Gain

What is the Gain?

The value of the assets can grow at any time. For instance, if an investor purchased stock worth 15k and its value goes up to 25k in a year, then the investor will be on a 10k gain. The value of the asset can change multiple times.

So, the actual gain happens when the investor sells their asset at a value higher than its original price.

Everything You Must Know About Gains

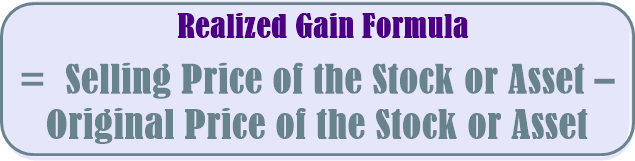

Gain meaning & its calculation is as simple as finding the difference between the purchase and sales price. If the balance is positive, then that would be the gain. However, this will be the gross gain value. In order to calculate the net gain from the asset, you will have to subtract the expenses or depreciation on that asset. A gain can be realized and unrealized.

The former refers to the profit that the investor makes when they have sold their property and the money is realized. Unrealized gain, on the other hand, refers to the paper gain. This means the owner has not sold the asset yet and the money is not realized. However, the value of the asset in the market has increased. Unrealized gains can change several times before you have signed the deal with a buyer.

Now, the total gain you make from the sale of the asset depends on a number of factors. Most importantly, you need to know whether or not the gain is taxable. Of course, the taxable gain will result in lower profits as compared to the non-taxable gains. The more annual tax you pay on your asset, the lower the profits you will get from the property.

Talk to our investment specialist

Taxes and Gains

Many states have made the realized gains subject to taxes. This means the seller will need to pay tax on the property they own. Not only is it confined to the property, but the government could impose the tax on other valuable assets, such as your furniture, jewellery, and sales of other precious assets. The rate of the tax will vary from state to state. However, gains from the sale of the most valuable assets are taxable. Often known as capital tax, this tax is imposed on the net profit only.

Let’s say you make a profit of Rs. 40,000 from the sale of your property. However, you also suffered a loss of Rs. 10,000 in shares. Now, you are going to pay taxes on Rs. 30,000, which is the net capital gain amount. It is important to note that only the net Capital Gains will be considered for the calculation of the taxable income. For instance, the taxable income in the stock transaction will be charged on the balance of the purchase and sales price of the shares minus the brokerage commission and other expenses. Gross income doesn’t matter when it comes to capital gains tax calculation.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.