Dark Pool

What are Dark Pools?

The dark pool is a type of financial forum or exchange. With the help of the dark pool, institutional investors are given the opportunity to trade without any exposure right after the given trade has been reported or executed.

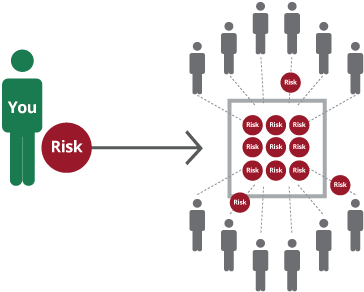

Dark pools can be regarded as a form of ATS (Alternative Trading System) that provides specific investors with the chance to place bulk, large-sized orders while making trades without revealing the overall intentions publicly during their search for a seller or a buyer.

The Basics of Dark Pool

The concept of dark pools was introduced during the 1980s. It occurred when the SEC (Securities & Exchange Commission) gave permission to the brokers to ensure transactions for large-sized blocks of shares. The SEC ruling and electronic trading concept in 2007 was designed for increasing competition while also reducing the overall transaction costs. This has promoted an overall increase in the total number of dark pools out there.

Dark pools are known to charge lower fees in comparison to financial exchanges. This is because these are often situated within a large-sized firm, and not typically a Bank.

One of the major advantages of ensuring dark pool trading is that institutional investors who are known to make large trades are capable of doing so without being publicly exposed while searching for potential sellers & buyers. The given aspect helps in preventing devaluation of heavy prices –which could occur otherwise. For instance, Bloomberg LP is known to be the owner of Bloomberg Tradebook. It is known to be registered with the Securities & Exchange Commission (SEC).

The concept of dark pools was initially launched & utilized by an array of institutional investors for blocking trades that involved several securities. However, for large orders, dark pools are no longer utilized.

The devaluation has increasingly become risky. Moreover, electronic Trading platforms are permitting prices to respond quite instantly to the respective pressures. If new data is going to be reported only once the trade has been executed, then, however, the news is going to have a much less significant impact on the existing Market.

Dark Pools & High-frequency Trading

As supercomputers have evolved featuring algorithmic-based programs over just a few milliseconds, HFT (High-frequency Trading) has become quite dominant over the trading volume on a daily Basis. The revolutionary HFT technology is known to allow institutional traders to implement the respective orders of large-share blocks quite ahead of the investors. This helps in capitalizing on fractional downticks or upticks in the respective share prices.

Talk to our investment specialist

When there is the execution of the subsequent orders, profits get instantly gathered by the respective HFT traders who might be then closing the given positions. Given the type of legal piracy is known to occur several times on a daily basis while delivering significant gains for the respective HFT traders. Eventually, High-frequency Trading has become quite persuasive that it has become increasingly difficult to implement large trades with the help of a single exchange.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.