What is Negative Goodwill?

Negative Goodwill (NGW) is the polar opposite of goodwill, which occurs when one company pays a premium for the assets. It is a phrase used in the business world to describe the reduced buying price paid when a company buys another company or its assets for much less than their Fair Market Value. Negative goodwill usually indicates that the selling party is in financial difficulties or has filed Bankruptcy and has the only choice of selling its assets for a fraction of their actual value. It may be due to financial trouble, severe selling pressure, and significant debt commitments, all of which reduce the company's acquisition price.

It implies that intangible assets had a reduced or no value or that the firm was sold under duress without receiving the benefits of its intangible assets. Nevertheless, it almost always works to the buyer's advantage.

Tangible and Intangible Assets and Negative Goodwill

It's crucial to understand the difference between tangible and intangible assets before diving deeper into the said concept:

- Tangible assets have an actual shape and are worth money. Property, plant, and equipment are some of the most common examples.

- Intangible assets have no physical form, have no monetary value, and are sometimes difficult to identify. Intellectual property, brand recognition, and valuable life are examples of intangible assets.

Goodwill is the value of intangible assets like brand awareness and intellectual property that can be extremely valuable for well-established and innovative businesses. Intangible assets are not considered in the Market value calculation but may be included in the acquisition price.

Talk to our investment specialist

Negative Goodwill Example

Let's say Company ABC pays INR 40 lakhs for the assets of Company XYZ, but the assets are truly worth INR 70 lakhs. This transaction is only possible because XYZ is in desperate need of money, and ABC is the only person who is willing to pay that amount. In this situation, ABC's Income statement must reflect the INR 30 lakhs gap between the purchase price and the fair market value as negative goodwill.

Negative Goodwill Balance Sheet

Goodwill is documented as an asset on the selling company's Balance Sheet, but negative goodwill is reported as a liability because it lowers the valuation. Goodwill can also be reported as a contra-asset or a reduction of assets to show the amount of NGW.

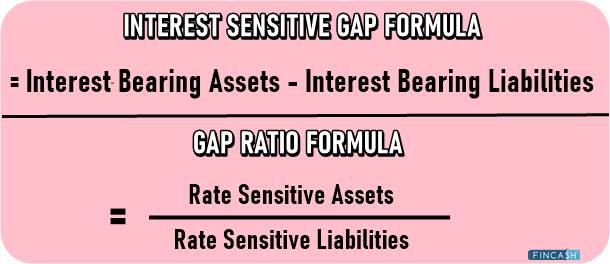

Goodwill vs Negative Goodwill

Negative goodwill rises when the purchase price paid for an asset is less than its market worth. On the other hand, Goodwill is created when the acquisition price exceeds the market worth of the company's assets. This amount is the premium paid by the buyer for the intangible value of the company's assets.

While negative goodwill indicates terrible circumstances, the presence of goodwill (i.e., positive) suggests that the intangible worth of assets is high and the company is under no pressure to sell - a situation that benefits the seller.

What leads to Negative Goodwill?

Negative goodwill is usually the result of one of the following factors:

- A company might be forced or financially troubled to sell either its assets or the entire organisation.

- As macroeconomic conditions are continually changing, asset valuation, particularly long-term fixed assets, may be erroneous, resulting in inaccurate market valuations. Incorrectly evaluated intangible assets might result in reduced market prices and negative goodwill.

Conclusion

Negative goodwill is essential to monitor since it provides investors with a complete picture of a company's worth. Such acquisitions raise reported assets, income, and shareholder equity, thereby distorting performance metrics like Return on Assets (ROA) and Return On Equity (ROE), which appear lower as a result.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.