Annual Return

What is Annual Return?

The Annual return is the return an investment provides over a period of time. The annual return is expressed as a time-weighted annual percentage. Here, the sources of returns can include returns of capital & capital appreciation and dividends.

If the annual retrun is expressed as annual percentage rate, then the annual rate will usually not take into account the effect of compounding interest. But, if the annual return is expressed as annual percentage yield, then the number takes into account the effects of compounding interest.

Annual Returns on Stocks

The annual return expresses the stock’s increase in value over a stipulated period of time. In order to calculate an annual return, information on the current price of the stock and the price at which it was purchased it to be known. If any splits have occurred, the purchase price needs to be adjusted accordingly. Once the costs are determined, the simple return percentage is first calculated, with that estimated figure ultimately being annualized.

Talk to our investment specialist

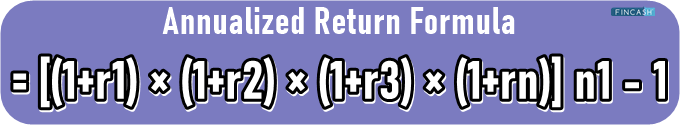

Annual Return Calculation

Let’s take a few examples to understand the calculation

Example 1: Monthly Returns

Let’s assume that we have 2 percent monthly returns. Since there are 12 months in a year, the annual returns will be:

Annual returns = (1+0.02)^12 – 1= 26.8%

Example 2: Quarterly Returns

Let’s assume that we have 5 percent quarterly returns. Since there are four quarters in a year, the annual returns will be:

Annual returns = (1+0.05)^4 – 1= 21.55%

The annual return is expressed as a percentage, which allows for easier comparison of different investments or asset classes. It considers both the Capital Gains or losses (the change in the investment's value) and any income generated from dividends, interest, or distributions during the year.

It's important to note that annual return is a historical measure based on past performance and does not guarantee future results. It is a useful tool for evaluating investment performance over a specific period, but it should be used in conjunction with other metrics and factors to make informed investment decisions.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.