Incidental Expenses

What are Incidental Expenses?

Incidental expenses are those expenses that are insignificant in nature and are linked to business travel. The expense is all about the unnecessary travel and entertainment costs that one may incur during business travel or tour.

Incidental expenses are transportation costs, food cost, phone bills, tips, room service during travel, etc.

Important Points to Remember

1. Policies and Procedures

If you are an employee, remember that all the policies and procedures of incidental expenses are written in your company’s employee handbook.

2. Limited

He incidental costs are usually categorised as personal and business. These are provided in a limited amount to the employee. If the costs go above the sanctioned amount, the employee will have to pay for it.

3. Tracking

The incidental expenses will have to be tracked by the company for tax purposes.

4. Track Record

The employee is required to keep a track for all the payments and purchases done with the sanctioned amount.

Talk to our investment specialist

5. Receipt

The employee should be able to give the history of all expenses in the company’s expense log book with receipt or bill.

6. Reimbursement

Reimbursement should be carried out via cheques in order to give clarity on all due payment reimbursed to the employee.

Method for Meals and Incidental Expenses

One of the major incidental expenses is a meal. There are 5 methods to figure out meal and incidental expenses. They are mentioned below:

- Actual Cost Method

- High-Low Method

- Incidental Expenses Only Method

- Per Diem Travel Allowance Under Accountable Plans Method

- Standard Meal Allowance Method

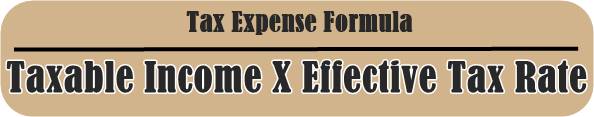

Incidental Expenses and Tax

The business type and taxpayer have a huge impact on incidental expenses. In general cases, the incidental expenses might be deductible in case they are ancillary to business expenses that are both necessary and ordinary.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.