 94 42.3 28.2 71.5 Axis Gold Fund Growth ₹48.8914

↑ 2.74 ₹2,835 32.1 60.4 95.3 42.3 28.3 69.8 ICICI Prudential Regular Gold Savings Fund Growth ₹51.6533

↑ 2.61 ₹6,338 31.2 59.6 93.9 42.2 28.2 72 IDBI Gold Fund Growth ₹43.3878

↑ 2.31 ₹809 31.8 59.5 93.8 42.1 28.2 79 Nippon India Gold Savings Fund Growth ₹63.6919

↑ 3.09 ₹7,160 30.8 59.3 93.8 42 28 71.2 HDFC Gold Fund Growth ₹49.6937

↑ 2.32 ₹11,458 30.3 59 94.1 41.8 27.9 71.3 Kotak Gold Fund Growth ₹63.9239

↑ 3.07 ₹6,556 30.5 58.9 93.9 41.7 27.8 70.4 Aditya Birla Sun Life Gold Fund Growth ₹48.3821

↑ 2.36 ₹1,781 30.8 58.6 93.8 41.6 28 72 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 2 Mar 26 Research Highlights & Commentary of 8 Funds showcased

Commentary SBI Gold Fund Axis Gold Fund ICICI Prudential Regular Gold Savings Fund IDBI Gold Fund Nippon India Gold Savings Fund HDFC Gold Fund Kotak Gold Fund Aditya Birla Sun Life Gold Fund Point 1 Highest AUM (₹15,024 Cr). Lower mid AUM (₹2,835 Cr). Lower mid AUM (₹6,338 Cr). Bottom quartile AUM (₹809 Cr). Upper mid AUM (₹7,160 Cr). Top quartile AUM (₹11,458 Cr). Upper mid AUM (₹6,556 Cr). Bottom quartile AUM (₹1,781 Cr). Point 2 Established history (14+ yrs). Established history (14+ yrs). Established history (14+ yrs). Established history (13+ yrs). Oldest track record among peers (15 yrs). Established history (14+ yrs). Established history (14+ yrs). Established history (13+ yrs). Point 3 Rating: 2★ (top quartile). Rating: 1★ (upper mid). Rating: 1★ (lower mid). Not Rated. Rating: 2★ (upper mid). Rating: 1★ (lower mid). Rating: 1★ (bottom quartile). Top rated. Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 28.22% (top quartile). 5Y return: 28.31% (top quartile). 5Y return: 28.15% (upper mid). 5Y return: 28.19% (upper mid). 5Y return: 27.99% (lower mid). 5Y return: 27.95% (bottom quartile). 5Y return: 27.76% (bottom quartile). 5Y return: 28.05% (lower mid). Point 6 3Y return: 42.32% (top quartile). 3Y return: 42.26% (top quartile). 3Y return: 42.19% (upper mid). 3Y return: 42.13% (upper mid). 3Y return: 41.97% (lower mid). 3Y return: 41.84% (lower mid). 3Y return: 41.74% (bottom quartile). 3Y return: 41.65% (bottom quartile). Point 7 1Y return: 94.00% (upper mid). 1Y return: 95.29% (top quartile). 1Y return: 93.90% (lower mid). 1Y return: 93.76% (bottom quartile). 1Y return: 93.75% (bottom quartile). 1Y return: 94.08% (top quartile). 1Y return: 93.93% (upper mid). 1Y return: 93.79% (lower mid). Point 8 1M return: 14.47% (lower mid). 1M return: 19.32% (top quartile). 1M return: 15.47% (upper mid). 1M return: 14.91% (lower mid). 1M return: 13.10% (bottom quartile). 1M return: 17.32% (top quartile). 1M return: 17.05% (upper mid). 1M return: 13.79% (bottom quartile). Point 9 Alpha: 0.00 (top quartile). Alpha: 0.00 (top quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Alpha: 0.00 (bottom quartile). Point 10 Sharpe: 3.25 (lower mid). Sharpe: 3.44 (upper mid). Sharpe: 3.10 (lower mid). Sharpe: 3.48 (top quartile). Sharpe: 3.01 (bottom quartile). Sharpe: 3.29 (upper mid). Sharpe: 3.55 (top quartile). Sharpe: 3.08 (bottom quartile). SBI Gold Fund

Axis Gold Fund

ICICI Prudential Regular Gold Savings Fund

IDBI Gold Fund

Nippon India Gold Savings Fund

HDFC Gold Fund

Kotak Gold Fund

Aditya Birla Sun Life Gold Fund

Now when you the major difference between Gold Mutual Funds and Gold ETFs invest in an avenue that is best suited for you.

FAQs

1. Is trading in gold ETFs similar to that of trading in equity?

A: Yes, gold ETFs are similar to equity as you can trade these on the National stock exchange (NSE). Additionally, you can also evaluate these against international stocks and shares. In other words, the price of gold ETFs will continuously change with the market condition, which is similar to stocks and shares' behavior.

2. Can I earn dividends through gold ETFs?

A: Gold ETFs means that 95% to 99% is invested in physical gold, and 5% is invested in security Debentures. None of these investments produce dividends, and hence, gold ETFs do not pay dividends. However, buying and selling of gold ETFs depending on market Volatility can make excellent returns.

3. Why are gold ETFs considered suitable investments?

A: Gold ETFs require lesser investments to enter the market and have been known to produce good returns and hence, it is often considered a good investment. Moreover, if you are looking to diversify your investment Portfolio, gold ETFs can prove suitable investments.

4. Why should I invest in Gold Mutual Funds?

A: If you want to invest in paper gold without opening a DEMAT account, you have to invest in Gold Mutual Fund. There is no specified entry or exit system for the gold mutual funds.

5. What are the main benefits of gold mutual funds?

A: The gold mutual funds are one of the best ways of diversifying your investment portfolio without having to worry about an exit load. This also works as a protection against inflation as you will enjoy the benefits of owning gold without having any real gold. You can trade the gold mutual funds across almost all geopolitical boundaries, thus protecting your investment.

6. Do gold ETFs require fund managers?

A: Yes, gold ETFs have to be purchased from Asset Management Companies or AMCs. Moreover, you will have to open a DEMAT account to trade in gold ETFs. Thus, without a fund manager associated with the particular AMC from which you are purchasing the gold ETFs, you will not be able to trade in the securities.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.