Economic Value Added (EVA)

What is Economic Value Added?

Created by Stern Value Management – a consulting firm - Economic Value Added (EVA) – was originally implemented as Stern Stewart & Co. Basically, it is a metric of the financial performance of a company on the basis of its residual wealth assessed by subtracting the capital cost from the operating profit, adjusted for taxes on the basis of cash.

Generally, EVA can be referred to as an economic profit, considering that it helps to capture the real economic profit of a firm.

Explaining Economic Value Added:

EVA is considered as an incremental difference in the rate of return over the cost of capital of a company. Primarily, it can be used to evaluate the company’s value that it generates from money invested.

In case the EVA of a company is negative, it will define that the company is not creating value from the invested funds. On the other hand, a positive EVA shows that the company is competent enough to create adequate value from the invested funds.

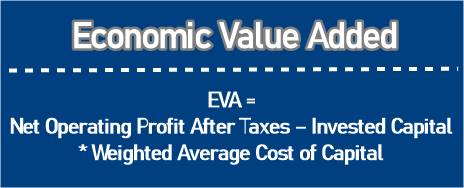

EVA Formula

Technically, EVA can be calculated as:

EVA = Net Operating Profit After Taxes – Invested Capital * Weighted Average Cost of Capital

Talk to our investment specialist

EVA Components

The EVA equation demonstrates that there are three major components that the Economic Value Added of a company comprises. To begin with, Net Operating Profit After Taxes (NOPAT) is the capital amount that is invested.

It can be calculated manually, but is generally listed in the financials of a public company. And then, the Weighted Average Cost of Capital (WACC) is another component. It is the average rate of return that a firm anticipates paying its investors.

The weights are taken in the form of a fraction of every financial source mentioned in the capital structure of a company. Generally, WACC can also be calculated seamlessly; however, it is generally given as a public record.

Lastly, there is Capital Investment, which is the amount of money used to backup a certain project. Often, an equation is used for the invested capital to calculate EVA, which is:

EVA = Total Assets – Current Liabilities.

These two figures can easily be located on the balance sheet of the company. In such a scenario, the EVA formula would be:

EVA = NOPAT – (Total Assets – Current Liabilities) * WACC

The major objective of Economic Value Added is to quantify the cost, or charge, of Investing capital into a specific firm or project. And then, it is assessed to figure out whether the funds are generating an adequate amount of cash to be regarded as a good investment.

The charge demonstrates the minimum return that an investor would require to make the investment a worthy action. Having a positive EVA makes it easier to show that a project is generating excessive returns than the required amount.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.