What is Arms Index?

Commonly referred to as the short-term trading index, the Arms Index meaning is a technical indicator that is mainly used for the comparison of the total progressing and declining stocks with the high and low stock trading volume. The concept was established by Richard W. Arms Jr. in the year 1967.

You could easily calculate the Arms Index by finding out the ratio of the progressing and declining stocks with the volume. In Arms Index, 1 is considered to be the most crucial value. After all, crossing this value will suggest if it is a strong or weak Market. Below we have listed the important components of the Arms Index. Let’s check them out:

- Advancing Stock – As the name suggests, advancing stock refers to the stock issues, which have risen as compared to the past evaluation.

- Declining Stock – Declining stock refers to the issues that have reduced as compared to the past evaluation.

- Advancing Volume – Advancing volume refers to the total stock issues that have increased.

- Declining Volume – Declining volume refers to the total stock issues that have reduced.

Calculation of the Arms Index

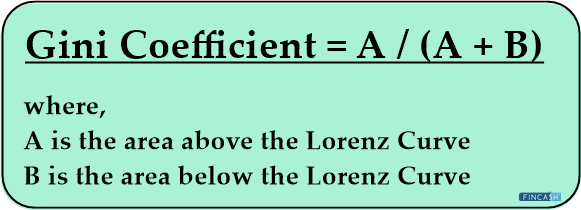

There are several software systems and charting applications used for the calculation of the Arms Index. You could use either software system for calculating Arms Index or measure it by hand. If you are doing it manually, then you must find out the AD ratio. To calculate the AD ratio, you must divide the advancing volume by declining volume.

Divide the value you get from the above calculation by AD volume. Note the results, draw them on the graph, and repeat every step for the next interval. Finally, you can join all these points to create a graph to check the movement of the Arms Index.

Talk to our investment specialist

Significance of the Arms Index

Arm Index matters the most in finance. In fact, the concept is so important that it is shown on the New York Stock Exchange’s wall for extended durations during the stock trading hours. Note that Arms Index is completely different from any form of indices, as it takes the total volume of stocks into account.

Another important thing you must note is that there are quite a few indices available and you may have to employ a couple of these indicators to get an accurate analysis. Experts recommend investors pair the arms index with a few different indices just so they get a clear picture of the AD ratio.

In addition to that, the investors must closely look into the rate of change as well as the TRIN readings just to find out if the market will switch the direction in the coming days. The major benefit of the Arms Index is that it enables users to find the real-time information of the Arms Index. It also gives people a clear picture of when they must purchase and sell the stocks. While the system has proven to be quite effective, it can generate inaccurate readings at times. It may also result in certain technical errors.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.