Discount

What is a Discount ?

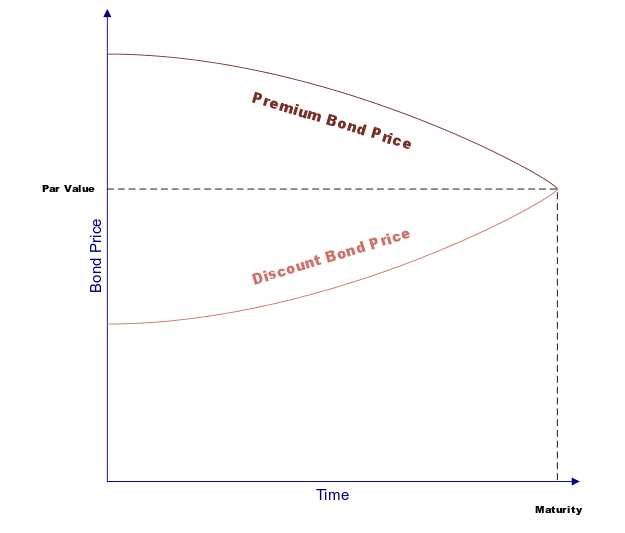

In finance, discount refers to a situation when a bond is trading for lower than its par or face value. The discount equals the difference between the price paid for a security and the security's Par Value.

Details of Discount

For example, if a bond with a par value of Rs. 1,000 is currently selling for Rs 990 INR, it is selling at a discount of (Rs. 1000/Rs. 990) - 1 = 1%, or Rs. 10. The reason a bond will trade at a discount is if it has a lower interest or coupon rate than the prevailing interest rate in the economy. In other words, since the issuer is not paying as high of an interest rate to the bondholder, the bond must be sold at a lower price to be competitive, or else no one would buy it. This interest rate, known as a coupon, is generally paid on a semiannual basis. The term coupon comes from the days of physical bond certificates (as opposed to electronic ones), when some Bonds had coupons attached to them. Some examples of bonds that trade at a discount include U.S. savings bonds and Treasury bills.

Stocks and other securities can similarly be sold at a discount. However, this discount is not due to interest rates; rather, a discount is usually implemented in the stock market in order to generate buzz around a particular stock. In addition, the par value of a stock only specifies the minimum price the security can be sold for upon its initial entrance into the market.

Talk to our investment specialist

Deep Discounts and Pure Discount Instruments

A type of discount bond is a pure discount instrument. This bond or security pays nothing until maturity. This type of bond is sold at a discount, but when it reaches maturity, it pays the par value. For example, if you purchase a pure discount instrument for Rs. 900 and the par value is Rs. 1,000, you'll get Rs. 1,000 when the bond reaches maturity. Investors don't receive interest income from holding these securities, however, their return on investment is measured by the price appreciation of the bond. The more discounted the bond at the time of purchase, the higher the investor's rate of return at time of maturity.

One type of pure discount bond is a zero-coupon bond, which doesn't pay interest but instead is sold at a deep discount. The discount amount is equal to the amount lost by a lack of interest payments. Zero-coupon bond prices tend to fluctuate more often than bonds with coupons.

A deep discount doesn't only apply to zero-coupon bonds; it is generally considered to apply to any bond that is trading for 20% below market value and beyond.

Discounts vs. Premiums

A discount is the opposite of a premium, which applies when a bond is sold for higher than par value. A premium occurs if the bond is sold at, for example, Rs. 1,100 instead of its par value of Rs. 1,000. Conversely to a discount, a premium occurs when the bond has a higher interest rate than the current market rate.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Thanks for the great guide and new ideas for creating discount offers to increase sales!