Bid and Ask Price

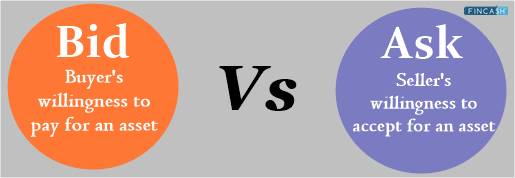

A two-way price quote known as "bid and ask" (sometimes known as "bid and offer") reflects the best prospective price where security can be purchased or sold at a specific point in time. The Bid Price represents a buyer's maximum willingness to pay for a stock share or other security.

The ask price is the lowest amount at which a seller is ready to sell the same security. When any buyer is willing to pay the highest available offer —or when any seller is willing to sell at the biggest bid—a transaction or trade happens.

The gap, or the spread between the bid and ask prices, is a key measure of the liquidity of an asset. Generally, the tighter the spread, the more liquid the market.

Difference Between Ask Price and Bid Price

The bid price is the highest amount that traders are ready to pay for security. On the other hand, the ask price is the lowest price at which the security's owners are willing to sell it. For example, if a stock's ask price is Rs. 20, a buyer must make an offer of at least Rs. 20 to purchase it at today's price. The bid-ask spread refers to the difference between the bid and ask prices.

How to Read the Bid-ask Spread?

The buyer sets the bid price and expresses how much they are ready to pay for the stock. The seller specifies their price, sometimes known as the "ask price." The stock exchanges and the entire broker-specialist system are responsible for facilitating the coordination of bid and ask prices. This service comes at a cost, which impacts the stock's price.

When you place a stock purchase or sale order, it is processed according to rules that decide which trades are performed first. If purchasing or selling the stock as fast as possible is your primary concern, you can place a market order, which implies you'll accept whatever price the market offers you at the time.

Talk to our investment specialist

Should I Buy at Bid or Ask Price?

The lowest price a vendor will take is the ask price. The spread is the gap between the bid and ask prices. The smaller the liquidity, the larger the spread. Whenever somebody is ready to sell the security at the bid price or purchase it at the ask price, a trade takes place. If you're buying the stock, you'll pay the ask price, and if you're selling it, you'll get the bid price.

How to Profit from Bid-Ask Spread?

Bid-ask spreads might be large depending on the asset and the market. Traders will not be prepared to pay the price over a particular threshold, and sellers might not be willing to approve prices lower than a certain level. Therefore, the bid-ask gap can expand considerably during illiquidity or market Volatility.

What's Meant When the Bid and Ask Price in Forex Are So Close?

When the bid and ask prices are close, it usually suggests that the security has plenty of liquidity. The security is considered a "narrow" bid-ask spread in this circumstance. This might be advantageous to investors because it makes it easier to enter and exit positions, especially large ones.

Securities having a broader bid-ask spread can, on the other hand, be time-consuming and costly to trade.

Bid-Ask Price Example

John is a retail investor interested in buying Security A stock. He notices that Security A's current stock price is Rs. 173 and decides to buy ten shares for Rs. 1,730. He was perplexed when he saw that the entire cost was Rs. 1,731.

It had to be an error, John reasoned. He eventually recognises that the current stock price of Rs. 173 is the price of Security A's last traded stock, and he paid Rs. 173.10 for it.

Conclusion

There are ways to avoid the bid-ask spread, but most investors are better off sticking with the tried-and-true system, even if it means a small loss in profit. Start with a paper Trading Account first if you're thinking about expanding out.

Advanced tactics are for experienced investors only, and amateurs may end up in a worse situation than when they started. This isn't to say you won't ever get to the point where you can use them and maybe even excel at them, but while you're just getting started, you're probably better off sticking to the basics.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.