Accounts Payable Turnover Ratio

What is Accounts Payable Turnover Ratio?

It is a short-term liquidity measure that is used to enumerate the rate at which a company pays its suppliers. With accounts payable turnover, one can get to know how many times a company is paying its accounts payable within a specific period.

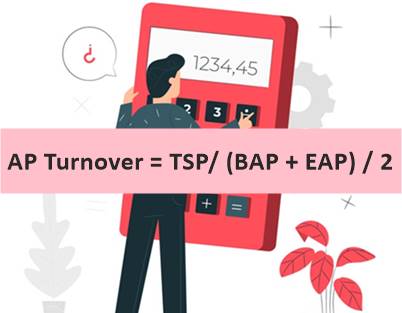

The AP Turnover Ratio Formula

AP Turnover = TSP/ (BAP + EAP) / 2

Here,

- AP = Accounts payable

- TSP = Total supply purchases

- BAP = Beginning accounts payable

- EAP = Ending accounts payable

Understanding Accounts Payable Turnover Ratio

The accounts payable turnover ratios let investors know the frequency of the company paying its AP in a period. In simple words, the ratio helps to evaluate the speed at which a company is paying to its suppliers.

This turns out to be an essential metric for investors to evaluate whether the company has enough revenue or cash to meet short-term responsibilities.

How to Calculate Accounts Payable Turnover Ratio?

The average accounts payable can be calculated for a period by subtracting the accounts payable balance at the beginning from the accounts payable balance at the end. Now, divide this result by two to get the average accounts payable. Then, take total supplier purchases for that specific period and divide the same by the average accounts payable.

Talk to our investment specialist

Accounts Payable Turnover Ratio Examples

Suppose there is a company that has purchased its inventory and materials from a supplier for the past one year and got the following results:

- Total supplier purchases were Rs. 10,00,000 for a year

- Accounts payable was Rs. 3,00,000 for a start and the accounts payable were Rs. 5,00,000 at the end

Now, the average accounts payable for the whole year will be calculated as:

- Rs. 3,00,000 + Rs. 5,00,000 / 2 =

Rs. 4,00,000

Now, the accounts payable turnover ratio will be calculated as:

- Rs. 10,00,000 / Rs. 4,00,000 which will be equal to 2.5 for a year. This means that the company paid 2.5 times during that year.

Now, let’s suppose that during the same year, a competitor of this company had acquired the following results:

- Total supplier purchases were Rs. 10,00,0000 for a year

- Accounts payable at the start was Rs. 15,00,000 and during the end it was Rs. 20,00,000

Now, the average accounts payable will be:

- Rs. 15,00,000 + Rs. 20,00,000 / 2 =

Rs. 1,75,0000

The accounts payable turnover ratio can be calculated as:

Rs. 10,00,0000 / Rs/ 1,75,0000 which will be equal to 6.29 for a year.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.