What is Expense Ratio?

An expense ratio is an annual fee that funds charge their shareholders. The expense ratio is charged in percentage. Major components of the cost are like legal cost, advertising cost, administration cost, and the management cost. This fee is different from the commission or sales fee and or the expenses incurred on the buying and selling of Portfolio.

The expense ratio is charged daily by deducting a very small fraction of the fund’s assets. Mainly, the fund sponsor has operational costs, and this percentage (expense ratio) covers those costs.

Usually, if the Mutual Funds’ assets are small, the expense ratio may be high. It is because the fund can meet its expenses from a smaller asset base. And, if the net assets of the mutual fund are large, the expense ratio is ideally lower as expenses are spread across a wider asset base.

Components of Expense Ratio

There are three major types of expenses as a part of the Expense Ratio :

1. Management Fee

Mutual Fund Houses appoint fund managers for managing mutual fund schemes. The management fee or investment advisory fee is used to compensate the managers of the portfolio. On average this fee is annually about 0.50 percent– 1.0 percent of the funds’ assets.

2. Administrative Costs

The administrative costs are the expenses of running the fund. This would include customer support, information emails, communications, etc.

3. Distribution Fees

The 12-1b distribution fee is collected by most of the mutual fund companies for advertising and promoting the fund.

Talk to our investment specialist

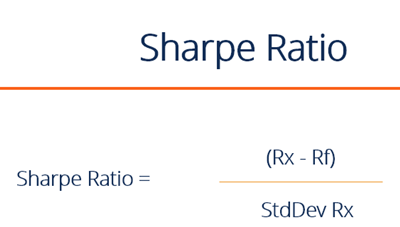

How is the Expense Ratio Calculated?

The expense ratio is expressed as a percentage of the average weekly net assets of the fund and is calculated as follows:

Expense Ratio= Operating Expenses/Average Value of Fund Assets

In the above calculation, loads and sales commissions, as well as trading-related activities, are also excluded, as these charges are a one-time cost.

The expense ratio of a mutual fund is disclosed twice in a year, in March and September.

Calculation of Total Expense Ratio

For illustration purpose- Let's suppose that you invest INR 20,000 in a fund with an expense ratio of 2 percent, then you are paying the fund INR 400 to manage your money. The Mutual Fund’s NAVs are reported after netting off the fees and expenses and therefore, it is important to know how much the fund is charging as expenses.

Mutual fund expense ratios range from 0.1 percent – 3.5 percent for Tax saving funds in India.

Compare Expense Ratio of Various Equity Funds

For brief understanding, here's a list of expense ratio of various Equity Mutual Funds:

| Name of Mutual Fund Scheme | Type of Mutual Fund | Expense Ratio |

|---|---|---|

| Franklin Asian Equity Fund | Global | 3.0% |

| Motilal Oswal Multicap 35 Fund | Multi-Cap | 2.1% |

| IDFC Infrastructure Fund | Sector Fund | 2.9% |

| Aditya Birla Sun Life Banking And Financial Services Fund | Sector Fund | 2.8% |

| IDFC Tax Advantage (ELSS) Fund | ELSS | 2.9% |

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.