Gold ETFs Vs Physical Gold: What Should You Buy?

Are you confused between buying a physical gold or Investing in Gold ETFs? Well, the growing popularity of gold ETFs has caught many investors' attention and thus the question of "where should I invest?" arises. Though both the forms (Gold ETFs vs Physical gold) are a way of holding gold, barring the form of investment and other marginal differences that exist. Hence, in this article- Gold ETFs Vs Physical Gold, we will see which form offers better investment benefits.

What are Gold ETFs?

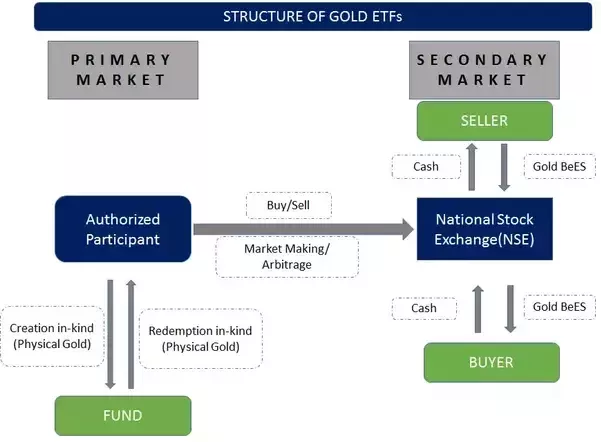

When it comes to a non-physical form of Gold Investment, gold ETFs are a popular choice in India. Gold ETFs (Exchange Traded Fund) are listed schemes that invest in underlying gold bullion. These are listed and traded on major stock exchanges. Gold ETFs are held in electronic form, where one unit is equal to one gram of gold. Additionally, the underlying gold is 99.5% pure.

Benefits of Investing in Gold ETFs

- Purity: One of the biggest benefits of investing in Gold ETFs is that the purity is constant. Since each unit is backed by the price of pure gold, there is no risk to purity.

- Efficiency: Another advantage of Investing in Gold ETFs is that it is cost efficient. There is no premium like making charges attached to it. One can buy at the International rate without any markup.

- No risk to safety: Since the units of Gold ETFs are in the Demat account of the holder, there is no risk of theft.

- Low investment amount: With one share equal to one gram of gold, one can purchase in small quantities. Investors can buy and accumulate gold by making small investments over a period of time.

Investing in Physical Gold

This has been the traditional way of buying/accumulating gold in India. Physical gold can be bought in the form of jewellery, ornaments, bars, coins, etc.

Benefits of Investing in Physical Gold

- It is a tangible asset. Owning gold in metal forms like a coin or jewellery offers this advantage. Additionally, this gold can be used for personal consumption.

- It is liquid in nature. One can sell physical gold easily on the open market.However, this is relatively less liquid than Gold ETFs.

- In the long term, gold has proved to be one of the best investment options. In the last five years, gold has given 24% annualised returns. In very long term periods, gold almost always beats inflation.

Talk to our investment specialist

Gold ETFs Vs Physical Gold: Which is Better?

Investment

A physical form of gold like coins, bars or biscuits are available in the standard denomination of 10gm that requires a huge investment. Gold ETFs are available in small quantities, i.e., even in 1gm.

Making Charges

Physical gold holds 10-20% of making charges, whereas, gold ETFs don’t hold any making charges.

Purity of Gold

In ornaments or jewellery, purity of gold is always in question, but gold ETFs deals with 99.5% purity of gold.

Pricing

Pricing in physical gold is never uniform, also, prices may slightly vary from jeweller to jeweller. Gold ETFs are priced as per International standards and are always transparent.

Wealth Tax

One percent wealth tax is applicable if the value of physical gold possessed by an individual is more than INR 30 lakhs. Whereas, in gold ETFs, wealth tax is not applicable.

Returns

The return charges in physical gold is calculated as follows: - Return = Current price of a gold minus buying price & making charges of an ornament. And in gold ETFs, the return is calculated by taking the current price of a gold unit trading on the stock exchange minus brokerage charges and buying price.

Storage Cost

Since, many people keep their gold in Bank lockers, it attracts storage costs. On the other hand, gold ETFs do not attract any storage expense since they are held in the electronic form.

Liquidity

Physical gold can be purchased from jewellers or banks, but can be only exchanged through jewellers. Buying/selling of the gold ETF is much easier as it is traded on the stock exchanges - NSE and BSE.

| Parameters | Physical Gold | Gold ETFs |

|---|---|---|

| Demat Account | No | No |

| Short Term Capital Gains | If held for less than 3yrs, then short-term capital gain tax is as per income tax slab | Same as physical gold |

| Long Term Capital Gains | If sold on profit after 3yrs then a capital gain tax of 20% with indexation is applicable | Same as physical gold |

| Convenience | Held physically | Held electronically |

Fund Selection Methodology used to find 5 funds

Best Gold ETFs to Invest 2026 - 2027

Some of the best underlying gold ETFs to invest are:

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Aditya Birla Sun Life Gold Fund Growth ₹45.7966

↓ -0.53 ₹1,781 22.6 47.3 81.3 39.3 27 72 Invesco India Gold Fund Growth ₹43.8958

↓ -0.52 ₹476 21.5 45.8 78.3 38.5 26.6 69.6 SBI Gold Fund Growth ₹46.1239

↓ -0.55 ₹15,024 22.4 47.5 81.5 39.7 27.3 71.5 Nippon India Gold Savings Fund Growth ₹60.2398

↓ -0.65 ₹7,160 22.2 47.2 81.2 39.3 27.1 71.2 ICICI Prudential Regular Gold Savings Fund Growth ₹48.6828

↓ -0.60 ₹6,338 22.1 47 81.2 39.5 27.1 72 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 6 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Aditya Birla Sun Life Gold Fund Invesco India Gold Fund SBI Gold Fund Nippon India Gold Savings Fund ICICI Prudential Regular Gold Savings Fund Point 1 Bottom quartile AUM (₹1,781 Cr). Bottom quartile AUM (₹476 Cr). Highest AUM (₹15,024 Cr). Upper mid AUM (₹7,160 Cr). Lower mid AUM (₹6,338 Cr). Point 2 Established history (13+ yrs). Established history (14+ yrs). Established history (14+ yrs). Oldest track record among peers (15 yrs). Established history (14+ yrs). Point 3 Top rated. Rating: 3★ (upper mid). Rating: 2★ (lower mid). Rating: 2★ (bottom quartile). Rating: 1★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 26.98% (bottom quartile). 5Y return: 26.58% (bottom quartile). 5Y return: 27.34% (top quartile). 5Y return: 27.12% (lower mid). 5Y return: 27.14% (upper mid). Point 6 3Y return: 39.27% (bottom quartile). 3Y return: 38.53% (bottom quartile). 3Y return: 39.67% (top quartile). 3Y return: 39.34% (lower mid). 3Y return: 39.53% (upper mid). Point 7 1Y return: 81.30% (upper mid). 1Y return: 78.28% (bottom quartile). 1Y return: 81.52% (top quartile). 1Y return: 81.25% (lower mid). 1Y return: 81.17% (bottom quartile). Point 8 1M return: 4.23% (bottom quartile). 1M return: 4.57% (upper mid). 1M return: 4.44% (lower mid). 1M return: 4.60% (top quartile). 1M return: 4.02% (bottom quartile). Point 9 Alpha: 0.00 (top quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Alpha: 0.00 (bottom quartile). Point 10 Sharpe: 3.08 (bottom quartile). Sharpe: 3.23 (upper mid). Sharpe: 3.25 (top quartile). Sharpe: 3.01 (bottom quartile). Sharpe: 3.10 (lower mid). Aditya Birla Sun Life Gold Fund

Invesco India Gold Fund

SBI Gold Fund

Nippon India Gold Savings Fund

ICICI Prudential Regular Gold Savings Fund

How to Invest in Gold Mutual Funds Online?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

Conclusion

While physical gold form loses out to gold ETFs with extra benefits like no making charges and wealth tax, both still hold certain kind of advantages and disadvantages distinct to each other. Hence, it is advisable for investors to weigh their gold investment requirements carefully and invest in a form that meets their objectives!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.