What is Marginal Profit?

Marginal profit refers to the income an organization earns on selling one additional unit of the product. Marginal can be defined as the extra cost or revenues you earn from producing the additional unit. Marginal cost is the extra cost you incur for an extra unit. The difference between the marginal cost and the revenues you earn from producing and selling the extra unit refers to the marginal profit.

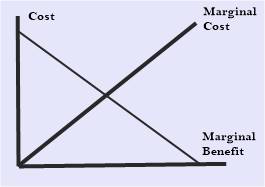

This concept is used to determine the total profit you are making from the production of the additional units. It is specially calculated to determine when to increase and decrease production levels. In the microeconomics context, the organization is supposed to expand its production and earn more profits when the marginal cost is equal to the marginal profit. In simple terms, marginal profit refers to the profit you earn from manufacturing the additional unit of a product. It must not be confused with the net profit or average profit.

How Marginal Profits Affect the scale of Production?

Marginal profit has a great impact on the scale of production. That’s because when a firm expands and it increases the level of production, the revenues of the company could either increase or decrease. It is important to note that the marginal revenue can get zero and negative. If that happens, the firm will increase the production levels until the cost and revenues are equal or the margin profit reaches zero. That’s the state when the company earns no extra profit for producing the additional unit of a product.

However, not all companies expand their production levels when the marginal profit reaches a negative scale. Many companies end up decreasing the level of production or shutting down the business altogether if they don’t think the marginal revenue will grow in the future.

Note that the marginal profit is used for calculating the revenues you earn from producing an extra unit of the product only. It has nothing to do with the company’s overall profitability. Ideally, the company stops production as soon as they notice the additional unit of product will affect the overall profitability of the company.

Talk to our investment specialist

Factors Affecting Marginal Profits

The factors that affect the marginal cost of a product are labor, taxes, cost of raw materials, and interest on the debt. It is important to note that fixed costs must not be added for the calculation of the marginal profit as these are considered one-time payments. They have no impact on the profitability of the additional unit produced. This payment is to be made once a month or yearly. The sunk cost can be defined as the amount you spend on the heavy equipment and machinery. These costs have nothing to do with the profitability of the additional unit.

While every company wants to achieve the state where marginal cost equals the marginal profit, only a few of them manage to reach that level. The technical and political factors, changes in trends, and growing competitions contribute to the differences between the marginal cost and revenues.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.