Defining Inflation Swap

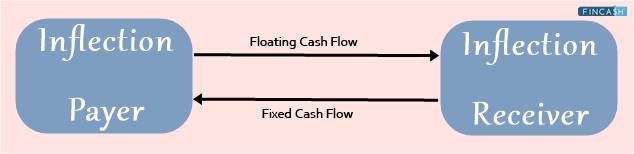

An Inflation swap refers to a contract allowing one party to transfer inflation risk to another by exchanging fixed cash flows.

Working of an Inflation Swap

Financial experts utilize inflation swaps to limit the risk of inflation and to profit from price Volatility. Inflation swaps are valuable instruments for a wide Range of institutions. Inflation payers are often institutions that get inflation cash flows as part of their core business. A utility firm is an excellent example because its Income is connected to inflation (either expressly or implicitly).

In an inflation swap, one party receives a variable (floating) payment tied to an inflation rate and pays an amount based on a Fixed Interest Rate. In contrast, the other party pays the inflation rate linked payment and receives the fixed interest rate payment, such as the Consumer Price Index (CPI).

The party paying the Floating Rate does so by multiplying the inflation-adjusted rate by the notional principal amount. In most cases, the principal does not change hands. Each cash flow is represented by one Leg of the swap.

The payment streams are calculated using fictitious funds. The most frequent type of swap is a zero-coupon swap, in which the cash flows are swapped only at maturity.

An inflation swap, like other swaps, is initially valued at Face Value. The value of the swap's outstanding floating payments will vary to be either positive or negative when interest and inflation rates change. The swap's Market value is calculated at predefined intervals. Depending on the swap value, a counterparty will post Collateral to the other party and vice versa.

Talk to our investment specialist

Pros of Inflation Swap

An inflation swap can provide an analyst with a relatively precise estimate of what the market regards to be the "break-even" inflation rate. It is conceptually very similar to how a market determines the price of any item, namely the agreement between a buyer, a seller to trade at a predetermined rate. The given rate in this situation is the expected rate of inflation.

The two parties to the swap reached an agreement based on their respective estimates of the inflation rate for the time in issue. The parties trade cash flows as per a notional principal amount, but instead of hedging or speculating on interest rate risk, their primary focus is on the inflation rate.

Conclusion

An investor purchasing a Commercial Paper is an example of an inflation swap. Simultaneously, the investor enters into an inflation swap contract in which he receives a fixed rate and pays a floating rate tied to inflation. By entering into an inflation swap, the investor effectively converts the commercial paper's inflation component from floating to fixed.

The commercial paper provides the investor with real LIBOR plus a credit spread and a variable inflation rate that an investor can exchange for a fixed rate with a counterparty.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.