What is Fixed Asset Turnover Ratio?

Fixed Asset Turnover is a ratio that compares the value of a company's sales revenue to the value of its assets. It is used to assess management's capacity to produce revenue from fixed assets.

Often it is computed on a yearly basis, although it can be calculated over a shorter or longer duration if necessary. It tells investors, lenders, creditors, and management whether the firm is making the best use of its fixed assets.

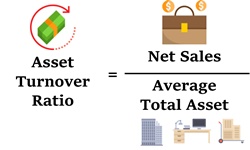

Fixed Asset Turnover Ratio Formula

The formula for calculating the Fixed Asset Turnover Ratio is as follows:

Fixed asset turnover ratio = Net sales / Average net fixed assets

This ratio is derived by dividing net sales by net fixed assets over a year. The amount of property, plant and equipment less cumulative depreciation is referred to as net fixed assets. Net sales are defined as gross sales, fewer refunds, and allowances.

For example, XYZ Company has 5 lacs in gross fixed assets and 2 lacs in cumulative depreciation. In the previous 12 months, sales totalled 9 lacs. XYZ's fixed asset turnover ratio is calculated as follows: 9 lacs / 5 lacs - 2 lacs which give a 3:1 ratio.

Fixed Asset Turnover Ratio Interpretation

High Fixed Asset Turnover Ratio

For most firms, a high ratio is desirable. It shows that fixed asset management is more efficient, resulting in higher returns on asset investments. There is no precise % or range that can be used to assess if a firm is effective at producing revenue from such assets. This can only be determined by comparing a company's current ratio to earlier periods, as well as ratios of other similar firms or industry norms. Fixed assets differ greatly from one firm to the next and from one sector to the next, thus comparing ratios of comparable types of organisations is important.

Low Fixed Asset Turnover Ratio

The fixed asset turnover ratio can be low if the company is failing in sales and has a large amount of fixed-asset investment. This is particularly true for manufacturing companies that rely on large machinery and buildings. Although not all low ratios are undesirable, a low ratio may have a negative connotation if the firm just made significant substantial fixed asset purchases for modernisation. A falling ratio might indicate that the firm is over-Investing in fixed assets.

Talk to our investment specialist

Problems With Fixed Asset Turnover Ratio

- Impact of Reinvestment

Unless the firm invests a comparable amount in new fixed assets to replace older ones, ongoing depreciation will lower the quantity of the denominator, causing the turnover ratio to grow over time. As a result, a company whose management team chooses not to reinvest in its fixed assets will see a modest improvement in its fixed asset ratio for a period of time, after which its ageing asset base will be unable to manufacture goods efficiently.

- Industry Type

In a heavy sector industry, such as automotive manufacturing, where substantial Capital Expenditure is necessary to do business, the fixed asset turnover ratio is particularly helpful. Other businesses, such as software development, have such low fixed asset investments that the ratio is useless.

When a firm utilises accelerated depreciation, such as the double falling balance technique, the quantity of net fixed assets in the denominator of the calculation is falsely reduced, causing turnover to look larger than it should be.

The Bottom Line

The Fixed Assets Turnover Ratio is a key metric that analysts, investors, and lenders look at. A higher ratio is always regarded as a good thing. The use of ratios, however, should be limited to comparisons within the same industrial group because the ratio is affected by a variety of factors such as the nature of the product, the capital-intensive industry, new capacity creation, changes in technology, changes in the demand pattern for the company's products, supply and operational time of fixed assets, fixed asset age, outsourcing feasibility, and so on. Any choice made by management should be based on a comprehensive examination of all of these variables, as well as other financial indicators.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.