What is Enterprise Multiple?

The enterprise multiple, often known as the EV multiple, is a ratio that is used to calculate a company's value. The enterprise multiple, which is equal to enterprise value divided by Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA), considers a company's debt in the same way as a potential buyer would.

The definition of a 'good' or 'poor' business multiple varies by industry.

The enterprise multiple is primarily used by investors to judge whether a firm is undervalued or overvalued. A low ratio in comparison to peers or historical norms suggests that a company is undervalued, whereas a high ratio suggests that it is overpriced. Because it ignores the distorting effects of different countries' tax systems, an enterprise multiple is useful for cross-national comparisons. Enterprise value, which incorporates debt and is a stronger statistic for merger and acquisition (M&A) objectives than market capitalization, is often used to locate suitable takeover prospects.

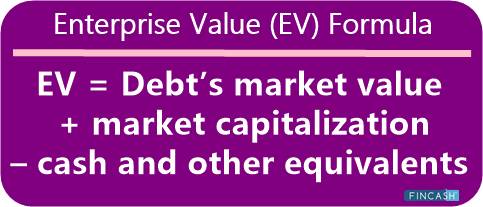

Depending on the industry, enterprise multiples can differ. Higher enterprise multiples in high-growth businesses (e.g. biotech) and lower multiples in slow-growth industries are acceptable expectations (e.g. railways). The enterprise value (EV) of a firm is a measure of its economic worth. It's routinely used to figure out how much a company is worth if it's bought. Because it incorporates the debt an acquirer would have to absorb as well as the cash they would get, it is thought to be a superior valuation indicator for M&A than a market cap.

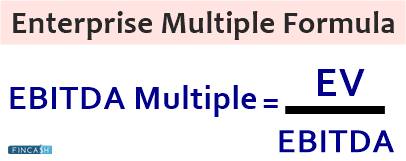

Enterprise Multiple Formula

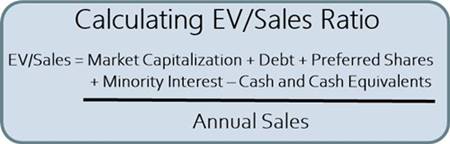

Enterprise Multiple = EV / EBITDA

Here,

- EBITDA is referred to Earnings Before Interest, Taxes, Depreciation, and Amortization

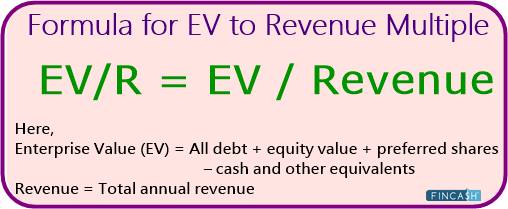

- EV: Enterprise Value = Total debt + Market Capitalization – cash equivalents

Talk to our investment specialist

Limitations of Enterprise Multiple

An enterprise multiple is a statistic for identifying attractive targets for buyouts. However, be wary of value traps, which are stocks that have low multiples because they are merited (for example, the company is struggling and won't recover). This gives the appearance of a good investment, but the industry or company's fundamentals indicate negative returns. Investors believe that a stock's historical performance predicts future returns, so when the multiple drops, they typically jump at the chance to acquire it at a low price. Understanding the industry and the company's fundamentals can aid in determining the stock's true value.

Examining predicted profitability and determining if the predictions pass the test is one simple approach to do this. TTM multiples should be less than forwarding multiples. When these forward multiples appear to be extremely cheap, the reality is that the expected EBITDA is higher, and the stock price has already declined, indicating the market's caution. As a result, it's critical to understand the company's and industry's catalysts.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.