Present Value - PV

What is Present Value - PV

Present value (PV) is the current value of a future sum of money or stream of cash flows given a specified rate of return. Future cash flows are discounted at the discount rate, and the higher the discount rate, the lower the present value of the future cash flows. Determining the appropriate discount rate is the key to properly valuing future cash flows, whether they be earnings or obligations.

Details of Present Value - PV

Present value is also referred to as the discounted value. The basis is that receiving Rs. 1,000 now is worth more than Rs. 1,000 five years from now because if you got the money now, you could invest it and receive an additional return over the five years.

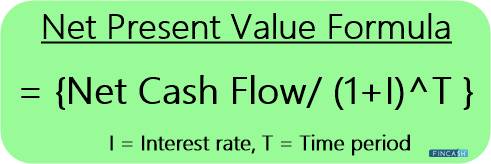

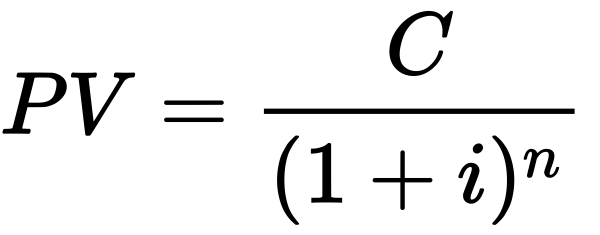

The equation for calculating present value is:

Present value = FV / (1 + r)n

Where: FV = future value, r = rate, n = number of periods

The calculation of discounted or present value is extremely important in many financial calculations. For example, net present value, bond yields, spot rates and pension obligations all rely on discounted or present value. Learning how to use a financial calculator to make present value calculations can help you decide whether you should accept such offers as a cash rebate, 0% financing on the purchase of a car, or pay points on a mortgage.

Talk to our investment specialist

Future Value Compared With Present Value

Present value is used in reference to future value and the comparison of present value with future value (FV) best illustrates the principle of time value of money and the need for charging or paying additional risk-based interest rates. Simply put, the money today is worth more than the same money tomorrow because of the passage of time - i.e., in nearly all scenarios a person would rather have a $1 today versus that same $1 tomorrow. Future value can relate to the future cash inflows from Investing today's money, or the future payment required to repay money borrowed today.

Discount Rate for Finding Present Value

The discount rate is the sum of the time value and a relevant interest rate that mathematically increases future value in nominal or absolute terms. Conversely, the discount rate is used to work out future value in terms of present value, allowing a lender or capital provider to settle on the fair amount of any future earnings or obligations in relation to the present value of the capital. The word "discount" refers to future value being discounted to present value.

Present Value Examples

Present value provides a basis for assessing the fairness of any future financial benefits or liabilities. For example, a future cash rebate discounted to present value may or may not be worth having a potentially higher purchase price. The same financial calculation applies to 0% financing when buying a car. Paying some interest instead of on a lower sticker price may work out better for the buyer than paying zero interest on a higher sticker price. Paying mortgage points now in exchange for lower mortgage payments later makes sense only if the present value of the future mortgage savings is greater than the mortgage points paid today.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.