Marginal Revenue

What is Marginal Revenue?

Marginal revenue (MR) refers to the rise in revenue from the sale of an additional unit of goods and services. It is revenue that a firm generates for each additional unit sold. Along with this, there is a marginal cost attached, which has to be accounted for. Marginal revenue remains constant over a certain level of output, however, it follows the law of diminishing returns and will slow down as the output level increases.

A firm will calculate marginal revenue by dividing the change in total revenue by the change in the total output of quantity. This is why the selling price of a single additional unit sold is equal to marginal revenue. For instance, company ABC sells its first 50 items for or a total cost of Rs. 2000. It sells its next item for Rs. 30. This means that the cost of the 51st item is Rs. 30. Note that marginal revenue disregards the previous average price of Rs. 40 and only analyses the incremental change.

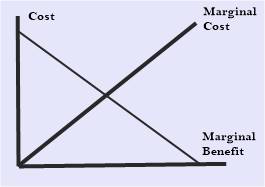

The benefits that come from adding the additional unit is known as marginal benefits. One of the main benefits is when the marginal revenue is more than the marginal cost, thereby, culminating in a profit from new commodities sold.

A firm will experience the best results when production and sales continue until marginal revenue equals marginal cost. Above and beyond that, the production cost of an additional unit will be more than the revenue generated. When the marginal revenue falls below marginal cost, companies usually take up to the cost-benefit principle and stop the production process as no further benefits will be gathered from producing extra.

Marginal Revenue Formula

The formula for marginal revenue is as follows:

Marginal Revenue= Change in Revenue ÷ Change in Quantity

MR= ∆TR/∆Q

Marginal Revenue Curve

The marginal revenue curve is a 'U' shaped curve indicating that the marginal cost for additional units will be less. However, with selling more incremental units the marginal cost will begin to rise. This curve is downward sloping because with an additional unit sold, revenue would be generated close to normal revenue. But as more units are sold, you would be required to reduce the price of the item you are selling. Otherwise, all the units will remain unsold. The phenomenon is commonly known as the law of diminishing margin. So, remember that the more you sell after a normal limit, the more the price will diminish and accordingly, the revenue too.

Talk to our investment specialist

Marginal Revenue in Competitive Firms Vs. Monopolies

The marginal revenue for competitive companies is usually constant. This is because the market directs the right price level and companies do not have much discretion over the price. This is why perfectly competitive companies maximize profits when marginal cost equal market price and marginal revenue. However, MR is different when it comes to monopolies.

For a monopolist, the benefit of selling an additional unit is less than the market price. A competitive company's marginal revenue always equals its average revenue and price. Note that a company’s average revenue is its total revenue earned further divided by total units.

When it comes to a monopoly, since the price changes as a quantity sold changes, the marginal revenue diminishes with every additional unit. Moreover, it will always be equal to or less than average revenue.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.