Gamma

What is Gamma?

Gamma meaning could be defined as the rate at which the delta changes on the movement of the underlying stock. It is specifically used to calculate the changes in the delta with a slight move in the stock. For example, an option that has a 0.50 delta and 0.10 gamma with the underlying going up to some value, then the option’s delta will be 0.60.

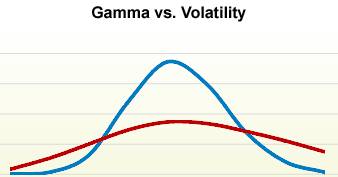

It is important to note that gamma is larger when the option is near the money. The value of the gamma tends to be the lowest when the option is away from the money. Gamma is quite crucial for investors and managers who are involved in hedging. In order to measure the changes in gamma, investors can use “color”.

How are Delta and Gamma Connected?

The concept is quite useful for those holding long options. If the delta moves up some value, it will boost your profit. It also helps you decelerate the possible losses if the delta moves against the investor. Gamma is one of the important concepts for investors. It helps you ascertain the price movement of the option.

The long options tend to have a positive gamma, while the short-term options are known for a negative gamma. That’s the reason why short options are associated with higher risks. If you consider the definition of Gamma and Delta in physics, then gamma could be defined as the acceleration of the long and short options. Delta, on the other hand, refers to the speed of the option. Now, calculating the gamma and delta of an option could be a little complex. You might need to use the financial software and spreadsheets to get the most accurate numbers. Let’s understand the concept with an example.

Suppose a Call Option has a delta value of 0.4. Should the stock value moves up some value, the option will increment by a certain percentage. Similarly, the delta of this option will also change accordingly. Let’s say the given value movement in the underlying stock changed the value of the delta to 0.53. Now the difference between the value of delta before and after the growth in the underlying stocks will indicate gamma.

Talk to our investment specialist

Can Gamma be Risky for Option Sellers?

There is no denying that gamma is extremely important for option buyers. It helps control losses and increases profits for buyers. However, the same concept can turn out to be risky for option sellers. If you see it from the vendor’s perspective, gamma can result in losses and decelerated profits.

All option buyers and sellers need to use gamma and keep themselves up-to-date with its expiration risk. The sooner you move to the expiration, the narrower your odds curve gets. It is important to note that your delta curve gets narrower with the probability curve. If that happens, there is a good chance you will have to deal with the aggressive gamma movements. Though it is not bad for option buyers, aggressive gamma can result in an accelerated loss for option sellers. It is best to avoid such aggressive swings.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.