What is a Hedged Tender?

A hedged tender is an investment technique in which an investor sells a portion of their stock short, hoping that not all of the shares tendered will be accepted.

This method aims to mitigate the risk of loss if the tender offer is not accepted. The offer guarantees a profit to the shareholder regardless of the tender offer's outcome.

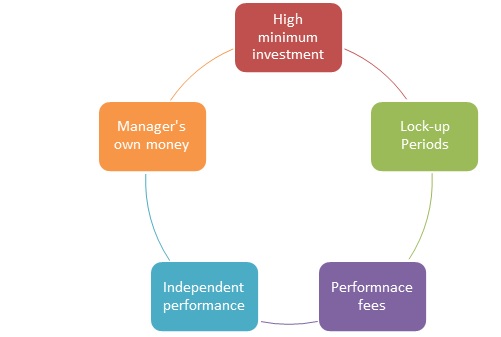

Understanding Hedged Tenders

It's helpful to check the components of hedged tenders to get a better understanding of them:

Tender Offer

A tender offer refers to a public takeover bid in which one firm (the acquiring company) bids on another company (target company). To persuade the target company's shareholders to sell, the acquirer makes a tender offer to buy shares within a specific term and at a higher price than the Market price.

Tender

A tender refers to how shareholders submit their shares to be bought for the takeover once a tender offer is made.

Pro-Rata

The allotment of equal proportions is referred to as pro-rata. If an acquiring business makes a 50 percent pro-rata bid, they will only buy up to 50 percent of the shares that the shareholder bids for. If a shareholder contributes 2,000 INR, they may accept 1,000 INR, and if they offer 1,000 INR, they may receive 500 INR, and so on.

Short Sell

Short selling is a strategy in which an investor borrows, sells, and returns security that does not belong to them. A hedged tender occurs when a shareholder short sells the remaining shares that would not have been bought through the tender, essentially simulating the sale of all of their holdings.

Hedging

Any risk management method – in this case, to protect against a drop in share value – is referred to as hedging. Shareholders of the target firm might use the hedged tender method to limit their risk when an acquiring company makes a tender offer. The shareholder makes a tender offer, and if they believe that not all of their shares will be accepted, they might short sell the remaining shares. If the tender offer is finished, the shareholder can lock in the price for all of their shares in this manner.

How a Hedged Tender Works?

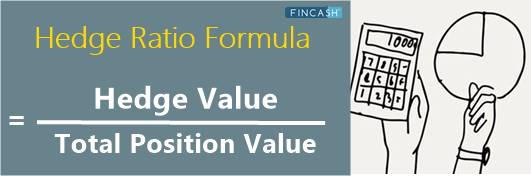

A hedged tender is a strategy to protect against the possibility that the issuing company will reject some or all of the shares tendered as part of a tender offer. A tender offer is an offer by one investor or firm to buy a specific number of shares of another company's stock at a greater price than the current market price.

Hedged Tender as Insurance

Any hedging type, including a hedged tender method, is a form of insurance. Hedging is the process of reducing or transferring risk in a business or Portfolio. Consider a company that wants to protect itself from currency risk by constructing a factory in a country where it exports its goods.

Investors hedge to protect their assets from a lousy market occurrence that would cause them to depreciate. Hedging may imply caution, but many of the most aggressive investors employ hedging tactics to boost their chances of making a profit. By reducing risk in one element of a portfolio, an investor can typically increase absolute returns while putting less cash at risk in each investment.

Hedging against investment risk can also be defined as the strategic use of market instruments to mitigate the risk of adverse price changes. In another way, investors hedge one investment with another.

Hedged Tender Example

An acquiring business makes a tender offer for 50% of the target firm's shares for 50 INR when the market price is 35 INR. If a target firm shareholder expects just half of their submitted shares to be accepted, they will tender all of their shares and short sell the other half.

The news of the public takeover will cause share prices to rise close to the 50 INR bid, so the shareholder will short sell the shares on the market, securing the sale price for 50% of their ownership. When the tender is approved, the acquiring business purchases 50% of the shares of the shareholder. The shareholder can return the shares to the short sale counterparty with the unsold 50%.

The shareholder will have sold all of their shares for close to 50 INR using the hedged tender technique. If the tender turns down, the shareholder will have sold half of their stock for around 50 INR. If the shareholder had not employed the hedged tender technique and the tender offer had been rejected, the value of all 100 percent of the shares would most certainly plummet.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.