Accredited Asset Management Specialist (AAMS)

What is an Accredited Asset Management Specialist?

Accredited asset management specialist is a professional designation that the College for financial planning (CFP) awards to financial professionals upon completing a self-study program, agreeing to comply with the ethics code, and passing an exam successfully.

The applicants earn the successful right to use this designation along with their names for almost two years, which can help to enhance their professional reputation, job opportunities, and AAMS salary.

About Accredited Asset Management Specialists

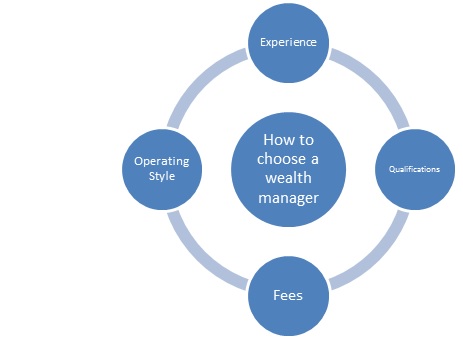

The AAMS program started back in 1994. Today, it is being taught explicitly online through the CFP’s platform. Basically, the program comprises 12 modules, beginning with the asset management process review.

And then, it covers a wide Range of topics like insurance, investments, estate planning issues, retirement, and taxation. To continue with the privileges related to the designation, AAMS professionals have to complete 16 hours of consistent education every two years and pay a specific fee for the same.

The program is developed in association with some of the top investment firms. Applicants also get to explore case studies that are based on real-life scenarios, which are designed to prepare students for the effectiveness in the world and build lasting relationships with clients.

Moreover, the self-study program also covers a variety of topics, like investors, asset management process, risk, policy and change, return and investment performance, Asset Allocation and selection, investment products taxation, and investment strategies.

Apart from that, it also takes care of investment opportunities for retirement, investment for small business owners, and benefit plans. Students follow this course online and generally complete the entire program within 9-11 weeks. Also, to pass the qualification, students have to give the final exam at one of the testing centres approved by the CFP.

Talk to our investment specialist

Specific Considerations of AAMS

The Financial Industry Regulatory Authority (FINRA) has specified that they don’t endorse or approve any professional designation or credential. However, they do list the AAMS as one available designation in the financial services industry.

As per the CFP, specific organizations recognize the AAMS designation as representing 28 hours of consistent education credit. To keep the public notified regarding the current status of AAMS designees, the CFP handles an online database that contains the names of members and the state of their positions.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.