FD కాలిక్యులేటర్ - ఫిక్స్డ్ డిపాజిట్ కాలిక్యులేటర్

స్థిర డిపాజిట్లు పెట్టుబడిదారులకు సహాయపడే దీర్ఘకాలిక పెట్టుబడి సాధనండబ్బు దాచు దీర్ఘ కాలానికి. ఇన్వెస్టర్లు స్థిరమైన కాలవ్యవధిని ఎంచుకోవచ్చు, దీని కోసం డిపాజిట్ ఉంచబడుతుందిబ్యాంకు. సాధారణంగా,ఎఫ్ డి పొదుపు ఖాతాలతో పోలిస్తే అధిక వడ్డీ రేట్లను అందజేస్తున్నందున దీర్ఘకాలిక సంపద సృష్టి కోసం చూస్తున్న వారికి పెట్టుబడులు ఉత్తమం.

FD వడ్డీ ఎలా లెక్కించబడుతుంది?

చాలా బ్యాంకుల్లో FDపై వడ్డీ త్రైమాసికానికి కలిపి ఉంటుంది. దీనికి సూత్రం:

A = P * (1+ r/n) ^ n*t , ఎక్కడ

- I = ఎ - పి

- ఎ = మెచ్యూరిటీ విలువ

- పి = ప్రధాన మొత్తం

- ఆర్ = వడ్డీ రేటు

- t = సంవత్సరాల సంఖ్య

- n = మిశ్రమ వడ్డీ ఫ్రీక్వెన్సీ

- I = వడ్డీ సంపాదించిన మొత్తం

FD యొక్క ప్రయోజనాలు

- FDని ఇలా ఉపయోగించవచ్చుఅనుషంగిక రుణాలు తీసుకున్నందుకు. మీరు మీ FD మొత్తంపై 80-90% వరకు రుణాలు తీసుకోవచ్చు

- డిపాజిటర్ తదుపరి ఫిక్స్డ్ డిపాజిట్ కోసం మెచ్యూరిటీ సమయంలో మొత్తాన్ని బదిలీ చేయడానికి ఎంచుకోవచ్చు.

- ఒక్కసారి మాత్రమే డబ్బు డిపాజిట్ చేయవచ్చు. జమ చేసిన తర్వాత, ఖాతా నుండి డబ్బును ఉపసంహరించుకుంటే పెనాల్టీ వస్తుంది.

- FD పథకాలు మిగులు నిధులను కలిగి ఉండి, దాని నుండి డబ్బు సంపాదించాలనుకునే వారికి మంచి పెట్టుబడి సాధనాలు.

Investment Amount:₹100,000 Interest Earned:₹28,930.22 Maturity Amount: ₹128,930.22ఫిక్స్డ్ డిపాజిట్ (FD) కాలిక్యులేటర్

Talk to our investment specialist

FDపై పన్ను ప్రయోజనాలు

ఇతర వ్యక్తిగత పన్ను ఆదా మరియు పెట్టుబడి సాధనాల మాదిరిగానే, ఫిక్స్డ్ డిపాజిట్ల పథకాలు కూడా ఆకర్షిస్తున్నాయిపన్నులు. మొత్తం వడ్డీ రూ. దాటితే FD నుండి వచ్చే రాబడిపై 10% TDS తీసివేయబడుతుంది. 10,000 ఒకే ఆర్థిక సంవత్సరంలో.

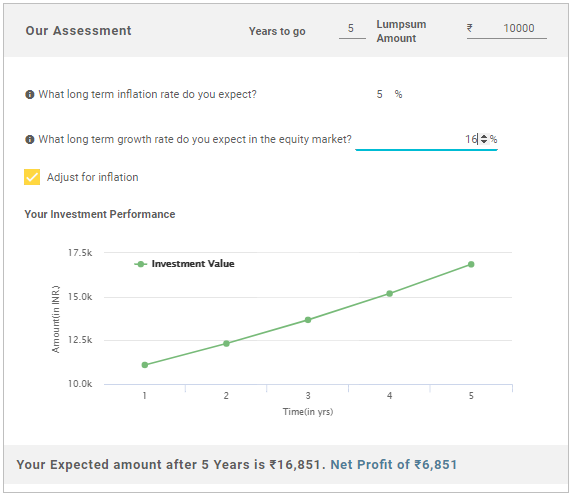

దీనితో పోల్చి చూద్దాంSIP పథకం మరియు SIPలు దీర్ఘకాలికంగా మరింత ప్రయోజనకరంగా ఉన్నాయని మీరు చూడవచ్చు. ఈక్విటీ నుండి దీర్ఘకాలిక లాభాలు పన్ను రహితం కాబట్టి, పెట్టుబడి పెట్టే ఏదైనా SIPELSS (ఈక్విటీ లింక్డ్మ్యూచువల్ ఫండ్స్) ఒక సంవత్సరం తర్వాత కూడా పన్ను రహితంగా ఉంటుంది.

*గత 1 సంవత్సరం పనితీరు & ఫండ్ వయస్సు > 1 సంవత్సరం ఆధారంగా ఫండ్ జాబితా క్రింద ఉంది.

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP World Gold Fund Growth ₹65.0104

↑ 2.21 ₹1,975 500 30.9 62.3 170.3 61.6 30.5 167.1 DSP World Mining Fund Growth ₹32.2112

↑ 1.48 ₹181 500 29.2 54.9 103 26.1 19.2 79 DSP World Energy Fund Growth ₹26.2618

↑ 0.84 ₹103 500 12.3 26.2 59.5 15.1 11.3 39.2 Edelweiss Emerging Markets Opportunities Equity Off-shore Fund Growth ₹23.9964

↑ 0.90 ₹191 1,000 15.1 26.8 52 20.9 6.1 41.1 Kotak Global Emerging Market Fund Growth ₹33.528

↑ 1.02 ₹539 1,000 10.5 18.5 46.6 20.7 7.9 39.1 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 10 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP World Gold Fund DSP World Mining Fund DSP World Energy Fund Edelweiss Emerging Markets Opportunities Equity Off-shore Fund Kotak Global Emerging Market Fund Point 1 Highest AUM (₹1,975 Cr). Bottom quartile AUM (₹181 Cr). Bottom quartile AUM (₹103 Cr). Lower mid AUM (₹191 Cr). Upper mid AUM (₹539 Cr). Point 2 Oldest track record among peers (18 yrs). Established history (16+ yrs). Established history (16+ yrs). Established history (11+ yrs). Established history (18+ yrs). Point 3 Top rated. Rating: 3★ (upper mid). Rating: 2★ (bottom quartile). Rating: 3★ (lower mid). Rating: 3★ (bottom quartile). Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Point 5 5Y return: 30.51% (top quartile). 5Y return: 19.22% (upper mid). 5Y return: 11.26% (lower mid). 5Y return: 6.12% (bottom quartile). 5Y return: 7.88% (bottom quartile). Point 6 3Y return: 61.59% (top quartile). 3Y return: 26.15% (upper mid). 3Y return: 15.10% (bottom quartile). 3Y return: 20.92% (lower mid). 3Y return: 20.70% (bottom quartile). Point 7 1Y return: 170.25% (top quartile). 1Y return: 102.97% (upper mid). 1Y return: 59.46% (lower mid). 1Y return: 52.00% (bottom quartile). 1Y return: 46.62% (bottom quartile). Point 8 Alpha: 2.12 (top quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: -0.75 (bottom quartile). Alpha: -1.44 (bottom quartile). Point 9 Sharpe: 3.41 (top quartile). Sharpe: 3.17 (upper mid). Sharpe: 1.88 (bottom quartile). Sharpe: 2.68 (lower mid). Sharpe: 2.63 (bottom quartile). Point 10 Information ratio: -0.47 (lower mid). Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: -0.84 (bottom quartile). Information ratio: -0.59 (bottom quartile). DSP World Gold Fund

DSP World Mining Fund

DSP World Energy Fund

Edelweiss Emerging Markets Opportunities Equity Off-shore Fund

Kotak Global Emerging Market Fund

2022 కోసం టాప్ ఫండ్లు

*1 సంవత్సరం పనితీరు ఆధారంగా ఉత్తమ నిధులు.

"The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in units of MLIIF - WGF. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or units of money market/liquid schemes of DSP Merrill Lynch Mutual Fund, in order to meet liquidity requirements from time to time. However, there is no assurance that the investment objective of the Scheme will be realized." Below is the key information for DSP World Gold Fund Returns up to 1 year are on The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in the units of BlackRock Global Funds – World Mining Fund. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may

constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or money market/liquid schemes of DSP BlackRock Mutual Fund, in order to meet liquidity requirements from time to time. Research Highlights for DSP World Mining Fund Below is the key information for DSP World Mining Fund Returns up to 1 year are on 1. DSP World Gold Fund

DSP World Gold Fund

Growth Launch Date 14 Sep 07 NAV (10 Mar 26) ₹65.0104 ↑ 2.21 (3.52 %) Net Assets (Cr) ₹1,975 on 31 Jan 26 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.41 Sharpe Ratio 3.41 Information Ratio -0.47 Alpha Ratio 2.12 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹10,843 28 Feb 23 ₹9,241 29 Feb 24 ₹8,778 28 Feb 25 ₹13,911 28 Feb 26 ₹41,909 Returns for DSP World Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 10 Mar 26 Duration Returns 1 Month 4.3% 3 Month 30.9% 6 Month 62.3% 1 Year 170.3% 3 Year 61.6% 5 Year 30.5% 10 Year 15 Year Since launch 10.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 167.1% 2023 15.9% 2022 7% 2021 -7.7% 2020 -9% 2019 31.4% 2018 35.1% 2017 -10.7% 2016 -4% 2015 52.7% Fund Manager information for DSP World Gold Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.93 Yr. Data below for DSP World Gold Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Basic Materials 95.89% Asset Allocation

Asset Class Value Cash 1.55% Equity 95.89% Debt 0.01% Other 2.56% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Gold I2

Investment Fund | -74% ₹1,458 Cr 1,177,658

↓ -41,596 VanEck Gold Miners ETF

- | GDX25% ₹497 Cr 573,719 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -2% ₹35 Cr Net Receivables/Payables

Net Current Assets | -1% -₹15 Cr 2. DSP World Mining Fund

DSP World Mining Fund

Growth Launch Date 29 Dec 09 NAV (10 Mar 26) ₹32.2112 ↑ 1.48 (4.81 %) Net Assets (Cr) ₹181 on 31 Jan 26 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.14 Sharpe Ratio 3.17 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹12,307 28 Feb 23 ₹12,279 29 Feb 24 ₹10,745 28 Feb 25 ₹11,677 28 Feb 26 ₹25,661 Returns for DSP World Mining Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 10 Mar 26 Duration Returns 1 Month 1.3% 3 Month 29.2% 6 Month 54.9% 1 Year 103% 3 Year 26.1% 5 Year 19.2% 10 Year 15 Year Since launch 7.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 79% 2023 -8.1% 2022 0% 2021 12.2% 2020 18% 2019 34.9% 2018 21.5% 2017 -9.4% 2016 21.1% 2015 49.7% Fund Manager information for DSP World Mining Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.93 Yr. Data below for DSP World Mining Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Basic Materials 95.77% Energy 1.05% Asset Allocation

Asset Class Value Cash 3.15% Equity 96.82% Debt 0.02% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Mining I2

Investment Fund | -99% ₹180 Cr 149,227

↓ -1,163 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -1% ₹2 Cr Net Receivables/Payables

Net Current Assets | -0% ₹0 Cr

ఇక్కడ అందించిన సమాచారం ఖచ్చితమైనదని నిర్ధారించడానికి అన్ని ప్రయత్నాలు చేయబడ్డాయి. అయినప్పటికీ, డేటా యొక్క ఖచ్చితత్వానికి సంబంధించి ఎటువంటి హామీలు ఇవ్వబడవు. దయచేసి ఏదైనా పెట్టుబడి పెట్టే ముందు పథకం సమాచార పత్రంతో ధృవీకరించండి.

Research Highlights for DSP World Gold Fund