Discount Bond

What is a Discount Bond

A discount bond is a bond that is issued for less than its par (or face) value, or a bond currently trading for less than its Par Value in the secondary market. Discount Bonds are similar to zero-coupon bonds, which are also sold at a discount, but the difference is that the latter does not pay interest.

A common example of a discount bond is a savings bond.

A bond is considered a deep-discount bond if it is sold at a significantly lower price than par value, usually 20% or more.

Details of Discount Bond

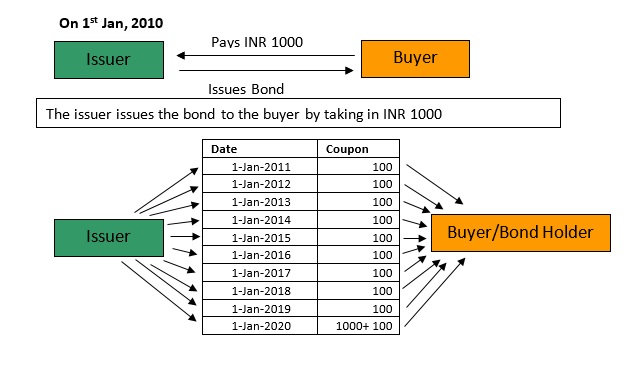

Investors that purchase bonds are paid interest by the bond issuer. This interest rate, also called a coupon, is usually paid semiannually. The frequency at which these coupons must be paid doesn't change; however, the amount of interest does, depending on market factors. As interest rates go up, bond prices go down, and vice versa. To illustrate this phenomenon, say, interest rates go up after an investor purchases a bond. The higher interest rate in the economy decreases the value of the bond since the bond is paying a lower interest or coupon rate to its bondholders. When the value of a bond decreases, it is likely to sell at a discount to par. This bond is referred to as a discount bond.

A bond is considered a discount bond when it has a lower interest rate than the current market rate and, consequently, is sold at a lower price. The "discount" in a discount bond doesn't necessarily mean that investors get a better yield than the market is offering, just a price below par. For example, if a corporate bond is trading at Rs. 980, it is considered a discount bond since its value is below the Rs. 1,000 par value.

Talk to our investment specialist

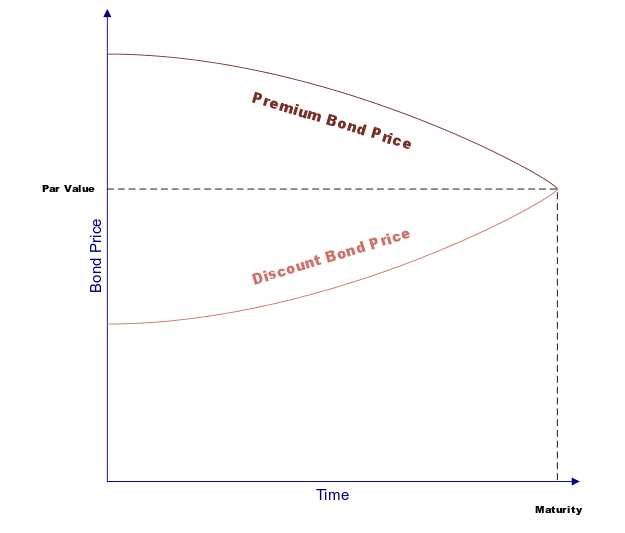

A discount bond is the opposite of a premium bond, which occurs when the market price of a bond is higher than the price for which it was originally sold. To compare the two in the current market, and to convert older bond prices to their value in the current market, you can use a calculation called yield to maturity (YTM). Yield to maturity considers the bond's current market price, par value, coupon interest rate, and time to maturity in order to calculate a bond's return.

Discount bonds can be bought and sold by both businesses and individuals. Businesses have strict regulations for the selling and purchasing of discount bonds; they must keep detailed expense records of the discount bonds bought and sold on a balance sheet.

Examples of Discount Bonds

Let's say you bought a bond a few years ago, but now you want to sell it. The value of your bond will most likely be different, since the market is constantly fluctuating. Let's say that interest rates have risen from 5% when you originally purchased the bond, to 10%. A potential investor will insist that you match this new 10% interest rate before purchasing the bond at face value. Alternatively, you could sell your bond for a lower price originally, so that the difference matches the amount of projected interest, and not have to worry about making interest payments at all. The amount of this projected interest will match the amount of your annual coupon, totaled over all years of payment. For example, if your coupon is for $20 and your bond has five years until maturity, the total interest will be Rs. 100, and an investor can pay that much less for the bond initially, rather than receiving coupons. Either way, in this situation, you hold a discount bond, since interest rates have gone up and consequently, the price is below the current market value.

Let's take another example to show a bit of what a business needs to do when selling a discount bond. In this situation, the bond seller is a business that originally purchased the bond for Rs. 10,000 but is now selling it at Rs. 9,000 due to rising interest rates. On the balance sheet, the business would need to record the current value of the bond, Rs. 9,000, and the amount of the discount, Rs. 10,000 - Rs. 9,000 = Rs. 1,000, to calculate the "Bond Payable" field, Rs. 10,000. The business would also need to amortize the amount, or pay it off in fixed installments over a set time frame. Amortization works much like depreciation, in that it reduces the discount amount over time, so that when the bond matures, the bond's carrying amount matches its par or face value. At this point, the business pays off the face value.

Pros and Cons of Purchasing a Discount Bond

If you buy a discount bond, the chances of seeing the bond appreciate in value are fairly high, as long as the lender doesn't default. If you hold out until the bond matured, you'll be paid the face value of the bond, even though what you originally paid was less than face value. Maturity rates vary between short-term and long-term bonds; short-term bonds mature in less than a year, while long-term bonds mature over ten to fifteen years, or even longer.

However, the chances of default might be higher, as a discount bond can indicate that the lender is in a less than ideal place in the market or will likely be in the future. The presence of discount bonds can indicate many things, such as predictions of falling dividends or a reluctance to buy on the part of the investors.

A zero coupon bonds is a great example of deep discount bonds. Depending on the length of time until maturity, zero-coupon bonds can be issued at very large discounts to par, sometimes 20% or more. Because a bond will always pay its full face value at maturity (assuming no credit events occur), zero-coupon bonds will steadily rise in price as the maturity date approaches. These bonds don't make periodic interest payments and will only make one payment (the face value) to the holder at maturity.

A distressed bond (one that has a high likelihood of default) can also trade for huge discounts to par, effectively raising its yield to very attractive levels. The consensus, however, is that these bonds will not receive full or timely interest payments at all. Because of this, investors who buy into these securities are very speculative, possibly even making a play for the company's assets or equity.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.