What is a Real Interest Rate?

A real interest rate is the interest rate considered to lend cash/loan between a lender and a borrower by subtracting the current inflation rate. The inflation-adjusted return is useful in determining the real cost to borrowers and the real profit to lenders.

This rate also showcases the time-preference rate for current products over future ones.

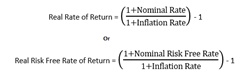

Real Interest Rate Formula

Simply, the real interest rate can be calculated by taking out the difference between the nominal interest rate and the inflation rate. Thus, the real interest rate formula is:

Real Interest Rate = Nominal Interest Rate - Inflation

Real Interest Rate Example

As an example, let's consider you have started your own small-scale business and now are looking for a loan. A well-known Bank is offering you a loan at a 10% interest rate, and the inflation is currently 5%, then the real interest will be calculated as:

- Nominal Interest Rate - Inflation = Real Interest Rate

- 10 - 5 = 5%

The real interest rate is 5%.

Real Interest Rate Vs Nominal Interest Rate

The nominal interest rate is the one that is actually paid on an investment or a loan. On the other hand, the real interest rate reflects the changes in purchasing power influenced by an investment. Generally, the nominal interest rate is the one that financial institutes advertise to back up their investment or loan.

By altering the nominal interest rate to recompense for the inflation’s effects helps to identify the changes in purchasing power of a certain capital over the period of time. As per the time-preference theory of interest, the real interest rate imitates the degree up to which a person chooses current products over future products.

If a borrower is eager to relish present use of funds, it shows a substantial time-preference for current products over future products. Also, in this case, a borrower might also be ready to pay a high-interest rate for the loan.

Similar to this, a lender, with a strong preference to put off the consumption of future products, shows a lesser time-preference and would be willing to offer loans at lower rates. This way, adjusting for inflation may help disclose the time-preference rate among participants of the market.

Talk to our investment specialist

Effect of Inflation Rates

In a situation where inflation is positive, the real interest rate will be lesser than the promoted nominal interest rate. For instance, if the money used to buy a Certificate of Deposit (CD) is about to earn 4% of interest every year, the rate of inflation is 3% per year. The interest rate received on a specific investment will be:

4% - 3% = 1%

Thus, the real value of money deposited in the CD will increase only by 1% in a year, when purchasing power is considered. However, if the same amount of money is deposited in a Savings Account with 1% of interest rate, the rate of inflation is at 3%, the purchasing power, or the real value of the funds will decrease since, after Accounting inflation, the real interest rate will be -2%.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.