J-Curve Effect

What is a J-Curve Effect?

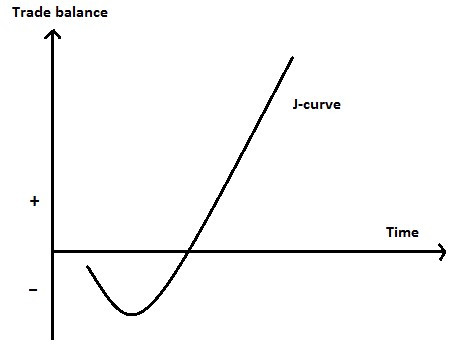

J-curve effect meaning implies a specific phenomenon in which the trade balance of a particular country tends to get worse after the depreciation of the respective currency before improving. Usually, any type of depreciation that occurs in the currency’s value is known to improve the overall trade balance of the given country by boosting exports & discouraging imports. However, this is not known to happen instantly due to the presence of major frictions within the given economy.

For instance, many importers as well as exporters, might be locked into some kind of binding agreement. This would ultimately force them to consider buying or selling a specific volume of goods even due to the presence of unfavorable conditions like currency’s exchange rate.

Under J Curve in the Field of Private Equity

In the field of private equity, J Curve or its effects helps in representing the nature of private Equity Funds to go forward with negative returns during the initial years, and then, deliver increasing returns during the later years upon maturing of the investments. The negative value of the returns during the starting of investments is known to be the result of management fees, investment costs, investment Portfolio still awaiting maturity, and some underperforming portfolios that might be written off during early days.

Talk to our investment specialist

In a general scenario, private equity funds are not known to take possession of the funds of the investors unless they have made definitions for profitable investments. The investors are simply known to commit the provision of funds to the respective fund manager as required or based on request.

Banks lending to private equity funds are known to negotiate for the cash flow sweep. It requires the payment of funds for debt-clearing with some or excess cash flow that has been generated. During the starting years, private equity funds are known to generate no or minimal cash flow for the respective investors. Moreover, the initial funds that are generated are utilized towards reducing the leverage of the company. The given concept is known to make use of extensive financial modeling with assistance from an experienced financial analyst.

When effective management of funds takes place, the private equity funds start experiencing unrealized gains that are followed by a series of events for gain realization. M&As (Mergers & Acquisitions), leveraged IPOs (Initial Public Offerings), and buy-outs are known to result in increased returns to the given fund. This helps in producing the J Curve shape of the graph. With the presence of excessive cash and the payments of debts, the extra cash is going to go to the hands to the private equity investors. The presence of a steep curve helps in representing a private equity fund that has been managed poorly –taking too long to realize returns while only generating lower returns.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.