Acquisition

What is an Acquisition?

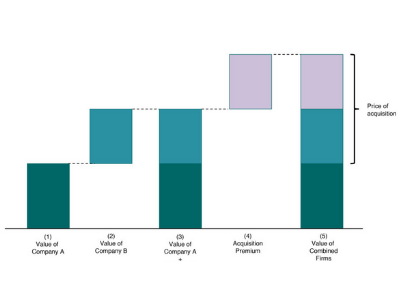

An acquisition is described as a corporate transaction where a company purchases a portion of a company’s shares or assets. Basically, the acquisition is made to take control in the company. There are various types of business combinations - acquisitions (both companies survive) merge (single company survive) and amalgamate (no one survives).

The acquiring company purchase the shares or the assets of the target company that gives the acquiring company to make the decisions regards to the acquired assets without taking approval of the shareholders from the target company.

Acquisition vs Merger

Acquisition and Merger are similar transactions where they are significantly different legal constructs. In an acquisition, both companies exist as a separate entity, but one of the companies becomes a Parent Company of the other. Whereas, in a merger, both the entities combine and only one company survive, while the other company doesn’t.

Talk to our investment specialist

Apart from this, the other type of transaction is an amalgamation where no legal entity continues to survive. Instead there an entirely new company is created.

Benefits of Acquisition

The benefits of the acquisition are as follows:

Reduce entry barriers

With acquisition and merger, a company is able to enter into a new Market and product lines directly with a brand. An acquisition can aid to overcome market entry that was previously challenging. Market entry can emerge as an expensive scheme for small businesses due to expenses in the market.

Market power

An acquisition can assist to augment the market share of the company quickly. Even the competition can be challenging, growth through acquisition can be helpful in gaining a competing edge in the marketplace.

New competencies and resources

A company can opt to take over other businesses to gain competencies and resources, which it does not hold currently. It can provide many benefits such as rapid growth in revenues and an improvement in the long-term financial position of the company that makes raising Capital for growth strategies easier.

Access to experts

When small businesses join large businesses they are able to access specialities such as financial, human resources specialist or legal.

Fresh ideas and perspective

Acquisition and merger make together a new team of experts with fresh views and ideas and who are passionate about assisting the business reach its goals.

Access to capital

After the acquisition, the access to capital for a larger company is enhanced. Whereas small business owners are usually forced to invest with their own money in business growth because of the inability to access large loan funds. Although, with the acquisition, there is an availability of a greater level of capital that allows the business owner to obtain funds.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.