Tracking Error

What is Tracking Error?

Tracking error is a measure of the difference between a Portfolio's returns and its benchmark. Tracking error is sometimes called active risk. The lower this number is the better, if the tracking error is high the fund manager has not taken the right level of risk, this is regardless of over or under performance. Tracking error are mostly associated with passive investment vehicles.

To figure out which fund best tracks an underlying index, we can calculate the fund's tracking error.

Tracking Error Formula

There are two ways to measure tracking error-

Method 1

The first is to subtract the benchmark's cumulative returns from the portfolio's returns, as follows:

Returnp - Returni = Tracking Error

Where: p = portfolio i = index or benchmark

However, the second way is more common, which is to calculate the standard deviation of the difference in the the portfolio and benchmark returns over time.

Talk to our investment specialist

Method 2

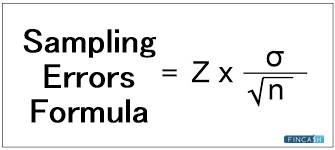

The formula for the second method is:

![]()

Tracking error is an important measure for investors to know how well the portfolio is replicating the index.

Factors Determining Tracking Error

There are several factors determine a portfolio's tracking error:

- Differences in market capitalization, investment style, timing and other fundamental characteristics of the portfolio and the benchmark

- The degree to which the portfolio and the benchmark have securities in common

- Differences in the weighting of assets between the portfolio and the benchmark

- The Volatility of the benchmark

- The management fees, brokerage costs, custodial fees and other expenses affecting the portfolio that don't affect the benchmark

- The portfolio's Beta

Moreover, the portfolio manager must collect inflows and outflows of cash from investors, which forces them to rebalance their portfolios time to time. This too involves indirect and direct costs.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.