Receivables Turnover Ratio

What is Receivables Turnover Ratio?

A receivables turnover ratio is a measure in Accounting to understand a firm’s efficiency in getting its receivables from customers to whom credit has been extended to. This phenomenon is also called accounts receivable turnover ratio. This is a ratio that indicates the effectiveness of how a firm manages the extended credit. It also measures the efficiency of how much time is taken before the debt is collected. It also measures the efficiency of the firm’s sales getting converted into cash during a period. This can be calculated on a monthly, quarterly or yearly basis.

Firms that maintain their receivable turnover ratio are extending loans without interest to their customers indirectly. This is because accounts receivable is the money owed without interest. When a firm sells a commodity or service to the customer, it could extend credit or 30 to 60 for the product. This means that the customer has to pay for the purchase within the time period allotted by the firm. Investors should compare the accounts receivable turnover of multiple firms within an industry to understand and pinpoint the average turnover ratio for the industry. If a firm has a higher receivables turnover ratio than others, the firm may prove to be a safe place for investment.

Receivables Turnover Ratio Types

Let’s take a look at what is high receivable turnover and low accounts turnover.

1. High Receivable Turnover

If a company has a high receivable turnover, it indicates that the account receivable is effective and has a high proportion of quality customers who pay their debts on time. It is also an indicator than a firm function on a cash basis.

2. Low Accounts Turnover

A low accounts turnover indicates that a firm may have a bad collection process with Bad Credit policies. It could also indicate that customers are not creditworthy.

Talk to our investment specialist

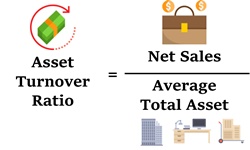

Difference Between Asset Turnover and Receivables Turnover

The major differences between asset turnover and receivables turnover are mentioned below:

| Asset Turnover Ratio | Receivables Turnover Ratio |

|---|---|

| The asset turnover ratio refers to the measuring of the value of a company’s sales or revenue which is relative to the value of the assets it holds | The receivables turnover ratio refers to the measuring of a company’s efficiency in collecting the money it has extended in credit to customers |

| The asset turnover ratio is an indicator of firm’s efficiency in employing assets to generate value | The receivables turnover ratio indicates the ability of a firm in using and managing credit and also how well it collects the debt from customers. |

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.