Fincash » How to Do Instant Redemption in Mutual Funds Through Fincash

Table of Contents

- Step1: Log In to Fincash.com Website & Go to Dashboard

- Step2: Click on Instant Redemption

- Step3: Folios Eligible for Instant Redemption are Displayed

- Step4: Enter Redeemable Amount

- Step5: Redemption Summary Page

- Step6: Enter OTP

- Step7: Redemption Status

- Instant Redemption Mutual Funds

Top 2 Debt - Liquid Fund Funds

How to Do Instant Redemption in Mutual Funds Through Fincash.com?

Through Instant Redemption people can redeem their Mutual Fund instantly. Instant Redemption is possible in some Liquid Funds. Through Fincash.com, it is possible for people to redeem their money in two Mutual Fund schemes that are, Aditya Birla Sun Life Cash Plus Fund and Reliance Liquid Fund - Treasury Plan. So, let us look at the steps that will help you to carry out the instant redemption process.

Step1: Log In to Fincash.com Website & Go to Dashboard

The first step in the instant redemption process is to login into Fincash.com website. For logging into the website, people need to enter their login credentials. Once they log in, they need to go to the dashboard. The icon for the dashboard is present on the top right corner and is second from right. This step showing the dashboard icon is given below as follows where the dashboard icon is highlighted in Green.

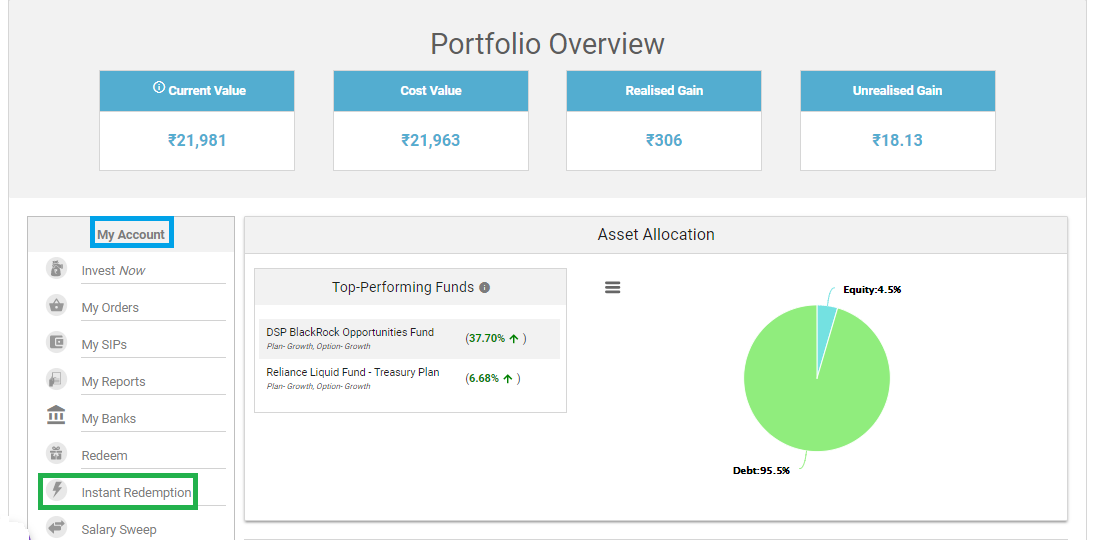

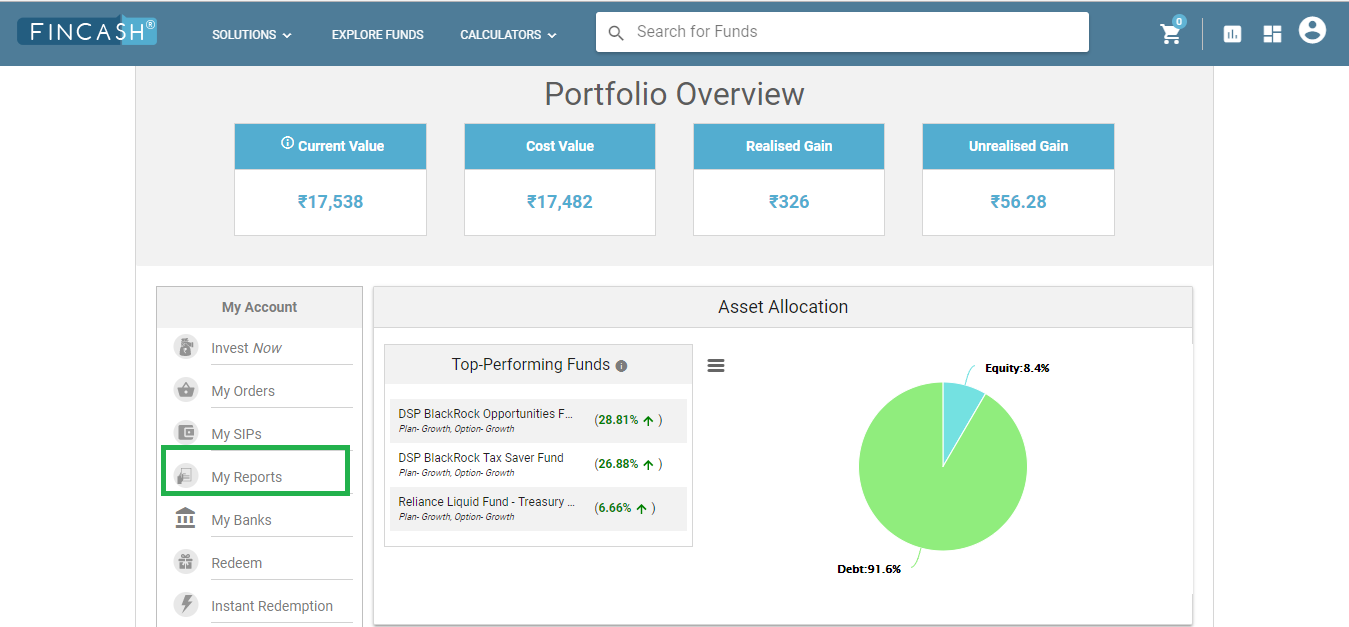

Step2: Click on Instant Redemption

After you click on the dashboard, a new page opens up. In this page, on the left side, there is a drop-down titled as My Account. Under this My Account section, you can find various options such as Invest Now, My Orders, My SIPs, and so on. Here, You Need to Click on “Instant Redemption Option”. The image for this step is given below as follows where My Account and Instant Redemption options are highlighted in Blue and Green.

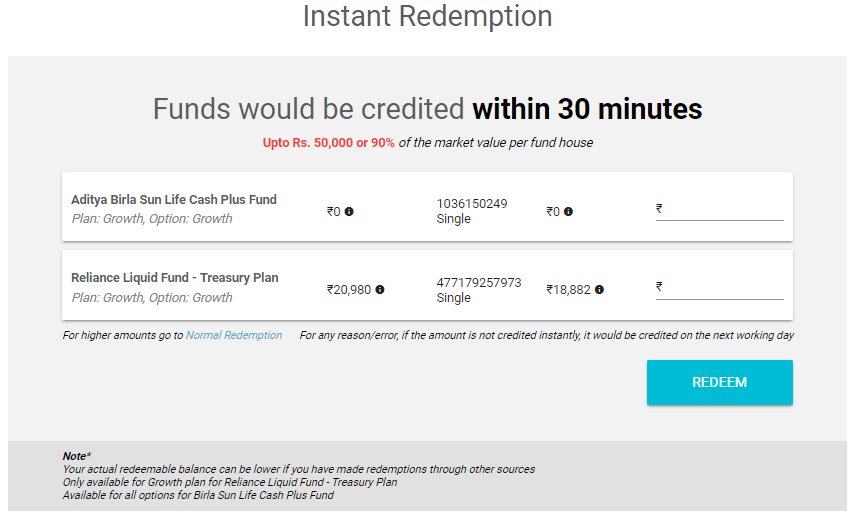

Step3: Folios Eligible for Instant Redemption are Displayed

Once you click on instant redemption, the instant redemption page opens up. In this page, all the schemes that offer instant redemption Facility are displayed. Through Fincash.com, you can avail for instant redemption option for the scheme, Aditya Birla Sun Life Cash Plus Fund and Reliance Liquid Fund – Treasury Plan. The image of this step is displayed below as follows.

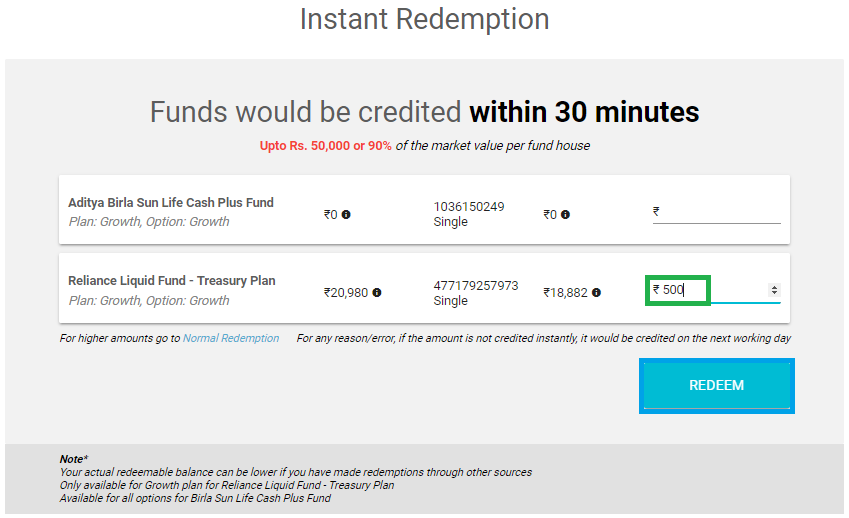

Step4: Enter Redeemable Amount

The next step is to enter the redeemable amount on the Instant Redemption Page. Here, you need to enter the amount that he/she wishes to redeem. However, there are certain important points that a customer should make note of. The maximum amount that can be redeemed in a day is INR 50,000 or 90% of the investment amount whichever is low. In this case, an example is shown where ₹500 is redeemed from Reliance Liquid Fund – Treasury Plan. After entering the amount to be redeemed, the investor needs to click on the Redeem Button which is below the amount. The image for this step is shown below where the redeemable amount is highlighted in Green and the Redeem Button is highlighted in Blue.

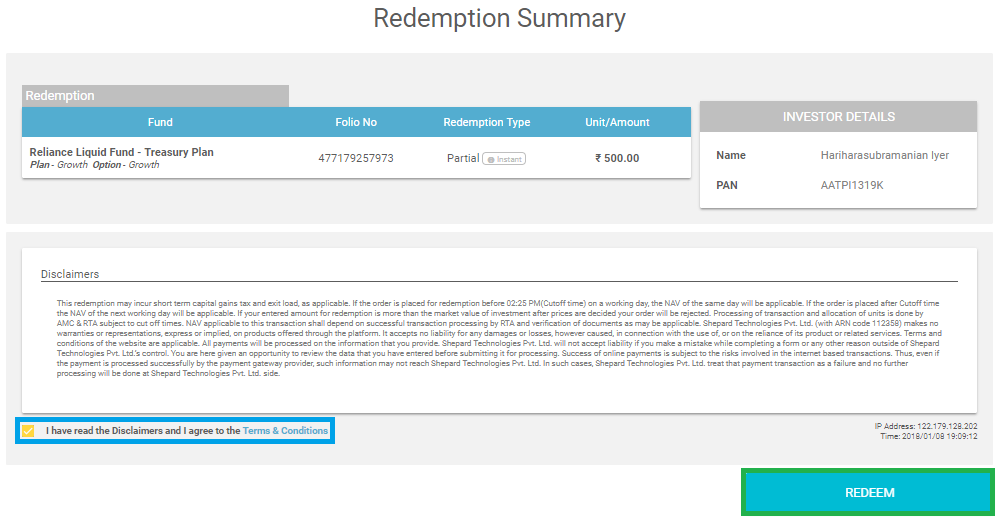

Step5: Redemption Summary Page

Once you click on Redeem Button, a new window titled Redemption Summary opens up. This page shows the summary of the scheme and the amount that needs to be redeemed. Here, you if you scroll down the screen, you need to tick mark the Disclaimers Button. Once you tick mark on the disclaimer, the Redeem Button Enables and then you need to click on Redeem. The image for this step is given below where the Disclaimer and Redeem Button are highlighted in Blue and Green.

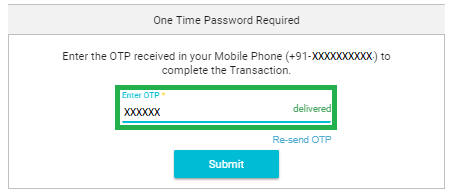

Step6: Enter OTP

Once you click on the next button, a small window pops up wherein; you need to enter your OTP. OTP or One Time Password is a unique number that customer receives both on his/her registered mobile number as well as email at the time of redemption. Ensure, that you enter the correct OTP or else; the transaction might get rejected. The image for the step is as follows where the Enter OTP is highlighted in Green.

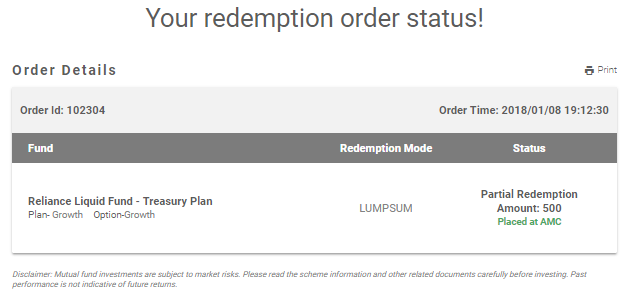

Step7: Redemption Status

This is the last step in the redemption process where the redemption status appears. Here, people get an Order ID which they can quote for future references. The image for this step is shown as follows.

Thus, from the above steps, we can see that the instant redemption process of Mutual Funds through Fincash.com is simple.

Talk to our investment specialist

Instant Redemption Mutual Funds

On Fincash.com there are 2 liquid funds which support instant redemption option as listed below

Fund NAV Net Assets (Cr) Debt Yield (YTM) Mod. Duration Eff. Maturity 1 MO (%) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) Aditya Birla Sun Life Liquid Fund Growth ₹389.29

↑ 0.07 ₹29,764 7.47% 1M 17D 1M 17D 0.5 1.8 3.7 7.2 5.6 5.2 Nippon India Liquid Fund Growth ₹5,898.02

↑ 1.14 ₹25,253 7.48% 1M 8D 1M 12D 0.5 1.8 3.7 7.2 5.5 5.2 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 17 May 24

(Erstwhile Aditya Birla Sun Life Cash Plus Fund) An Open-ended liquid scheme with the objective to provide reasonable returns at a high level of safety and liquidity through judicious investments in high quality debt and money market instruments. Aditya Birla Sun Life Liquid Fund is a Debt - Liquid Fund fund was launched on 30 Mar 04. It is a fund with Low risk and has given a Below is the key information for Aditya Birla Sun Life Liquid Fund Returns up to 1 year are on (Erstwhile Reliance Liquid Fund - Treasury Plan) The investment objective of the scheme is to generate optimal returns consistent with moderate levels of risk and high liquidity. Accordingly, investments shall predominantly be made in Debt and Money Market Instruments. Nippon India Liquid Fund is a Debt - Liquid Fund fund was launched on 9 Dec 03. It is a fund with Low risk and has given a Below is the key information for Nippon India Liquid Fund Returns up to 1 year are on 1. Aditya Birla Sun Life Liquid Fund

CAGR/Annualized return of 7% since its launch. Ranked 15 in Liquid Fund category. Return for 2023 was 7.1% , 2022 was 4.8% and 2021 was 3.3% . Aditya Birla Sun Life Liquid Fund

Growth Launch Date 30 Mar 04 NAV (17 May 24) ₹389.29 ↑ 0.07 (0.02 %) Net Assets (Cr) ₹29,764 on 31 Mar 24 Category Debt - Liquid Fund AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆☆ Risk Low Expense Ratio 0.33 Sharpe Ratio 1.19 Information Ratio -2.9 Alpha Ratio -0.23 Min Investment 5,000 Min SIP Investment 500 Exit Load NIL Yield to Maturity 7.47% Effective Maturity 1 Month 17 Days Modified Duration 1 Month 17 Days Growth of 10,000 investment over the years.

Date Value 30 Apr 19 ₹10,000 30 Apr 20 ₹10,610 30 Apr 21 ₹10,978 30 Apr 22 ₹11,353 30 Apr 23 ₹12,032 30 Apr 24 ₹12,904 Returns for Aditya Birla Sun Life Liquid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 May 24 Duration Returns 1 Month 0.5% 3 Month 1.8% 6 Month 3.7% 1 Year 7.2% 3 Year 5.6% 5 Year 5.2% 10 Year 15 Year Since launch 7% Historical performance (Yearly) on absolute basis

Year Returns 2023 7.1% 2022 4.8% 2021 3.3% 2020 4.3% 2019 6.7% 2018 7.4% 2017 6.7% 2016 7.7% 2015 8.4% 2014 9.2% Fund Manager information for Aditya Birla Sun Life Liquid Fund

Name Since Tenure Sunaina Cunha 15 Jul 11 12.72 Yr. Kaustubh Gupta 15 Jul 11 12.72 Yr. Sanjay Pawar 1 Jul 22 1.75 Yr. Dhaval Joshi 21 Nov 22 1.36 Yr. Data below for Aditya Birla Sun Life Liquid Fund as on 31 Mar 24

Asset Allocation

Asset Class Value Cash 99.57% Debt 0.21% Other 0.22% Debt Sector Allocation

Sector Value Cash Equivalent 74.89% Corporate 15.31% Government 9.58% Credit Quality

Rating Value AA 0.16% AAA 99.84% Top Securities Holdings / Portfolio

Name Holding Value Quantity Reverse Repo

CBLO/Reverse Repo | -9% ₹4,044 Cr 6.69% Govt Stock 2024

Sovereign Bonds | -6% ₹2,694 Cr 269,500,000

↑ 269,500,000 National Bank for Agriculture and Rural Development

Commercial Paper | -4% ₹1,926 Cr 39,000

↓ -1,000 Bank Of Baroda

Certificate of Deposit | -3% ₹1,192 Cr 24,000 India (Republic of)

- | -2% ₹1,036 Cr 105,000,000

↑ 105,000,000 India (Republic of)

- | -2% ₹989 Cr 100,000,000 Small Industries Development Bank Of India

Commercial Paper | -2% ₹943 Cr 19,000 India (Republic of)

- | -2% ₹941 Cr 95,596,200

↑ 95,596,200 Axis Bank Limited

Certificate of Deposit | -2% ₹870 Cr 17,500 HDFC Bank Limited

Commercial Paper | -2% ₹814 Cr 16,400

↑ 8,500 2. Nippon India Liquid Fund

CAGR/Annualized return of 6.9% since its launch. Ranked 11 in Liquid Fund category. Return for 2023 was 7% , 2022 was 4.8% and 2021 was 3.2% . Nippon India Liquid Fund

Growth Launch Date 9 Dec 03 NAV (17 May 24) ₹5,898.02 ↑ 1.14 (0.02 %) Net Assets (Cr) ₹25,253 on 31 Mar 24 Category Debt - Liquid Fund AMC Nippon Life Asset Management Ltd. Rating ☆☆☆☆ Risk Low Expense Ratio 0.34 Sharpe Ratio 0.93 Information Ratio 0 Alpha Ratio 0 Min Investment 100 Min SIP Investment 100 Exit Load NIL Yield to Maturity 7.48% Effective Maturity 1 Month 12 Days Modified Duration 1 Month 8 Days Growth of 10,000 investment over the years.

Date Value 30 Apr 19 ₹10,000 30 Apr 20 ₹10,611 30 Apr 21 ₹10,973 30 Apr 22 ₹11,343 30 Apr 23 ₹12,010 30 Apr 24 ₹12,877 Returns for Nippon India Liquid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 May 24 Duration Returns 1 Month 0.5% 3 Month 1.8% 6 Month 3.7% 1 Year 7.2% 3 Year 5.5% 5 Year 5.2% 10 Year 15 Year Since launch 6.9% Historical performance (Yearly) on absolute basis

Year Returns 2023 7% 2022 4.8% 2021 3.2% 2020 4.3% 2019 6.7% 2018 7.4% 2017 6.7% 2016 7.7% 2015 8.3% 2014 9.1% Fund Manager information for Nippon India Liquid Fund

Name Since Tenure Anju Chhajer 1 Oct 13 10.51 Yr. Siddharth Deb 1 Mar 22 2.09 Yr. Kinjal Desai 25 May 18 5.86 Yr. Data below for Nippon India Liquid Fund as on 31 Mar 24

Asset Allocation

Asset Class Value Cash 99.81% Other 0.19% Debt Sector Allocation

Sector Value Cash Equivalent 63.99% Corporate 22.49% Government 13.33% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity Triparty Repo

CBLO/Reverse Repo | -5% ₹1,581 Cr 91 DTB 23052024

Sovereign Bonds | -4% ₹1,490 Cr 150,000,000 India (Republic of)

- | -4% ₹1,484 Cr 150,000,000 6.69% Govt Stock 2024

Sovereign Bonds | -3% ₹1,124 Cr 112,500,000

↑ 112,500,000 Punjab National Bank

Domestic Bonds | -3% ₹985 Cr 20,000

↑ 20,000 India (Republic of)

- | -3% ₹939 Cr 95,000,000 Bank Of Baroda

Certificate of Deposit | -2% ₹817 Cr 16,500 Small Industries Development Bank of India

Commercial Paper | -2% ₹747 Cr 15,000 India (Republic of)

- | -2% ₹719 Cr 73,000,000

↑ 73,000,000 HDFC Bank Limited

Certificate of Deposit | -2% ₹695 Cr 14,000

In case if you have more queries, feel free to contact our customer support on +91-22-62820123 on any working day between 9.30am to 6.30 pm or write a mail to us anytime at support@fincash.com. You can even do online chat by logging on our website www.fincash.com.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

OK NICE AND PRODUCTIVE.