Break-Even Price

What is the Break-Even Price?

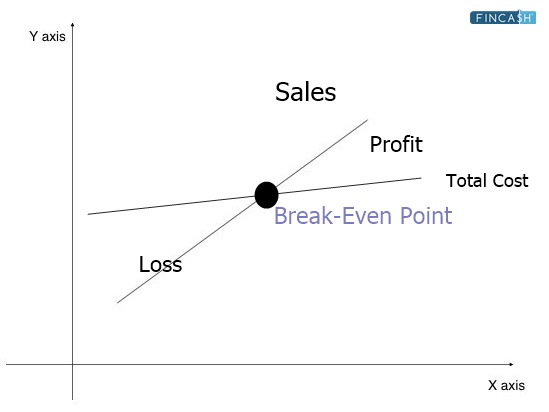

The break-even price is when the money received from the sale of a product covers the expenses associated with producing that product. It is an Accounting pricing methodology in which the price point at which a product will earn zero profit is calculated. In other words, it is the point at which cost is equal to revenue.

It can also refer to the amount of money for which a product or service must be sold to cover the costs of manufacturing or providing it. Break-even prices can be translated to almost any transaction.

Break-Even Price Illustration

For instance, let's take an example. The break-even price of a house would be the sale price at which the owner could cover the home's purchase price, interest paid on the mortgage, property taxes, maintenance, closing costs and Real Estate sales commissions, etc. At this price, the owner would not see any profit, but also would not lose any money while selling the house.

Break-Even Price Formula

The formula is:

Break Even Sales Price = (Total Fixed Costs/Production Volume ) + Variable Cost per Unit

Talk to our investment specialist

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.