Beta

What Does Beta Mean in Investments?

Beta measures Volatility in a stock’s price or fund relative to a benchmark and is denoted in positive or negative figures. Investors can use beta as a parameter to determine an investment security's market risk, and hence its appropriateness for a particular investor's risk tolerance. A beta of 1 signifies that the stock’s price moves in line with the market, beta of a greater than 1 designates that the stock is riskier than the market, and a beta of less than 1 means that the stock is less risky than the market. So, lower beta is better in a falling market. In a rising market, high-beta is better.

Application of Mutual Fund Beta

An investor can use beta in planning their mutual fund selection to determine volatility of the fund/scheme and to compare its sensitivity in movement to the overall market. One can use beta as a measurement to sensitivity or volatility. Beta is also used for planning for mutual fund diversification and can be used as part of the process of building a Portfolio of Mutual Funds.

Beta Formula

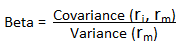

The formula for calculating beta is-

The covariance of the return of an asset with the return of the benchmark divided by the variance of the return of the benchmark over a certain period.

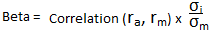

Similarly, beta could be calculated by first dividing the security's SD (Standard Deviation) of returns by the benchmark's SD of returns. The resulting value is multiplied by the correlation of the security's returns and the benchmark's returns.

Talk to our investment specialist

Example of Beta in Mutual Funds

| Fund | Category | Beta |

|---|---|---|

| Kotak Standard Multicap Fund-D | EQ-Multi Cap | 0.95 |

| SBI Bluechip Fund-D | EQ-Large Cap | 0.85 |

| L&T India value fund-D | EQ-mid-cap | 0.72 |

| Mirae Asset India Equity Fund-D | EQ-Multi Cap | 0.96 |

Like Beta, there are four other tools used to analyze any mutual funds or stocks in order to understand its volatility- Alpha, Standard Deviation, Sharp-Ratio, and R-squared.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.