Defining Hara-Kiri Swap

A hara-kiri swap is known as the cross-currency swap or the interest rate that doesn’t have any potential for originator’s profit. It was in the 1980s when this term turned popular. It was the time when Japanese brokers and banks were providing attractive interest rates to acquire business from foreign companies.

In Japan, hara-kiri is regarded as the type of slow ritual suicide. These swaps got dubbed as hara-kiri as it was regarded as a financial suicide when these transaction types couldn’t make any profit.

Explaining Hara-Kiri Swap

Hara-kiri swaps don’t offer any intrinsic advantage to parties that provide them. However, there could be some of the extrinsic advantages that can be considered. Providing an attractive swap to a huge company might compel them to deal with the Bank.

As a result, this may open chances to acquire profit elsewhere, like insurance policies, banking fees, loans, underwriting issues, and more. The risk to the Offering party is that high-end investors may end up availing advantages of the hara-kiri swap without offering any profitable business anywhere else.

Talk to our investment specialist

How does it Work?

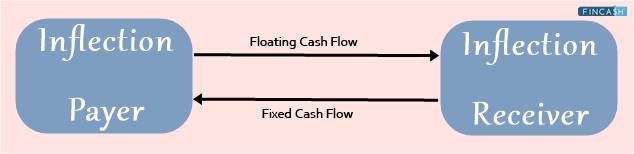

Hara-kiri swaps work similarly to any other interest rate swaps or currency. The only difference is that with the hara-kiri swap, the offered rate by the originator is more attractive in comparison to what is already available in the Market out there.

For instance, the swap originator may provide higher interest payments to a different party than what other banks or financial institutions are offering. Or, they might even provide an attractive exchange rate on currencies.

These actions decrease the bank’s profit margin, making it even less likely that they would get the benefit or profit directly from transactions. Generally, such swaps get traded Over the Counter (OTC), and often, in this case, get directly marketed by a brokerage or a bank to a potential client.

With OTC transactions, the parties get to negotiate the terms that they wish to have from the swap. This way, the originator may set minimum or maximum rates that they will receive or pay, specifically guaranteeing that the other party may come ahead or out on the swap.

With interest rates and exchange rates fluctuation, potentially large sums of money involved in such typical transactions, could turn out to be huge losses or missed profit for brokers or banks if the market goes toward the wrong way.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.