Marginal Propensity to Import (MPM)

What is Marginal Propensity to Import-?

The marginal propensity to import refers to the change in imports caused by a change in income. In other words, it refers to the amount that imports increase or decrease with each unit of a rise or fall in disposable income. The idea is that rising income for businesses and households increases greater demand for goods from overseas and vice versa.

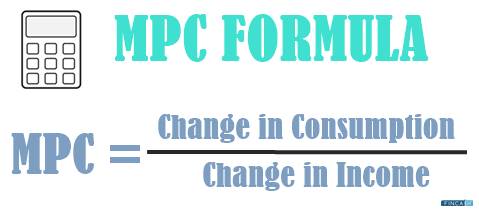

Marginal propensity to import is an element of Keynesian Macroeconomic theory. This is calculated as dlm/dy, meaning the derivative of the import function (Im) with respect to the derivative of the income function (Y).

This indicates the extent to which imports change because of changes in income of production. Countries that have more importance as the income of the population rises have a particular impact on global trade. If a country that purchases a number of goods from abroad goes through a financial crisis, the nation's economic woes' extent will be determined based on the impact exporting countries depend on the former's marginal propensity to import and the makeup of the goods imported.

If a country has a positive marginal propensity to consume it is most likely that it has a positive marginal propensity to import because a large portion of goods is likely to come from overseas.

The level of negative impact on imports from income that is falling is more when a country has a marginal propensity to import greater than its average propensity to import. The gap results in a greater income elasticity of demand for imports, which leads to a drop in income resulting in a more than the proportional drop in imports.

Important Points about Marginal Propensity to Import (MPM)

1. Factors determining MPM

Developed economies usually have a lower marginal propensity to import because they have sufficient natural resources within their borders. Whereas, countries that are dependent on purchasing goods from overseas usually have a higher MPM.

2. Keynesian Economics

The marginal propensity to import theory is an important aspect of the study of Keynesian Economics. First of all, this theory reflects induced imports. Secondly, it is a slope of import lines. This means that the negative of the slope of the net exports line makes it important to the slope of the aggregate expenditure line. This also affects the multiplier process.

Talk to our investment specialist

Advantages and Disadvantages of MPM

Marginal propensity to import is quite easy to measure. It is also useful as a tool to predict changes in imports based on expected changes in output. However, the issue exists when a nation's marginal propensity to import is unlikely to remain consistently stable.

The price of domestic and foreign goods change as well as exchange rates fluctuates. This impacts purchasing power of goods shipped in from overseas, therefore, as a consequence the size of the country's marginal propensity to import is affected.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.