How to Choose Funds Through Fincash.com?

Welcome to the World of Fincash.com!

Fincash.com offers a number of Mutual Fund schemes of almost all the fund houses. People can select the schemes as per their convenience and the ones that suits their requirements. So, let us have a brief look at the steps that will help us to choose the funds at Fincash.com that will help you to achieve your goals.

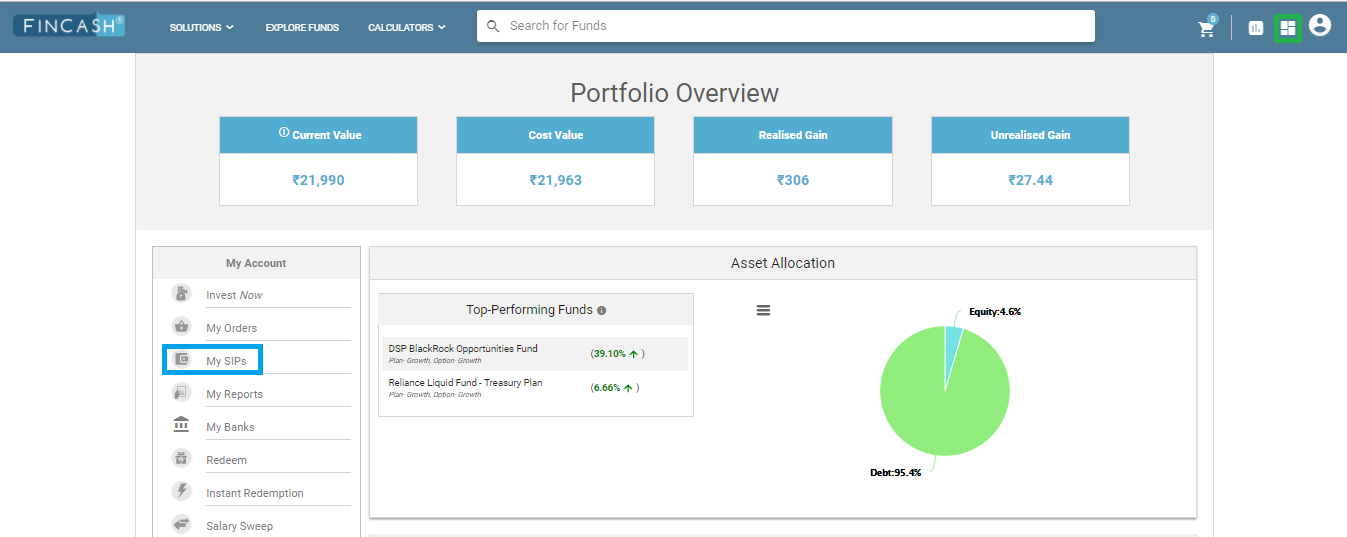

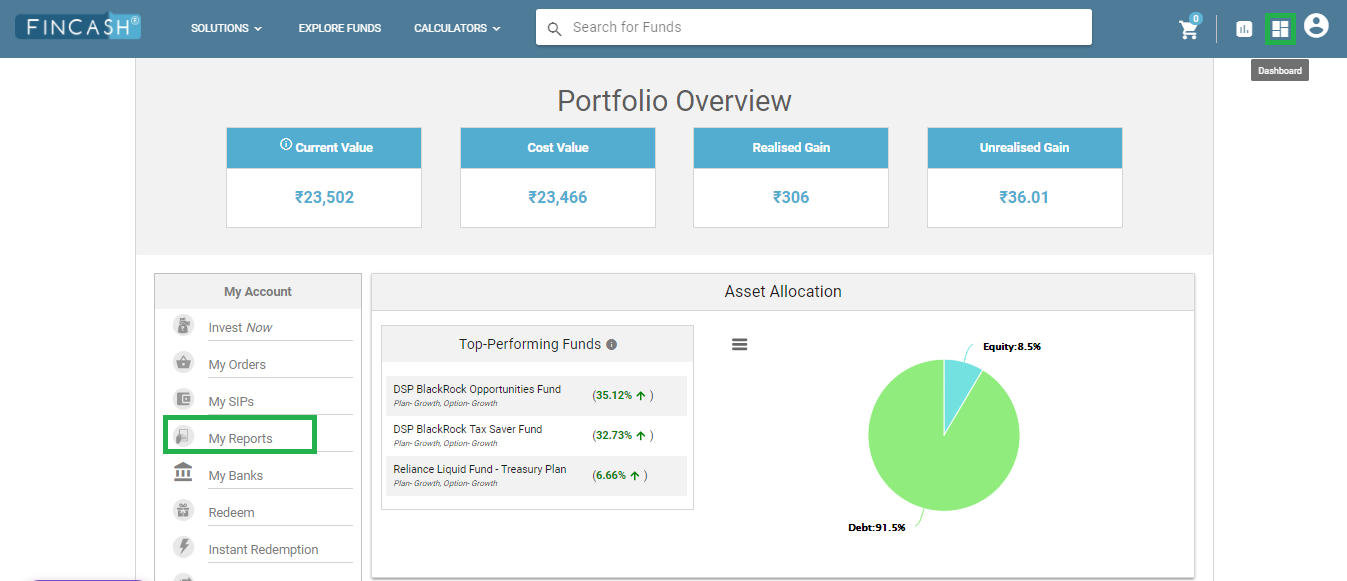

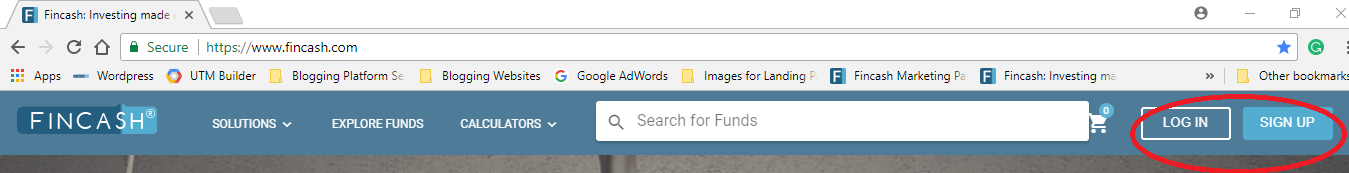

Visit Fincash.com Website & Login

In this step, the customer visits the website https://www.fincash.com and enters his login credentials. In case, if the customer is a first-timer he/she needs to click on the Sign Up and complete the registration process. The image for this step is given below where; the Log In and Sign Up buttons are circled in Red.

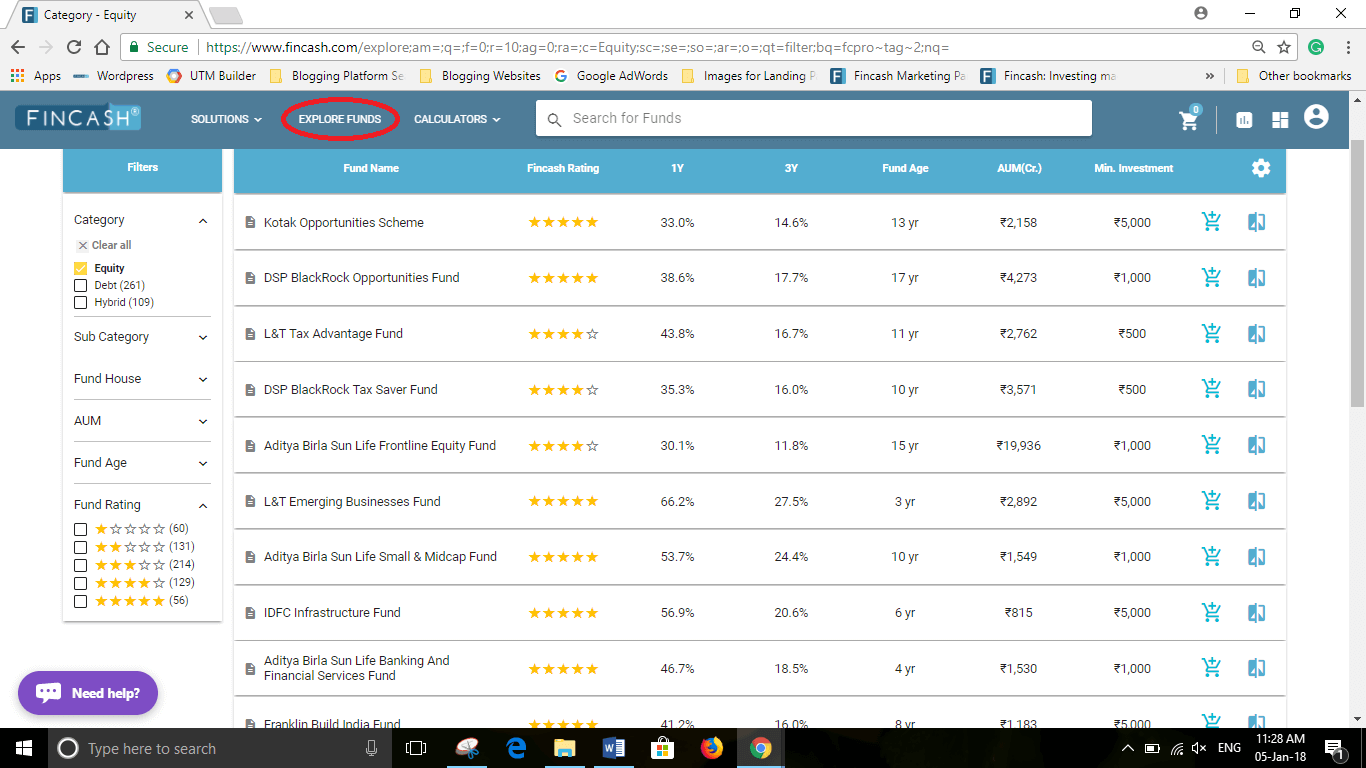

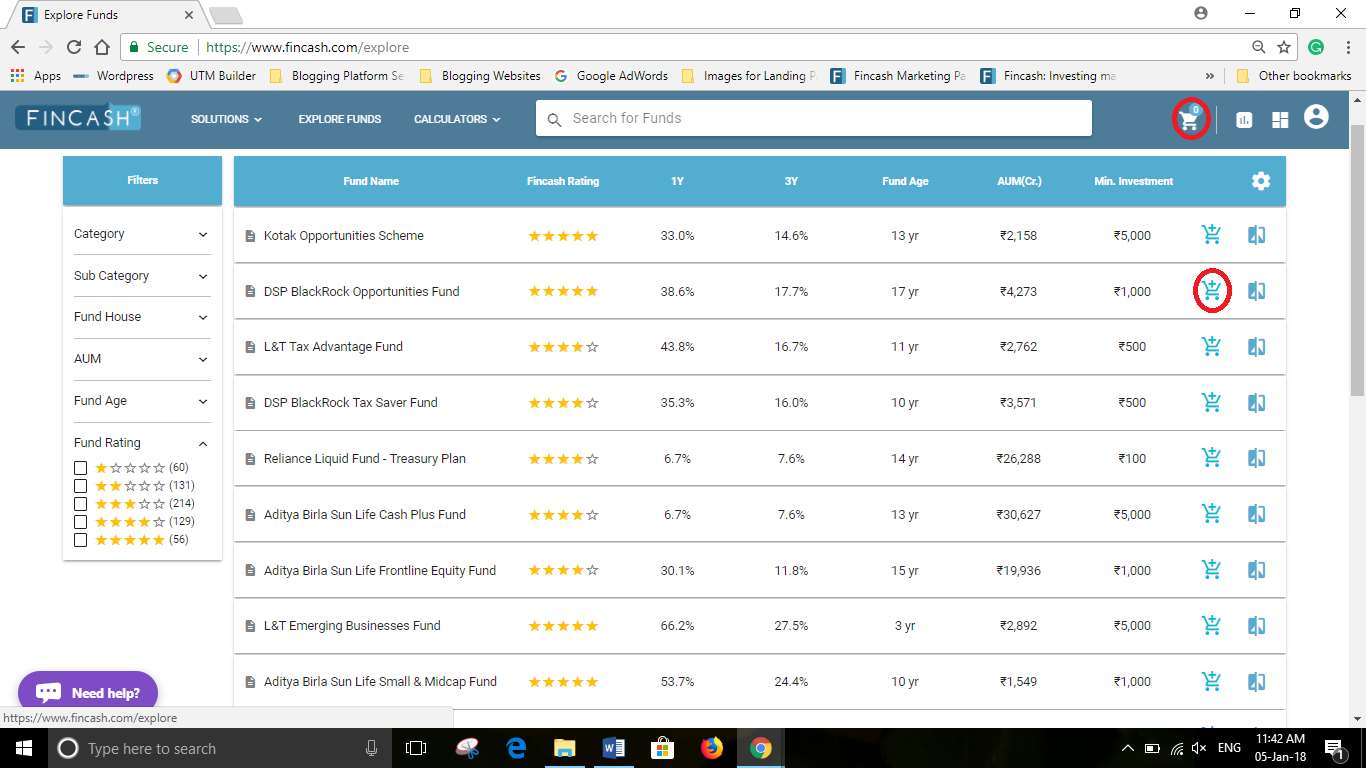

Click on Explore Funds & Choose the Desired Ones

After logging in, then you need to click on Explore Funds button and choose the Desired Funds. Here, you can find a lot of schemes out of which you can select as per your requirements. The image representation for this scheme is as follows where Explore Funds option is circled in Red.

Click on Add to Cart & Move to My Cart

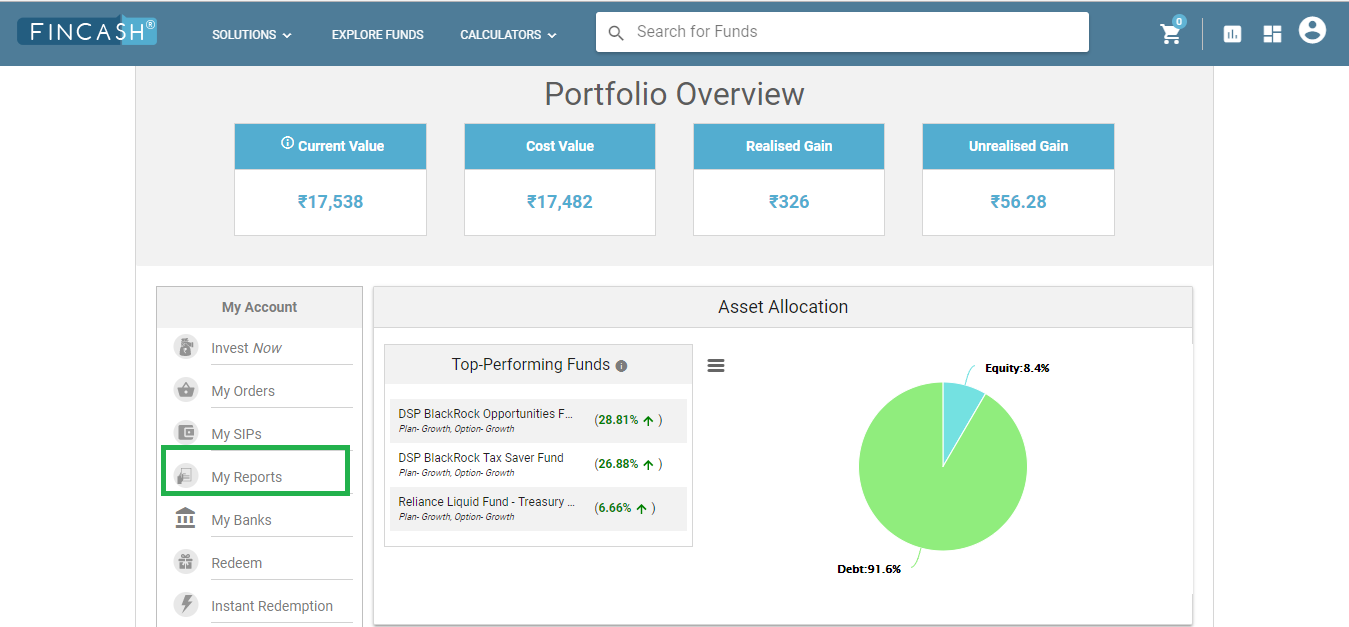

This is the third step. Here, once you select your desired fund you need to Add it to the Cart. After you add, you can either select more funds or click on the Cart Symbol which is on the top-right corner (4th from right). The image for this step is given below where the Cart Symbol is circled in Red.

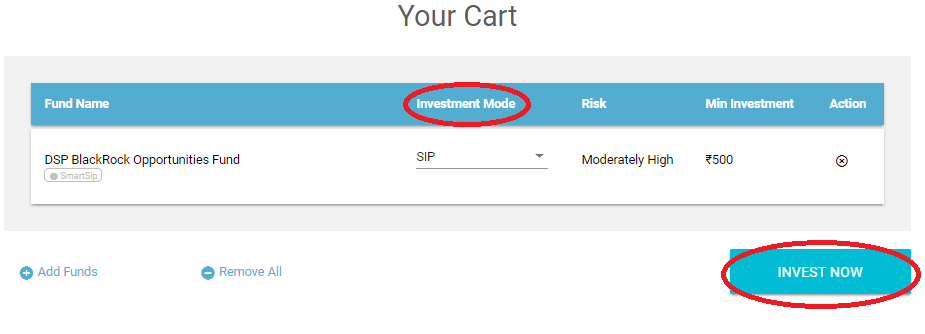

Select SIP or Lump Sum Option & Click on Invest Now

After Click on My Cart Symbol, a new screen opens where people choose SIP or Lump Sum Investment Mode. Here, people can choose SIP or Lump sum whichever is their preferred one and then click on Invest Button which is below the option. Here again, you get the option to add or remove funds. The image representation of this step is given below as follows where the Investment Mode and Invest Now are circled in Red.

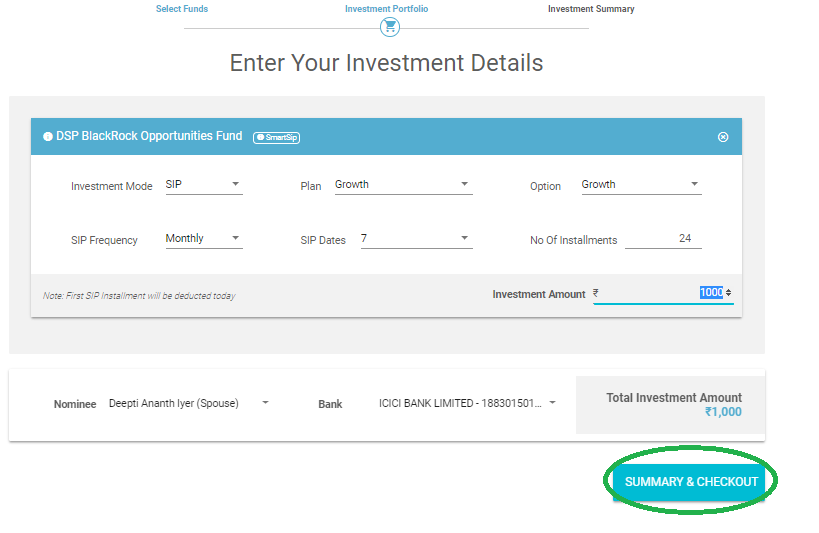

Enter Your Investment Details & Click on Summary & Checkout

Once you click on Invest Now, a new window opens where you need to enter your investment details like investment mode, investment amount, SIP tenure, SIP frequency, and so on. In case of Lump Sum investment, such details are not required as it is a one-time investment. After entering the investment details, you need to click on Summary & Checkout Button which is below the investment details. The image representation for this step is as follows where the Summary & Checkout Button is encircled in Green.

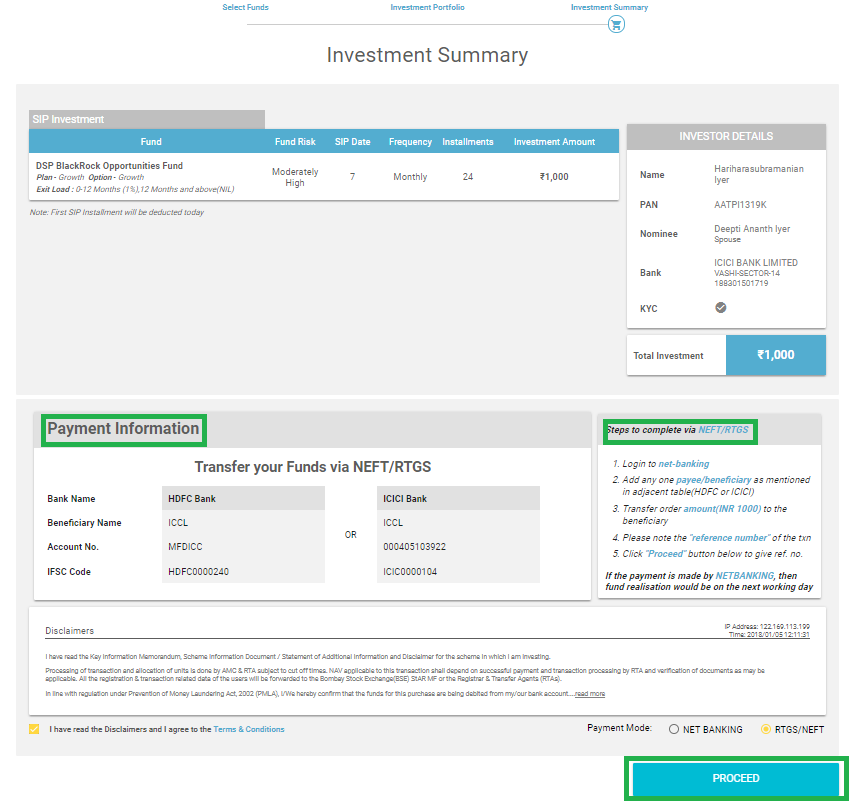

Investment Summary & Click Proceed

This is the last step in the process of selecting the product. In this step, people can see their Investment Summary. Here, once you scroll down the screen, you need to select the RTGS/NEFT or Net Banking Option. Also, they need to put a Tick Mark on the disclaimer which is at the bottom left of the investment summary and the Click on Proceed. If you RTGS/NEFT option, you can find the Payment Information which contains the account details in which you need to deposit money. Also, there is a small snippet step that shows how to transact using NEFT or RTGS. The image representation of this step is as follows where Payment Information, Steps to Complete a transaction via NEFT/ RTGS and Proceed Button are circled in Green.

Thus, the above steps show that to invest in Mutual Funds is easier. However, its always advised that you understand the modalities of the scheme completely before Investing. This will help you to ensure that your money is safe and it paves way for wealth creation.

For more investment related queries, please call our Customer Care Support & we will be happy to help you.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.