GSTR-9: Annual Return For Taxpayers

Under the GST tax regime, GSTR-9 is a mandatory ‘annual return’ that has to be filed by all registered taxpayers in India.

What is GSTR-9?

GSTR-9 is a document that taxpayers have to file on a yearly basis. This document contains all the data regarding the supplies and purchases made through the year under various tax categories i.e. Central Goods and Service Tax (CGST), State Goods and Service Tax (SGST), Integrated Goods and Service Tax (IGST) and HSN codes. Year’s turnover and audit details are also to be filed.

This is a unification of GSTR-1, GSTR-2A and GSTR-3B filings. It helps maintain transparency and Accountability.

Who Should File GSTR-9?

All GST-registered taxpayers are to file GSTR-9 once a year.

However, here’s a list of those who don’t need to file GSTR-9.

- Casual Tax persons

- Input Service Distributors

- Non-resident Taxable persons

- Individuals paying TDS

Due Dates for Filing GSTR-9

Usually, you are to file GSTR-9 on or before 31st December of the forthcoming financial year. However, the date can be extended if the government feels the need.

Types of GSTR-9 Form

GSTR-9

This is to be filed by those who’ve filed GSTR-1 and GSTR-3B.

GSTR-9A

This is to be filed by those who have undertaken the GST Composition Scheme.

GSTR-9B

This is to be filed by e-commerce operators who have filed GSTR-8 during the financial year.

GSTR-9C

This is to be filed by taxpayers with an aggregate turnover of Rs. 2.5 crore during the financial year.

Talk to our investment specialist

Details of GSTR-9 Form

GSTR-9 is the most important return for taxpayers. It records the complete details of the taxpayer’s inward and outwards supplies, ITC paid and other factors influencing tax liability for a financial year.

There is a total of 6 parts in this form.

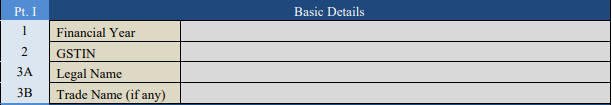

PART 1: Basic Details

This section asks for your details like GSTIN, name, trade name and financial year.

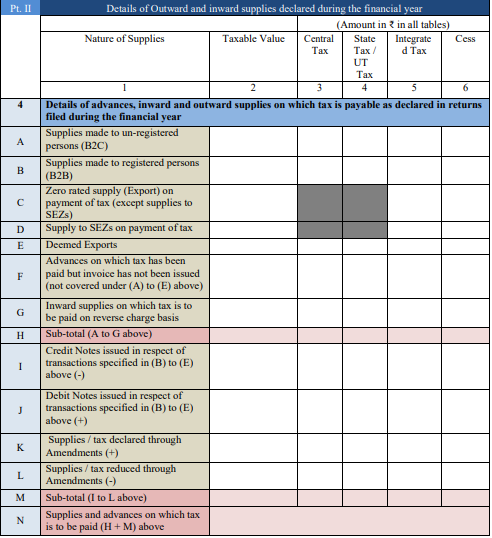

PART 2: Details of outward and inward supplies declared during the FY

This part is divided into two sections for collection of varied details.

Section 4

It involves the entry of details like purchases, sales, advances on which tax is payable. Enter taxable value, IGST, SGST, CGST and Cess value.

A. Supplies made to unregistered persons (B2C).

B. Supplies made to registered persons (B2B).

C. Exported zero-rated supplies for which tax has already been paid (except supplies made to SEZs).

D. Supply to SEZs on payment of tax.

E. Deemed exports.

F. Advances on which tax has been paid but the invoice has not been issued (not covered under (A) to (E) above)

G. Purchase supplies that are liable for reverse charge tax.

H. The subtotal of the transactions mentioned in lines (A to G above).

I. Any credit notes that have been issued for the transactions mentioned above.

J. Any debit notes that have been issued for the transactions mentioned above.

K. Supplies or tax declared through any Amendments.

L. Supplies or tax reduced through any Amendments.

M. The subtotal of the transactions mentioned in line (I to L above).

N. Supplies and advances which are liable for tax from lines (H and M above)

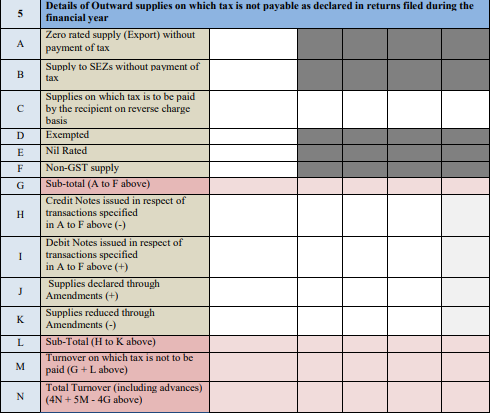

Section 5

It involves details of sales for which tax is not payable. This is as declared in the returns filed during the financial year.

A. Exported zero-rated supply without tax payment.

B. Supplies made to SEZs without tax payment.

C. Supplies for which reverse charge tax is to be paid by the recipient.

D. Exempted sales supplies.

E. Nil-rated sales supplies.

F. Non-GST supply.

G. The subtotal of the transactions mentioned in lines A to F above.

H. Any credit notes that have been issued for the transactions mentioned above.

I. Any debit notes that have been issued for the transactions mentioned above.

J. Supplies declared through any Amendments.

K. Supplies reduced through any Amendments.

L. The subtotal of the transactions mentioned in lines H to K above.

M. The turnover amount which is exempt from tax from line G and L above.

N. The total turnover amount, inclusive of all advances (4N + 5M - 4G above)

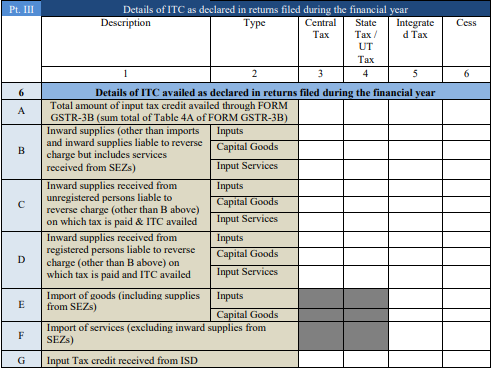

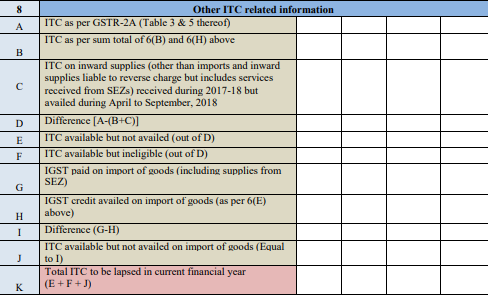

PART 3: Details of ITC as declared in returns filed during the financial year

The third part is divided into three questions. These questions ask about your ITC balance.

Section 6

It requires the entry of details of ITC availed. This is as declared in the returns filed during the financial year.

A. The total amount of ITC availed through GSTR-3B.

B. The purchase supplies made for inputs, capital goods, and input services (excluding imports and those purchase supplies that are liable to reverse charge, but including services received from SEZs).

C. The purchase supplies received from unregistered persons for inputs, capital goods, and input services which are liable to reverse charge, for which tax has been paid and ITC has been availed, except those mentioned in line B above.

D. The purchase supplies received from registered persons for inputs, capital goods, and input services, which are liable to reverse charge, for which tax has been paid and ITC has been availed, except those mentioned in point B above.

E. The imported goods, including supplies from SEZs, for inputs and capital goods.

F. The imported services, excluding purchase supplies from SEZs.

G. ITC that has been received from the ISD.

H. The amount of ITC reclaimed (besides that mentioned in line B above), under the provisions of the CGST Act.

I. The subtotal for lines (B to H above).

J. The difference between lines I and A (I - A).

K. The transition credit mentioned in TRAN-I, along with any revisions.

L. The transition credit mentioned in TRAN-II.

M. Any other ITC that has been availed, but not mentioned in any of the lines above.

N. The subtotal for lines (K to M above).

O. The total ITC availed for lines (I and N).

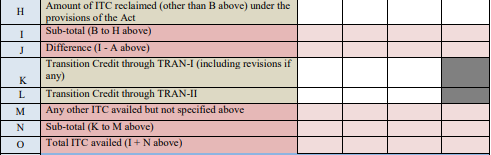

Section 7

Fill in information regarding the reversed ITC and ineligible ITC on the CGST, IGST, SGST and Cess value. A. As per the reversal of ITC in cases of non-payment of consideration (Rule 37).

B. As per the procedure for distribution of ITC by the ISD (Rule 39).

C. As per ITC with respect to inputs or input services and reversal (Rule 42).

D. As per ITC with respect to capital goods and reversal (Rule 43).

E. With respect to the blocked credits under GST (Section 17(5)).

F. The reversal of credit mentioned in TRAN-I.

G. The reversal of credit mentioned in TRAN-II.

H. Specifications of any other reversals.

I. The total reversed ITC mentioned in lines A to H above.

J. The net ITC available for utilization (section 6 line O minus section 7 line I)

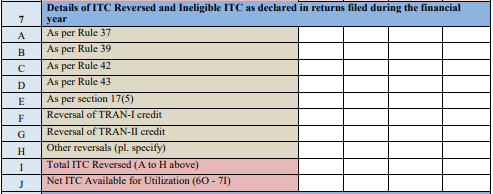

Section 8

It requires you to provide other ITC-related information. A. The ITC as given in GSTR-2A.

B. The total sum of ITC mentioned in line 6B and 6H.

C. The ITC on sales supplies besides imports and inward supplies liable to reverse charge. Include services received from SEZs during the duration of 2017-2018 but availed between April and September, 2018.

D. Difference between lines A and B plus C. [A - (B + C)]

E. The ITC that is available, but has not been availed, from line D above.

F. The ITC that is available, but is ineligible, from line D above.

G. The IGST paid on import of goods, including supplies from SEZs.

H. The IGST credit availed on import of goods, as mentioned earlier in line 6E.

I. The difference between lines G and H (G - H)

J. The ITC available but not availed on the import of goods (should be equal to line I).

K. The total ITC value that has lapsed, or is not valid for the current financial year. (E + F + J)

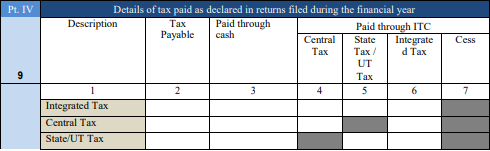

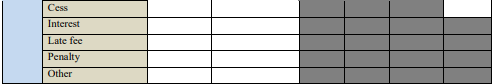

PART 4: Details of tax paid as declared in returns filed during the financial year

Specify the details regarding the tax paid and declared in returns filed during the financial year.

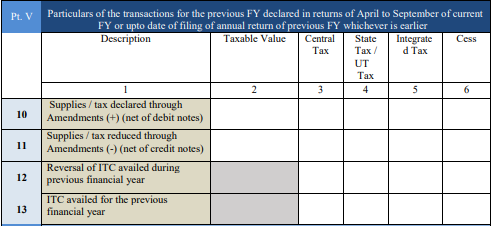

PART 5: Particulars of the transactions for the previous FY declared in returns of April to September of current FY or up to date of filing of annual return of previous FY, whichever is earlier.

Section 10 to 14

It has all the details related to transactions occurred during the previous financial year.

A. The supplies or tax declared through amendments.

B. The supplies or tax reduced through amendments.

C. The reversal of ITC availed during the previous financial year.

D. The ITC availed for the previous financial year.

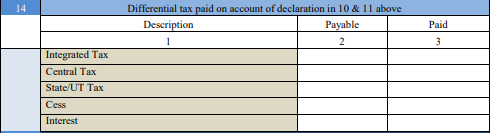

After filling in the above lines, enter the differential tax payable and paid for the following: Enter differential tax payable and paid here:

A. The integrated tax value (IGST).

B. The central tax value (CGST).

C. The state (SGST) or UT tax value.

D. The cess amount.

E. Interest value.

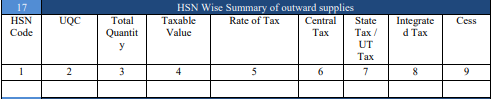

Part 6: Other Information

This part covers demands, refunds, special supplies, HSNs and late fees.

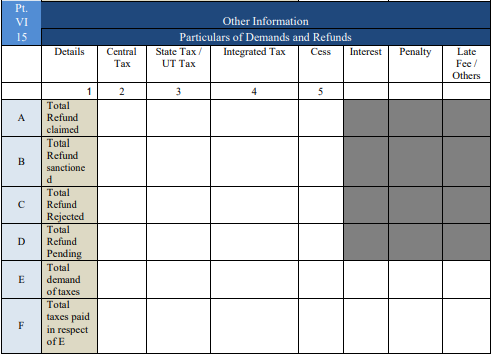

Section 15

It requires entry of details about demands and refunds.

A. The total refund claimed.

B. The total refund sanctioned.

C. The total refund rejected.

D. The total refund pending.

E. The total demand of taxes.

F. The total taxes paid for line E above.

G. The total demands pending from line E above.

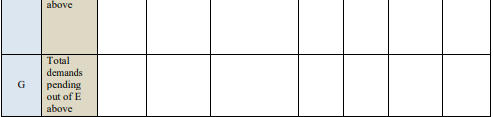

Section 16

It covers information on supplies received from composition taxpayers, deemed supplies, and goods sent on an approval basis.

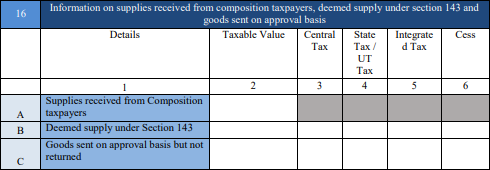

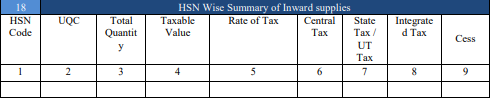

Sections 17 and 18

It lists the HSN-wise details for sales and purchase supplies. Along with this entry of their corresponding tax details and HSN codes is equally important.

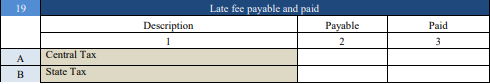

Section 19

It is for details of payable and paid late fees related to central and state taxes.

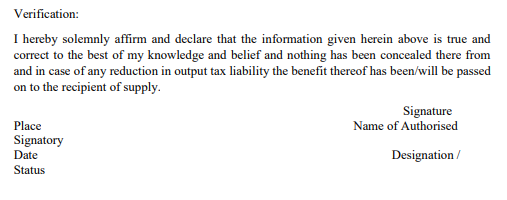

Verification is important before submitting the return. The taxpayer is required to authenticate return through digital signature certificate (DSC) or by Aadhar-based signature verification.

Penalty for Late Filing

Late filing of GSTR-9 will attract Rs.100 per day under CGST and Rs. 100 SGST. That means the taxpayer will have to pay Rs. 200 per day from the next day of the due date till the day of actual filing.

Conclusion

GSTR-9 is an important return and should be filed with uttermost caution and scrutiny of details. One should pay attention to file it on time to avoid any damage to goodwill or finances.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

You Might Also Like