How to Do Instant Redemption in Mutual Funds Through Fincash.com?

Through Instant Redemption people can redeem their Mutual Fund instantly. Instant redemption is possible in some Liquid Funds. Through Fincash.com, it is possible for people to redeem their money in two Mutual Fund schemes that are, Aditya Birla Sun Life Cash Plus Fund and Reliance Liquid Fund - Treasury Plan. So, let us look at the steps that will help you to carry out the instant redemption process.

Step1: Log In to Fincash.com Website & Go to Dashboard

The first step in the instant redemption process is to login into Fincash.com website. For logging into the website, people need to enter their login credentials. Once they log in, they need to go to the dashboard. The icon for the dashboard is present on the top right corner and is second from right. This step showing the dashboard icon is given below as follows where the dashboard icon is highlighted in Green.

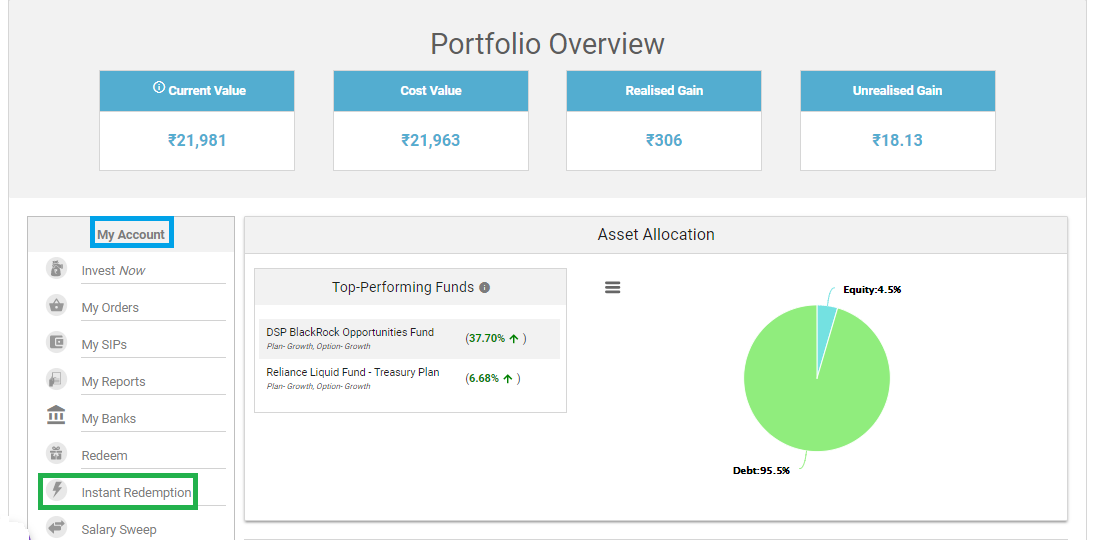

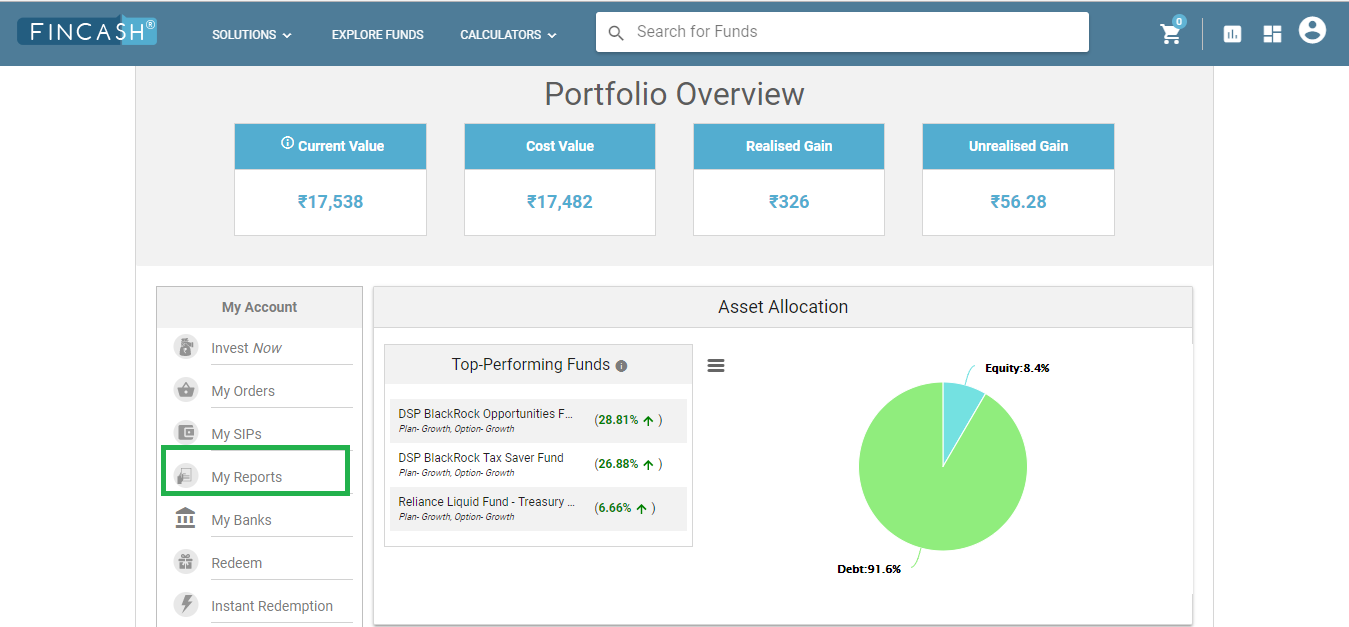

Step2: Click on Instant Redemption

After you click on the dashboard, a new page opens up. In this page, on the left side, there is a drop-down titled as My Account. Under this My Account section, you can find various options such as Invest Now, My Orders, My SIPs, and so on. Here, You Need to Click on “Instant Redemption Option”. The image for this step is given below as follows where My Account and Instant Redemption options are highlighted in Blue and Green.

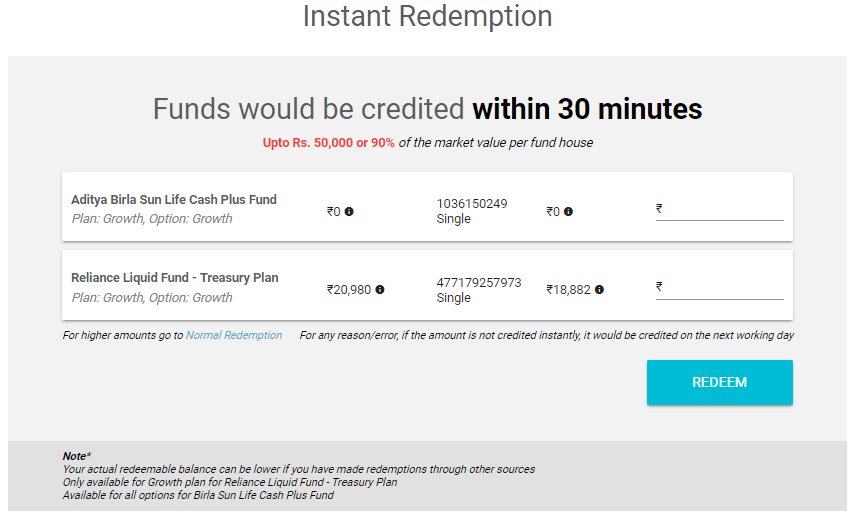

Step3: Folios Eligible for Instant Redemption are Displayed

Once you click on instant redemption, the instant redemption page opens up. In this page, all the schemes that offer instant redemption facility are displayed. Through Fincash.com, you can avail for instant redemption option for the scheme, Aditya Birla Sun Life Cash Plus Fund and Reliance Liquid Fund – Treasury Plan. The image of this step is displayed below as follows.

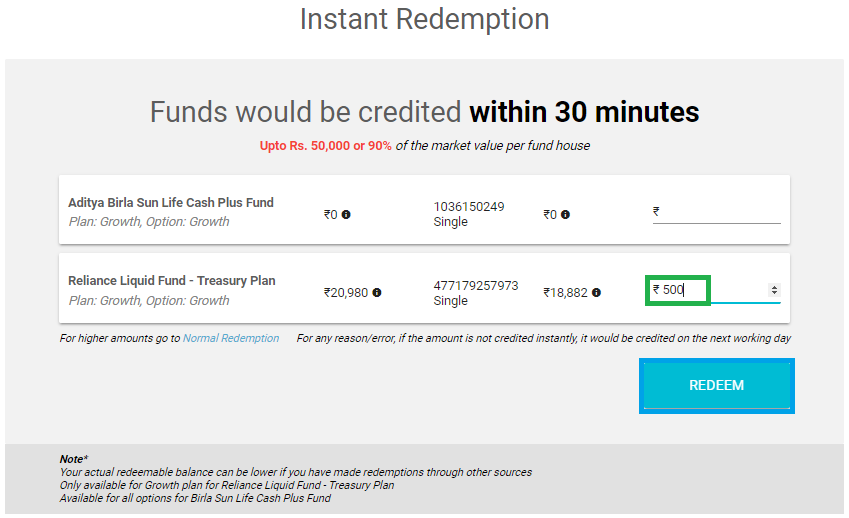

Step4: Enter Redeemable Amount

The next step is to enter the redeemable amount on the Instant Redemption Page. Here, you need to enter the amount that he/she wishes to redeem. However, there are certain important points that a customer should make note of. The maximum amount that can be redeemed in a day is INR 50,000 or 90% of the investment amount whichever is low. In this case, an example is shown where ₹500 is redeemed from Reliance Liquid Fund – Treasury Plan. After entering the amount to be redeemed, the investor needs to click on the Redeem Button which is below the amount. The image for this step is shown below where the redeemable amount is highlighted in Green and the Redeem Button is highlighted in Blue.

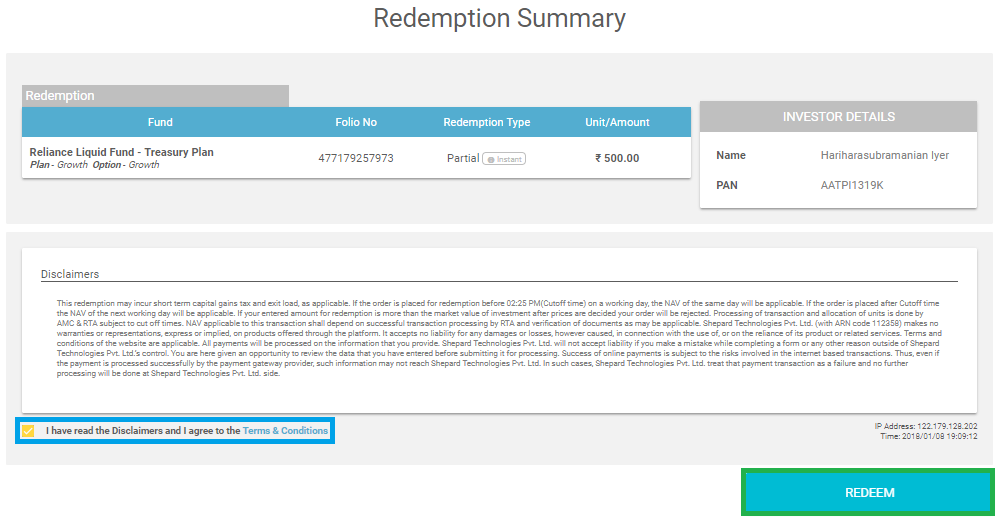

Step5: Redemption Summary Page

Once you click on Redeem Button, a new window titled Redemption Summary opens up. This page shows the summary of the scheme and the amount that needs to be redeemed. Here, you if you scroll down the screen, you need to tick mark the Disclaimers Button. Once you tick mark on the disclaimer, the Redeem Button Enables and then you need to click on Redeem. The image for this step is given below where the Disclaimer and Redeem Button are highlighted in Blue and Green.

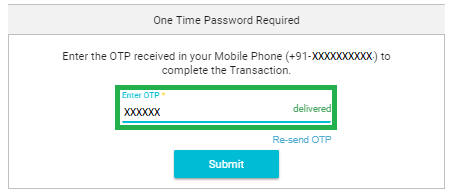

Step6: Enter OTP

Once you click on the next button, a small window pops up wherein; you need to enter your OTP. OTP or One Time Password is a unique number that customer receives both on his/her registered mobile number as well as email at the time of redemption. Ensure, that you enter the correct OTP or else; the transaction might get rejected. The image for the step is as follows where the Enter OTP is highlighted in Green.

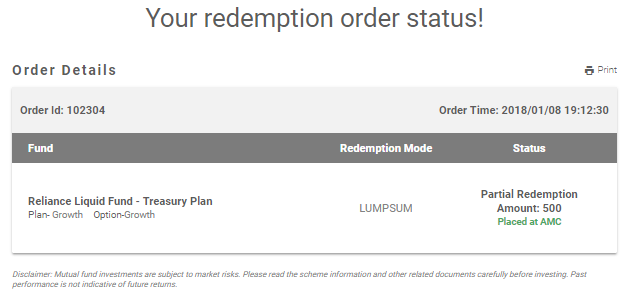

Step7: Redemption Status

This is the last step in the redemption process where the redemption status appears. Here, people get an Order ID which they can quote for future references. The image for this step is shown as follows.

Thus, from the above steps, we can see that the instant redemption process of Mutual Funds through Fincash.com is simple.

Talk to our investment specialist

Fund Selection Methodology used to find 10 funds

Instant Redemption Mutual Funds

On Fincash.com there are 2 liquid funds which support instant redemption option as listed below

Fund NAV Net Assets (Cr) Debt Yield (YTM) Mod. Duration Eff. Maturity 1 MO (%) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) Aditya Birla Sun Life Liquid Fund Growth ₹436.421

↑ 0.05 ₹47,273 6.19% 2M 1D 2M 1D 0.5 1.5 2.9 6.3 6.9 5.9 Nippon India Liquid Fund Growth ₹6,608.64

↑ 0.82 ₹27,591 8.73% 2Y 25D 2Y 5M 12D 0.5 1.5 2.9 6.3 6.9 5.8 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 2 Funds showcased

Commentary Aditya Birla Sun Life Liquid Fund Nippon India Liquid Fund Point 1 Highest AUM (₹47,273 Cr). Bottom quartile AUM (₹27,591 Cr). Point 2 Established history (21+ yrs). Oldest track record among peers (22 yrs). Point 3 Top rated. Rating: 4★ (bottom quartile). Point 4 Risk profile: Low. Risk profile: Low. Point 5 1Y return: 6.35% (upper mid). 1Y return: 6.32% (bottom quartile). Point 6 1M return: 0.53% (upper mid). 1M return: 0.53% (bottom quartile). Point 7 Sharpe: 3.21 (upper mid). Sharpe: 3.05 (bottom quartile). Point 8 Information ratio: 0.00 (upper mid). Information ratio: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 6.19% (bottom quartile). Yield to maturity (debt): 8.73% (upper mid). Point 10 Modified duration: 0.17 yrs (upper mid). Modified duration: 2.07 yrs (bottom quartile). Aditya Birla Sun Life Liquid Fund

Nippon India Liquid Fund

(Erstwhile Aditya Birla Sun Life Cash Plus Fund) An Open-ended liquid scheme with the objective to provide reasonable returns at a high level of safety and liquidity through judicious investments in high quality debt and money market instruments. Research Highlights for Aditya Birla Sun Life Liquid Fund Below is the key information for Aditya Birla Sun Life Liquid Fund Returns up to 1 year are on (Erstwhile Reliance Liquid Fund - Treasury Plan) The investment objective of the scheme is to generate optimal returns consistent with moderate levels of risk and high liquidity. Accordingly, investments shall predominantly be made in Debt and Money Market Instruments. Research Highlights for Nippon India Liquid Fund Below is the key information for Nippon India Liquid Fund Returns up to 1 year are on 1. Aditya Birla Sun Life Liquid Fund

Aditya Birla Sun Life Liquid Fund

Growth Launch Date 30 Mar 04 NAV (18 Feb 26) ₹436.421 ↑ 0.05 (0.01 %) Net Assets (Cr) ₹47,273 on 31 Dec 25 Category Debt - Liquid Fund AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆☆ Risk Low Expense Ratio 0.34 Sharpe Ratio 3.21 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load NIL Yield to Maturity 6.19% Effective Maturity 2 Months 1 Day Modified Duration 2 Months 1 Day Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹10,331 31 Jan 23 ₹10,856 31 Jan 24 ₹11,630 31 Jan 25 ₹12,483 31 Jan 26 ₹13,278 Returns for Aditya Birla Sun Life Liquid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 18 Feb 26 Duration Returns 1 Month 0.5% 3 Month 1.5% 6 Month 2.9% 1 Year 6.3% 3 Year 6.9% 5 Year 5.9% 10 Year 15 Year Since launch 7% Historical performance (Yearly) on absolute basis

Year Returns 2024 6.5% 2023 7.3% 2022 7.1% 2021 4.8% 2020 3.3% 2019 4.3% 2018 6.7% 2017 7.4% 2016 6.7% 2015 7.7% Fund Manager information for Aditya Birla Sun Life Liquid Fund

Name Since Tenure Sunaina Cunha 15 Jul 11 14.56 Yr. Kaustubh Gupta 15 Jul 11 14.56 Yr. Sanjay Pawar 1 Jul 22 3.59 Yr. Data below for Aditya Birla Sun Life Liquid Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 99.74% Other 0.26% Debt Sector Allocation

Sector Value Cash Equivalent 70.45% Corporate 25.61% Government 3.69% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity RBL Bank Ltd.

Debentures | -5% ₹2,477 Cr 50,000 27/02/2026 Maturing 364 DTB

Sovereign Bonds | -3% ₹1,599 Cr 160,500,000 Union Bank Of India (20/03/2026) ** #

Certificate of Deposit | -2% ₹1,239 Cr 25,000

↑ 25,000 12/02/2026 Maturing 364 DTB

Sovereign Bonds | -2% ₹998 Cr 100,000,000 19/02/2026 Maturing 91 DTB

Sovereign Bonds | -2% ₹997 Cr 100,000,000 Yes Bank Limited

Certificate of Deposit | -2% ₹994 Cr 20,000 Karur Vysya Bank Ltd.

Debentures | -2% ₹993 Cr 20,000 The Jammu And Kashmir Bank Limited

Debentures | -2% ₹991 Cr 20,000 HDFC Bank Limited

Certificate of Deposit | -2% ₹947 Cr 19,000 Punjab National Bank

Certificate of Deposit | -2% ₹895 Cr 18,000 2. Nippon India Liquid Fund

Nippon India Liquid Fund

Growth Launch Date 9 Dec 03 NAV (18 Feb 26) ₹6,608.64 ↑ 0.82 (0.01 %) Net Assets (Cr) ₹27,591 on 31 Dec 25 Category Debt - Liquid Fund AMC Nippon Life Asset Management Ltd. Rating ☆☆☆☆ Risk Low Expense Ratio 0.33 Sharpe Ratio 3.05 Information Ratio 0 Alpha Ratio 0 Min Investment 100 Min SIP Investment 100 Exit Load NIL Yield to Maturity 8.73% Effective Maturity 2 Years 5 Months 12 Days Modified Duration 2 Years 25 Days Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹10,328 31 Jan 23 ₹10,847 31 Jan 24 ₹11,611 31 Jan 25 ₹12,460 31 Jan 26 ₹13,249 Returns for Nippon India Liquid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 18 Feb 26 Duration Returns 1 Month 0.5% 3 Month 1.5% 6 Month 2.9% 1 Year 6.3% 3 Year 6.9% 5 Year 5.8% 10 Year 15 Year Since launch 6.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 6.5% 2023 7.3% 2022 7% 2021 4.8% 2020 3.2% 2019 4.3% 2018 6.7% 2017 7.4% 2016 6.7% 2015 7.7% Fund Manager information for Nippon India Liquid Fund

Name Since Tenure Kinjal Desai 25 May 18 7.7 Yr. Vikash Agarwal 14 Sep 24 1.38 Yr. Lokesh Maru 5 Sep 25 0.41 Yr. Divya Sharma 5 Sep 25 0.41 Yr. Data below for Nippon India Liquid Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 99.63% Other 0.37% Debt Sector Allocation

Sector Value Cash Equivalent 67.59% Corporate 31.9% Government 0.13% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity 12/02/2026 Maturing 91 DTB

Sovereign Bonds | -4% ₹1,151 Cr 115,319,500 Bank Of Baroda

Certificate of Deposit | -4% ₹945 Cr 19,000 19/02/2026 Maturing 91 DTB

Sovereign Bonds | -3% ₹748 Cr 75,000,000 26/02/2026 Maturing 91 DTB

Sovereign Bonds | -3% ₹747 Cr 75,000,000 12/03/2026 Maturing 91 DTB

Sovereign Bonds | -3% ₹696 Cr 70,000,000 HDFC Bank Limited

Certificate of Deposit | -2% ₹645 Cr 13,000 Karur Vysya Bank Limited

Certificate of Deposit | -2% ₹595 Cr 12,000

↑ 12,000 Canara Bank

Certificate of Deposit | -2% ₹570 Cr 11,500

↑ 11,500 Punjab National Bank

Certificate of Deposit | -2% ₹546 Cr 11,000

↑ 1,000 Punjab National Bank

Certificate of Deposit | -2% ₹497 Cr 10,000

In case if you have more queries, feel free to contact our customer support on +91-22-62820123 on any working day between 9.30am to 6.30 pm or write a mail to us anytime at support@fincash.com. You can even do online chat by logging on our website www.fincash.com.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

OK NICE AND PRODUCTIVE.