Economic Value of Equity (EVE)

What is the Economic Value of Equity?

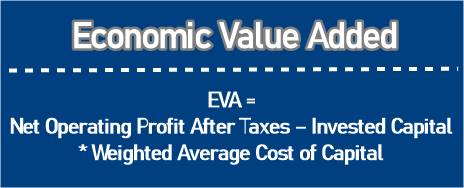

The Economic Value of Equity (EVE) is the calculation of cash flow that takes the current value of all asset cash flows and deduct the same from the current value of liability cash flows. Basically, a Bank uses EVE to regulate its liabilities and assets.

This one is a long-term economic measure that is used to evaluate the risk associated with interest rate. In simple words, it can be well-defined as the Net Present Value (NPV) of the cash flow present in the balance sheet of a bank.

This calculation is easily used for asset-liability management to assess alterations in the bank’s economic value.

Explaining Economic Value of Equity

By now, the definition and purpose of the economic value of equity would be quite clear. Basically, this value is used in the form of an estimate of total capital while assessing the total capital’s sensitivity to interest rate fluctuations.

Talk to our investment specialist

A bank might use EVE to create such models that demonstrate how interest rate alterations would be impacting its total capital. The impartial market values of assets and liabilities of a bank are directly associated with interest rates.

A bank creates models with all assets and liabilities that display the impact of an array of interest rate changes. This risk analysis is an essential tool that enables banks to get ready against consistently fluctuating interest rates and to perform better during stress tests.

Basically, stress testing economic value of equity is the internationally accepted standard for comprehending interest rate risk. A plus and minus of 2% stress test on every interest rate along with periodic EVE analysis is recommended.

Furthermore, a basic increase in interest rates may increase earnings for a bank. However, it may usually be the reason behind a decrease in the economic value of equity as there is a fundamental inverse relationship between interest rates and asset values as well as a direct relationship between interest rates and liabilities values.

But bank earnings and EVE do handle a relationship wherein the higher the EVE, the higher will be the possibility of increased future earnings created from the equity base.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

You Might Also Like