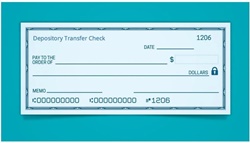

What is Depository Transfer Check?

A Depository Transfer Check (DTC) is utilized by a designated collection Bank for depositing the daily receipts of a corporation from various locations. It is an effective way of ensuring better cash management for industries that collect cash at multiple locations.

A third-party information service transmits data from each location. Right from there, the DTCs are generated for each deposit location. This data is then registered into the check-processing system at the specified destination bank for deposit.

How Does a DTC Work?

The industries utilize depository transfer checks to collect revenue from various locations. It is further deposited in one lump sum amount in an institution or at a bank. They are also known as depository transfer drafts.

Through a concentration bank, the third-party information service is used to transfer the data. A concentration bank is where it conducts the vast majority of its financial transactions or industry's primary financial institutions. Then the concentration bank further generates DTCs for each deposit place, which is registered into the system.

Talk to our investment specialist

Key Points

- The DTC may appear to be similar to a deposit check, but the only difference is they don’t have signatures on them

- Industries make use of depository transfer checks to maintain a better cash management system

- Automatic clearing house systems are being replaced with depository transfer check systems. But some industries continue to follow the DTCs for depositing purposes

- Depository transfer checks are not the exact thing as overnight deposits

A depository transfer check appears to be the same as a personal check except that the former is printed across the top centre of the check's face. These are non-negotiable instruments and do not possess a signature.

A DTC must not be confused with overnight deposits. After business hours, the deposits are put in a bag, and deposit slips are dropped off in this dropbox. And in the morning, when the bank opens, dropbox deposits the overnight deposit into the company's checking account.

Automatic Clearing House (ACH) Systems VS DTCs

DTC-based systems have been keenly getting replaced by the Automatic Clearing House (ACH). It is known as the electronic funds transfer system that speeds up payments. This funds transfer system typically deals with direct deposit, payroll, consumer bills, tax refunds, and other payments.

The ACH is administered by the NACHA (National automated clearing house association). The recent rule modifications enable most debit and credit transactions performed through the ACH to clarify the same working Business Day. It is considered cheaper, faster, and most efficient. Another important note is that industries that are not part of an ACH network must still use depository transfer checks.

Financial Involvement

Utilizing DTCs is an integral part of an industry's financial operations. It is because it permits the business to manage its cash flow in a better way. Being able to deposit the industry's cash into a concentration bank regularly assists the industry in reducing bankruptcy risks. Further, it improvises profitability by placing a more organized system for tracking the organized accounts and cash inflows receivable. It would also help avoid the risks associated with modifications in interest rates and currency.

Working Procedure of Depository Transfer Check (DTC)

- A facility manager at each specific location will get the information about the day's revenue and transfer the receipt to a third-party service provider

- From there, the receipts get collected from various locations

- Further, the third-party service provider transmits data to the concentration bank on the receipts

- It depends on the receipt's financial data; the concentration bank will generate and provide depository transfer checks for each specific location

- Next, the concentration bank will deposit the check into the company's account

- It is based on the check amount and a particular bank. Therefore, funds may not be promptly accessible for usage by the organization after depositing the check into the organization's bank account

Special Considerations

The other consideration is whether you can cash a depository check or not. Yes, depositing the check into your bank account is the same as any additional deposits. The bank may ask you to underwrite the back of the check as an assurance to a document that caused it.

Conclusion

The above-discussed information regarding the depository bank transfer will help organizations manage their inflows better. In the above post, you can find how it works, and a clear, understandable difference is are demonstrated between the automated clearinghouse and DTC. The corporate treasurer manages the corporate cash management effectively. Using DTC in the organizations is considered necessary because of its efficient function with substantial incoming and outgoing cash inflows emerging with low-profit margins.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.