Cash Cow

What is a Cash Cow?

In a typical growth-share BCG matrix, a cash cow meaning can be one of the four variants or quadrants that can be used for representing a product line, a product, or some company featuring a significant market share within the given mature industry.

A cash cow meaning could also indicate a reference to an asset, product, or business that, when acquired as well as paid off, could lead to the production of consistent cash flows across the entire lifespan.

Understanding Cash Cow Meaning

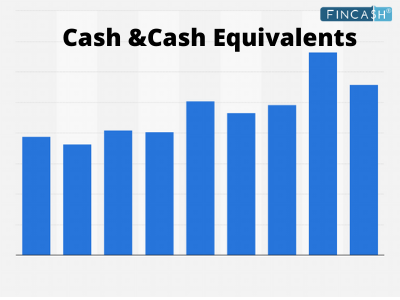

A cash cow can be referred to as the metaphor for the dairy cow that is known to produce milk across its entire life while requiring minimal to no maintenance. The given phrase has been applied to the business scenario that implies low maintenance. The cash cows in modern days are known to require minimal investment capital and help in providing cash flows perennially. These can be then allocated to other departments within the given corporation. Cash cows tend to be low at risk, and high on rewarding investments.

Cash cows tend to be one of the four quadrants or categories in the typical BCG Matrix –a business organization method that was brought into effect by the leading Boston Consulting Group (BCG) during the 1970s. The BCG Matrix also goes by the names as Boston Grid or Boston Box. It is known to place the business or products of the organization into one of the four quadrants or categories –cash cow, star, dog, and question mark.

The BCG matrix is helpful for organizations in understanding where their respective business stands with respect to the overall growth rate of the industry and the market share. It is known to serve as a typical comparative analysis of the overall potential & evaluation of the given business, market, and industry.

Some firms out there –especially large-scale organizations, are known to realize that the products or businesses within their respective Portfolio tend to fall under two broad categories. This stands, especially true with the given product lines at multiple points in the respective product lifecycle. Stars and cash cows are known to complement each other in the matrix. On the other hand, question mark and dogs make use of resources in a less efficient manner.

Talk to our investment specialist

Special Considerations

In contrast to the typical instance of a cash cow, in the BCG matrix, a star is referred to as a business or company that helps in realizing the high market share in the respective high-growth markets. Stars are known to require large-sized capital outlays. However, these are capable of generating significant cash. When a leading strategy gets adopted, stars are capable of morphing into cash flows.

Question marks are referred to as business units that experience reduced market share in the respective high-growth industry. They are known to require large amounts of cash for capturing more or sustaining the given position within the market.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.